The Truth About Leverage Mismatches: Copying High Leverage to Low Leverage Accounts

Education

Dec 22, 2025

3 Min Read

Discover why copying trades between accounts with different forex leverage (e.g., 1:500 Master to 1:30 Slave) can cause margin calls, errors, and blown accounts. Learn how Copygram's risk scaling ensures safe copying—with practical examples, tables, and pro tips.

🌍 Decoding Forex Leverage: Myths, Realities & Mathematical Truths

Leverage is a powerful double-edged sword in forex trading. It lets traders control positions much larger than their deposit. A 1:500 leverage turns $100 into a $50,000 controlling power, but also magnifies both profit and loss potential. Many traders misunderstand leverage mismatches—especially when copying trades across accounts with different ratios.

What happens if you copy trades from a 1:500 (Master) account to a 1:30 (Slave) account? Let's break down the risks, starting with the core mechanics of leveraged trading, then diving into real-world dangers and how you can protect yourself.

A high-leverage account can crush a low-leverage account if risks are not handled correctly.

Leverage Ratio: The multiplier the broker gives you on your trading capital (e.g., 1:30 or 1:500).

Margin Requirement: The minimum deposit needed to open a position. Higher leverage = lower margin needed per trade.

Lot Size: The volume or size of each trade placed.

💡 Key Takeaway

Leverage mismatches amplify risk! Copying directly from 1:500 to 1:30 can blow the lower-leverage account—even if the same lot size is used.

🧨 Why Leverage Mismatch Is a Recipe for Disaster

Suppose a Master account with 1:500 leverage opens a 1 lot EUR/USD trade, requiring just $200 margin. If a Slave account with 1:30 leverage tries to copy the same trade size, its broker demands up to $3,333 margin—far beyond what a small balance could support!

Margin requirements surge as leverage decreases—the same trade can be impossible to duplicate.

Account | Leverage | Margin Needed for 1 Lot |

|---|---|---|

Master | 1:500 | $200 |

Slave | 1:30 | $3,333 |

This is why trade copier users often encounter:

📉 Margin call trade copier errors

🚨 "Not Enough Money" or "Not Enough Margin" pop-ups

❌ Inability to open or maintain copied positions

🔥 Accounts blown due to forced liquidations

💡 Key Takeaway

Never copy lot sizes blindly: Always adjust for leverage. Copying 1:1 is only safe if leverage and equity are similar!

🛠️ Adjusting Lot Sizes for Different Leverage: The Safe Copying Formula

To ensure safe copying, calculate the maximum lot size your low-leverage account can support before any trade is copied. The golden rule:

Slave Lot Size = Master Lot Size × (Slave Leverage / Master Leverage)

Example: Copying from 1:500 Master to 1:30 Slave, a 1.0 lot order should become 1.0 × (30 / 500) = 0.06 lots.

This formula prevents overexposure, margin errors, and protects the account from forced liquidation.

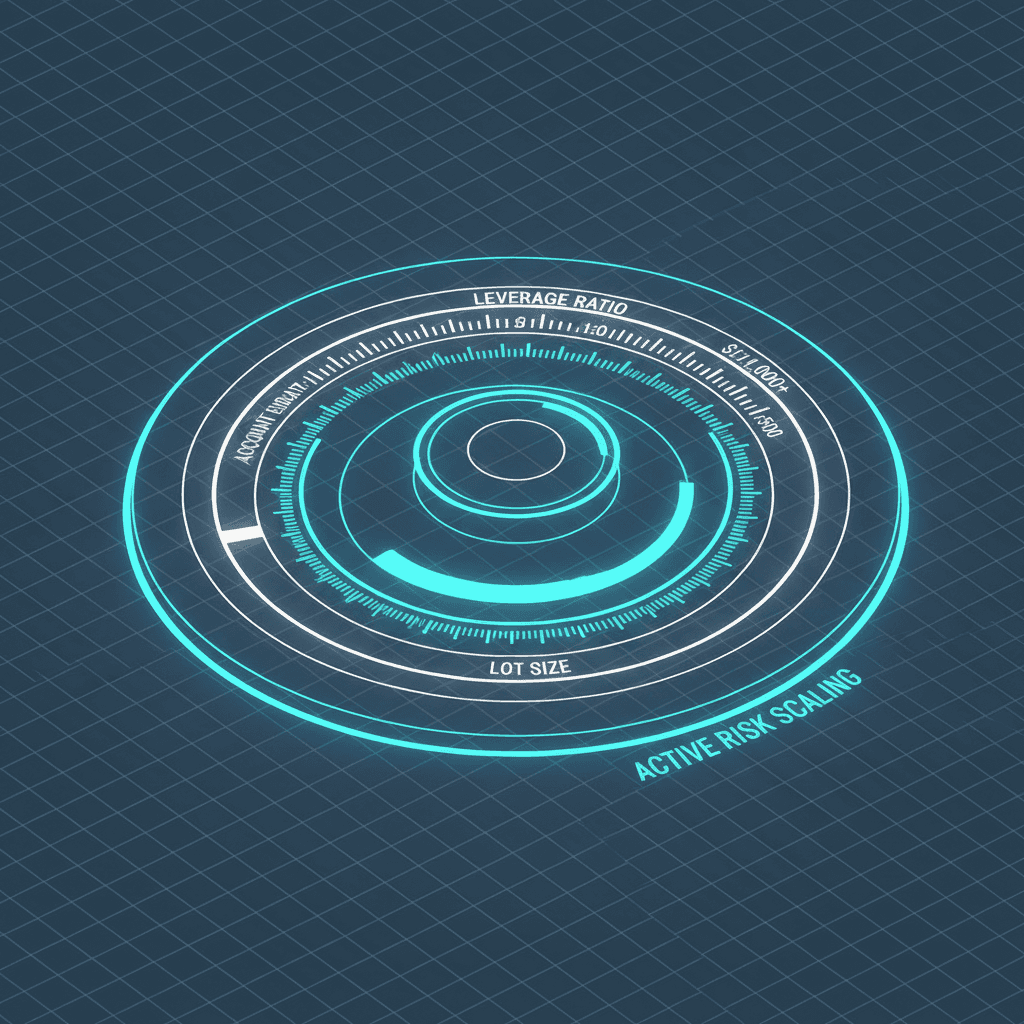

Copygram's risk scaling tools act like a precision dial—automatically setting safe lot sizes.

💡 Pro Tip

Don’t guess—use a lot sizing calculator or trust professional trade copier risk-adjustment features.

Align leverage settings before launching a copier.

Test a demo environment with real position sizes.

Regularly review margin usage and available equity.

🛡️ How Copygram’s Risk Scaling Protects Low-Leverage Accounts

Copygram’s advanced trade copier platform includes smart risk scaling options designed for scenarios involving leverage mismatches. Here’s how it shields your capital:

🤖 Automatic Lot Adjustments: Instantly recalculates lot sizes based on each account’s leverage ratio so you never over-commit.

🧮 Real-time Margin Check: Prevents trade copying if margin requirements exceed the destination account’s available funds.

⚙️ Customizable Scaling: Choose from fixed, proportional, or equity-based scaling—ideal for mixed-account setups.

🔒 Blowout Protection: Stops copying if equity or margin drops below your defined safety threshold.

These features help you copy trades from high-leverage (1:500) to strict regulatory accounts (1:30, often in the UK/EU) without risking catastrophic losses. Learn how to master drawdowns and protected copying with Copygram.

💡 Key Takeaway

Set up your risk scaling preferences before you start copying. The right settings could save your account during market turbulence!

📚 Q&A: Your Biggest Questions About Safe Copying and Leverage, Answered

Let’s address the most common concerns traders have about using a margin call trade copier when leverage isn't matched:

Q: What if my broker rejects a trade for "Not Enough Margin"?

A: Copygram’s system immediately alerts you and skips the order—keeping the rest of your portfolio safe.Q: How often should I review my lot size formulas?

A: Recalculate whenever your balance, leverage, or strategy changes. Automation tools take away the guesswork.Q: Can I set strict capital limits on my copier?

A: Yes! Use Copygram’s blowout and equity protection before copying even a single trade.Q: Is leverage the same as risk management?

A: No—high leverage can be controlled with smart risk parameters. It’s the combination that makes or breaks your account.

Check the Telegram Trade Copier for more automation options and Copygram’s knowledge base for comprehensive guides.

🚀 Final Checklist: Master Safe Copying Across Any Leverage

✅ Understand both accounts’ leverage before copying.

✅ Use the correct lot size formula, or let risk scaling software handle it.

✅ Activate margin and equity protections.

✅ Regularly monitor account health—even with automation.

✅ Never ignore copier warnings or errors!

💡 Copygram Insights

Successful copy trading is about precision, protection, and process. With Copygram’s comprehensive risk scaling, you can confidently trade—even between accounts with extreme leverage differences—without fear of a margin call disaster.

Ready to set up your copier for safety? Review process guides in our step-by-step copying tutorial.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.