Mastering Drawdown: Using a Copier to Protect Prop Firm Accounts from Breaches

Education

Dec 12, 2025

3 Min Read

Discover advanced strategies to stay within prop firm drawdown rules, implement daily loss limits, and safely copy high-risk trading strategies using Copygram. Learn how to optimize your copier settings, leverage risk multipliers, and protect your funded prop firm account from breaches.

Understanding Prop Firm Drawdown Rules: The Thin Line Between Success & Breach

Prop trading firms have strict rules to protect their capital—none as anxiety-inducing as the dreaded daily loss limit (think: FTMO's max daily loss limits). Breaching these thresholds, even for a moment, can mean the loss of a prized funded account. For traders using volatile strategies or copying trades from aggressive masters, the stakes couldn’t be higher.

Drawdown is the decline from a peak in trading equity.

Daily loss limits are hard maximums: exceed them, and your funded status is at risk.

Prop firms watch these metrics like hawks—especially during evaluation stages.

Staying compliant with these rules isn’t just about discipline; it’s about engineering your tech stack and risk settings to give you every possible edge.

When one trade breaches the daily loss limit, the domino effect can terminate your prop firm account in seconds.

Meet Copygram: Your Automated Shield Against Prop Firm Breaches

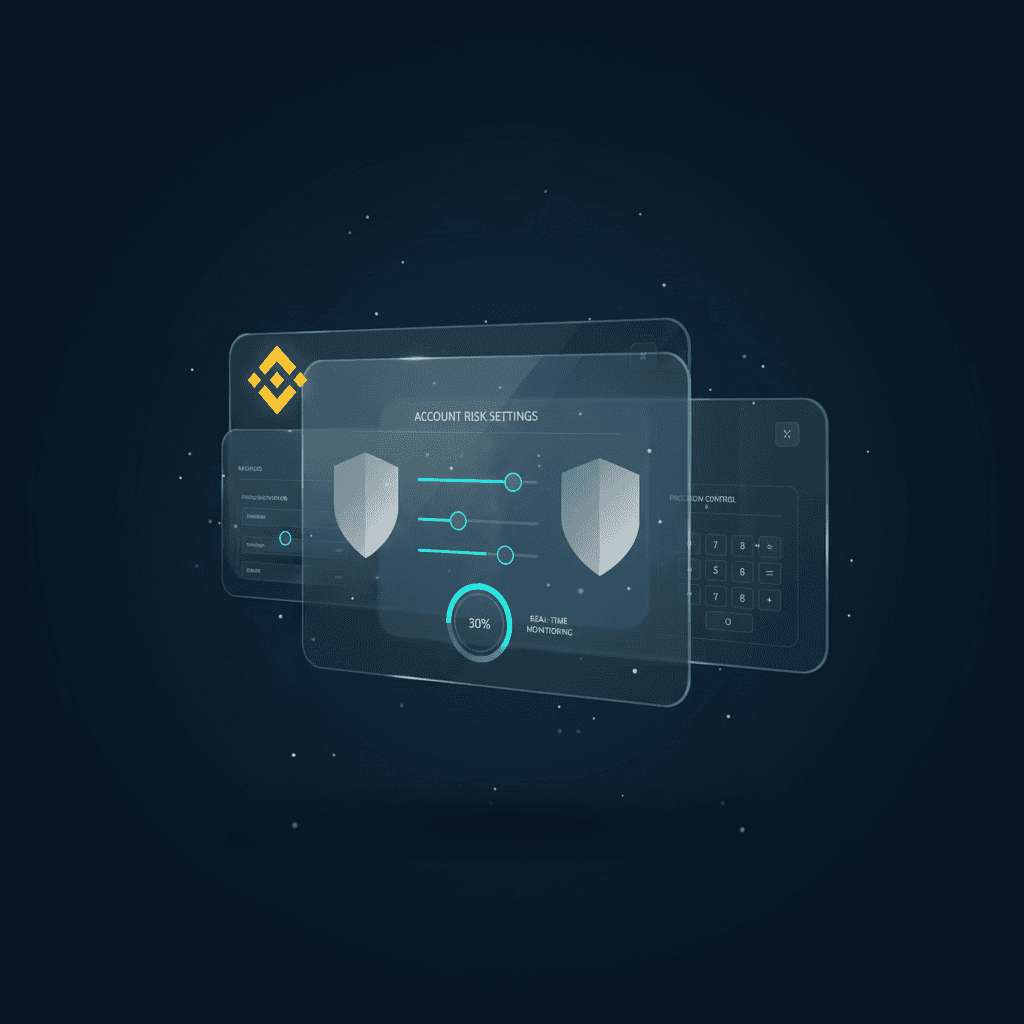

Copygram is a cloud-based trade copier trusted by thousands of prop firm traders hungry for both growth and security. By leveraging advanced multiplier controls (e.g., 0.5x risk), account-level filters, and equity protectors, Copygram isn’t just copying trades—it’s dynamically managing your risk for you.

Set a multiplier to copy only a fraction of the master’s lot size or risk: pull back when the original is aggressive.

Integrate a daily equity protector that automatically cuts off trading if your own loss limit approaches.

Build tailored copier profiles for each account to comply with diverse firm rules.

For a comprehensive walkthrough of setting up prop firm-safe strategies, don't miss our guide: Education Pass Prop Firm Challenge Trade Copier.

Copygram’s dashboard: Fine-tune risk with real-time controls and equity protection safeguards.

How to Smooth the Drawdown Curve: Step-by-Step Guide with Multipliers

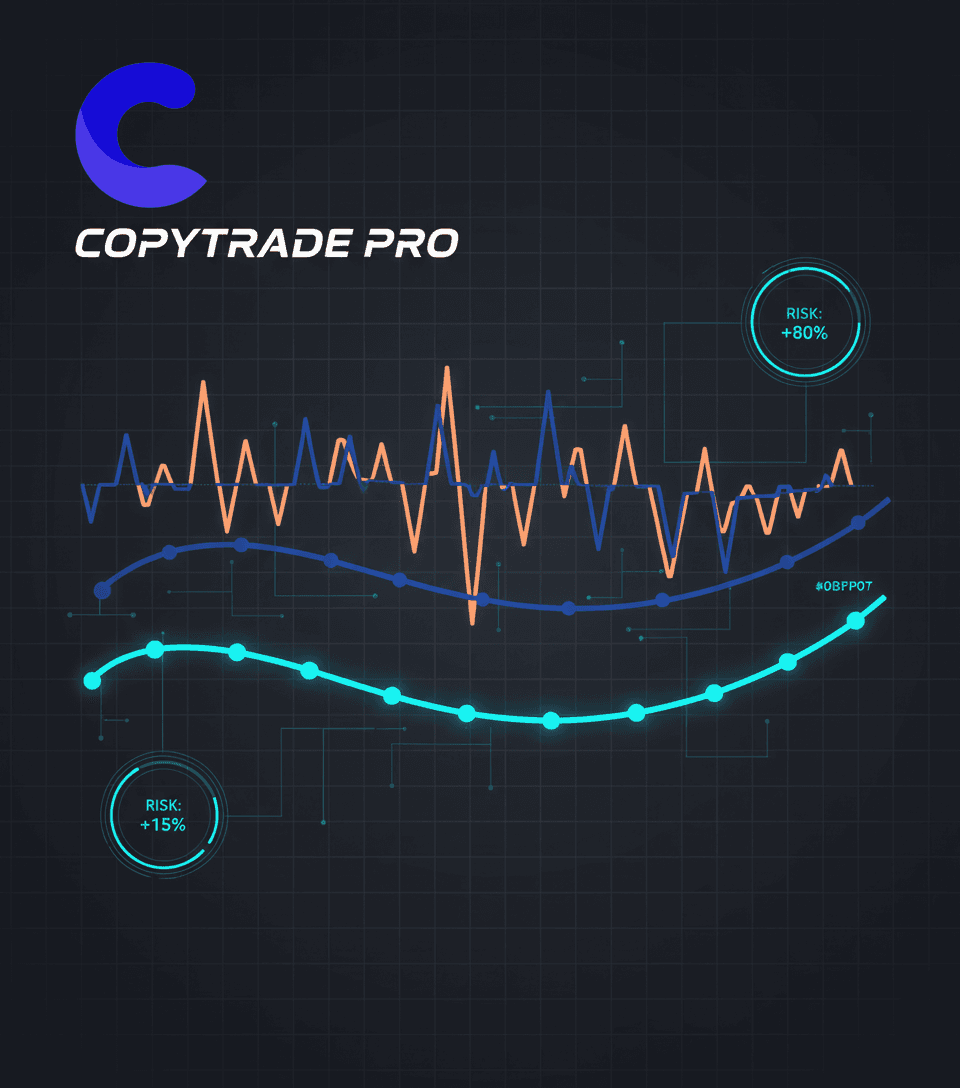

The key to consistent prop firm survival? Smooth out drawdown spikes before they threaten your funding. Here’s how Copygram’s multiplier system works in action:

Identify the Risk Level: Analyze your master trader’s typical drawdowns and risk metrics—historical max drawdown, per-trade loss, average win/loss ratio.

Select a Safe Multiplier: For aggressive masters (e.g., risking 2% per trade), set your copy account’s lot multiplier to 0.5x or even 0.3x, capping maximum per-trade loss.

Configure Equity Protector: Activate Copygram’s built-in equity protector, setting your daily loss to 4.5% (if FTMO, for example, requires max 5%).

Test and Adjust: Simulate trade copying in demo until data shows your account stays well inside prop firm thresholds—even during losing streaks.

Master Account Risk | Copy Multiplier | Estimated Drawdown (%) | Daily Loss Limit Safety? |

|---|---|---|---|

2% / trade | 0.5x | 1.0% | ✅ Yes |

3% / trade | 0.33x | ~1.0% | ✅ Yes |

1% / trade | 1.0x | 1.0% | ✅ Yes |

Notice how lowering the copy multiplier lets you run more aggressive source strategies—while your funded prop account stays inside safe limits. 📊

Pro tip: Always simbacktest before risking real capital. Set your daily cutoff lower than required to allow for slippage/gaps.

For more on prop firm selection and real-world case studies, visit Prop Firms.

Controlling your risk curve: Smooth out equity swings using Copygram’s multipliers and equity protection.

Case Study: Saving a Funded FTMO Account from Daily Loss Breach

Real scenario: A funded FTMO trader copies trades from a high-frequency master risking 2.5% per trade. Their FTMO daily loss limit is 5%. By configuring Copygram’s multiplier to 0.4x and setting the daily equity protector to 4.7%, they mitigated rapid drawdowns and protected their account—even during a severe losing streak by the master.

Number of loss trades: 5 rapid losses in a row

Master’s equity drop: 12.5%

Copy account drawdown (with correct settings): 5%

Outcome: FTMO account survived—master lost their account, copier stayed funded! 🙌

💡 Key Takeaway

When copying aggressive traders, always use risk multipliers and daily equity protectors. Never simply mirror lot sizes—optimize settings for your own prop firm’s risk profile.

Competitor Breakdown: How Copygram Stands Out in Risk Management

While many trade copiers offer basic settings, few provide per-account multipliers, instant equity protection, and automated cutoff customizable to fit the complex rules of firms like FTMO, MyForexFunds, and Topstep.

Feature | Copygram | Typical Copier |

|---|---|---|

Per-Account Multiplier | ✅ | ❌ |

Equity Protector | ✅ | ⚠️ (Manual/Delayed) |

Daily Loss Cutoff Automation | ✅ | ⚠️ (Complex Setup) |

Prop Firm Preset Profiles | ✅ | ❌ |

FAQ: Prop Firm Drawdown, Risk Settings & Daily Loss Limits

Q: How do I set a daily loss limit in Copygram?

A: Use the Equity Protector in your Copier settings and set your stop value up to 0.5% below your firm’s hard threshold. Q: Can I follow multiple masters with different risk levels?

A: Yes! Assign individual multipliers and protection settings to each master, optimizing per-account risk. Q: What if my master account hits a massive drawdown?

A: Your Copygram equity protector ensures you get stopped out before your own limit is breached—even if the master blows out entirely. Q: Does this work for all prop firms?

A: Yes. Copygram’s flexibility means you can comply with FTMO, MyForexFunds, The 5%ers, FundedNext and more. Q: How do I learn more about specific prop firm rules?

A: Visit our deep-dive reviews and guides: FundedNext Review and Guide or explore our Prop Firms hub.

🎯 Action Steps

Double-check your prop firm’s actual loss rules and publish them at your copier settings desk.

Set your Copygram risk multiplier at or below 0.5x if in doubt.

Enable daily equity protector to automate discipline (don’t rely on emotion in fast markets).

Practice risk setting in demo mode until you remain breach-free through multiple stress tests.

Document results and adjust—stability beats chasing every pip!

Further Learning & Resources

In-depth guide: Education Pass Prop Firm Challenge Trade Copier

Real reviews: Prop Firms FundedNext Review Pass Challenge Copygram

Explore all prop firm guides: Prop Firms

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles