Stop Loss Integrity: Why You Should Always Copy SL/TP Values

Education

Jan 13, 2026

3 Min Read

Understand the hidden risks of not copying stop loss and take profit values in automated trade copying. Discover why Copygram’s SL/TP sync is crucial for safety, especially for beginners. Learn how to maximize trade protection and avoid catastrophic losses.

Understanding Stop Loss and Take Profit: Your Automated Safety Net 🛡️

Stop Loss (SL) and Take Profit (TP) aren’t just settings on your trading platform—they are your primary lines of defense in fast-moving markets. These values set clear boundaries for potential losses and gains and act like an automated emergency brake when price action turns against you. But in the world of trade copying, their integrity is even more vital: if you don’t copy the SL/TP from the master account, your trades are left dangerously exposed.

Stop Loss: The automatic trigger to exit a losing trade at a predefined level, minimizing damage.

Take Profit: A set price where your profit is locked in automatically, ensuring you don’t miss out during sudden reversals.

In automation, these values are the pillars of risk management. Traders often underestimate the importance of stop loss, but not having SL/TP settings can spell disaster for copied accounts—especially in volatile forex and crypto markets.

A visible stop loss acts like a safety net, protecting your trades from market chaos—and hidden risks.

💡 Key Takeaway

In trade copying, neglecting SL/TP is not just a technical oversight—it’s a critical risk to your account’s survival. Even a single missed SL can cascade into catastrophic losses.

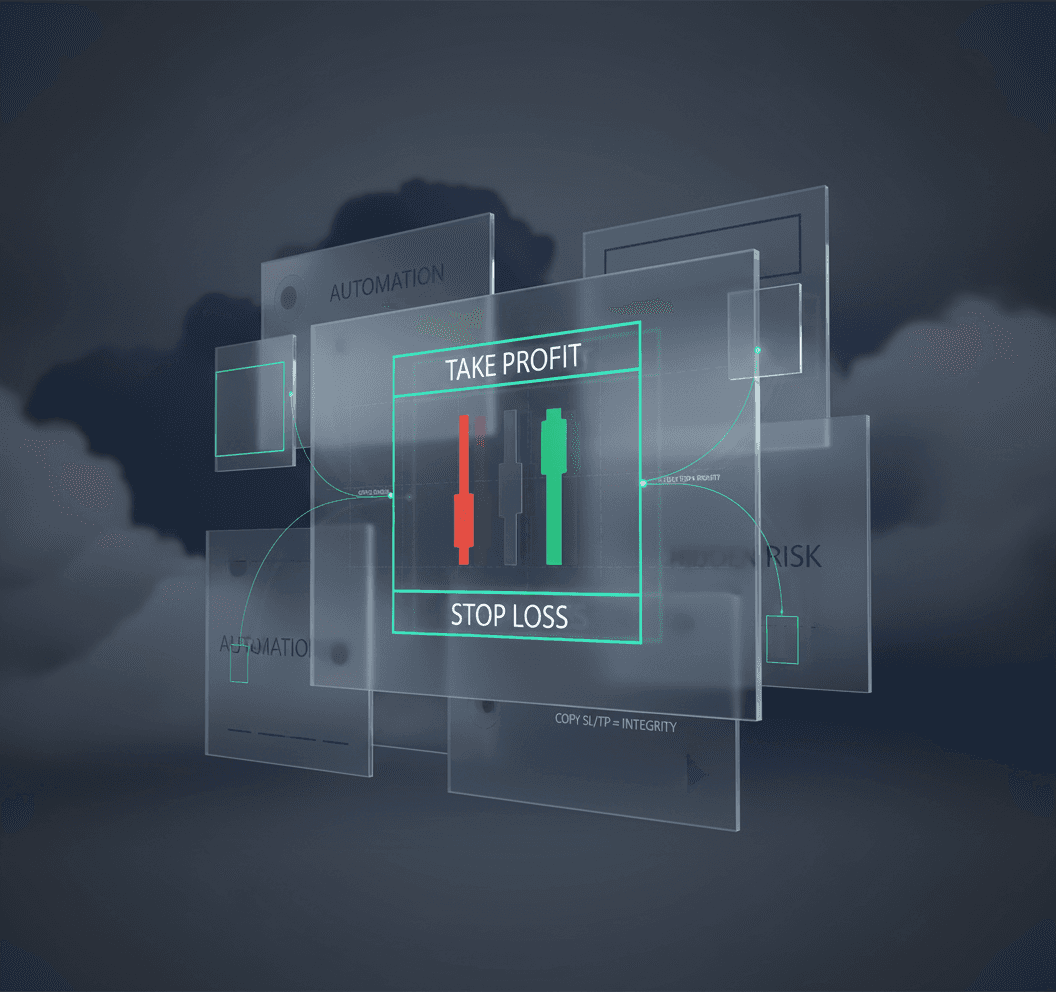

The Hidden Danger: When Stop Losses Are Not Copied

Some master traders deliberately “hide” their SL/TP, believing it shields them from stop hunting or keeps their strategies secret. While this tactic may sometimes work for the master, it fundamentally exposes the follower (slave) accounts to outsized risk.

What could go wrong if you don’t copy SL/TP?

✨ Communication Failure: If the link between master and slave disconnects (network outage, device crash, API changes), the slave account is left with open trades but no protection.

💔 Sleepless Nights: Without SL/TP, sudden market spikes can liquidate entire balances—especially during high-impact news events.

🔍 Regulatory and Broker Risks: Many brokers consider uncovered trades risky and may even force-close them or restrict your account.

This hidden stop loss risk is amplified the more you automate. Modern trading—especially with cloud-based solutions like Copygram—requires automated trade protection that never sleeps.

Layered protections—like visible stop loss and take profit—reduce hidden automation risks and create lasting trade integrity.

💡 Key Takeaway

If the master trader disconnects—even for seconds—slave accounts with no SL/TP are left on their own. Market moves can eradicate months of profits in a flash.

Copygram’s Approach: Mandatory SL/TP Sync for Genuine Account Protection 🔒

Copygram fundamentally believes in putting safety above secrecy. That’s why Copy SL/TP settings are strongly advised for all users—and are non-negotiable for beginners.

How does Copygram safeguard your account better?

🔐 Automatic Protection: When you enable copy SL/TP, your trades inherit the master’s risk boundaries—whether or not you’re online.

🛡️ 24/7 Cloud Coverage: Copygram’s cloud trades can close positions automatically, even if your local machine or VPS is off (read how it works).

📈 Consistent Results: With every trade protected, you get closer to replicating the actual master’s performance—in risk and in reward.

🤝 Alignment with Best Practices: Top-performing traders always use SL/TP. If your Signal Provider doesn’t, it’s a major red flag!

Beginners in trading, especially: never disable SL/TP syncing. It’s the single most important safety mechanism you have when copying trades.

Copygram’s strict SL/TP sync forms a secure boundary for your trades—unlocking true automation safety.

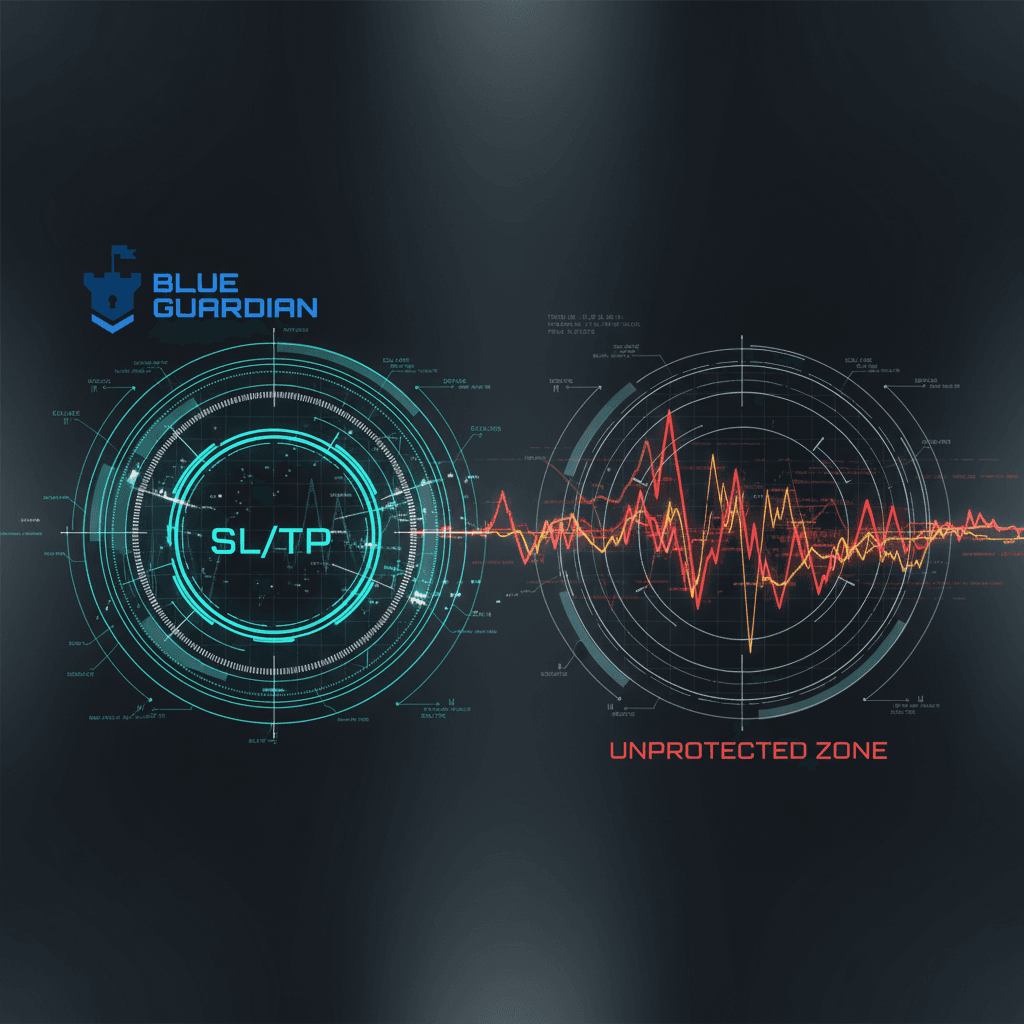

Scenario | With SL/TP Copied | No SL/TP Copied |

|---|---|---|

Master Disconnects Unexpectedly | Open trades close automatically at safe boundaries | Trades remain orphan, exposed to unlimited loss |

Market Gaps/News Volatility | 账户风险受控,亏损可管理 | Full account at risk, especially with leveraged trades |

Copygram System/Internet Outage | Built-in SL/TP on broker server triggers anyway | No safety net until system reconnects |

💡 Key Takeaway

Unprotected trades = unlimited risk. Copygram’s mandatory SL/TP sync feature closes the safety gap for all traders.

FAQ: Stop Loss, Take Profit & Copy Trading Safety 🧐

Here are the answers to some common questions Copygram users and beginners ask about the importance of copying SL/TP values and the risks of hidden settings:

Q: Can I safely copy trades without syncing SL/TP?

A: No. This massively increases your risk exposure. Always sync SL/TP unless you are a professional with a robust manual plan.Q: Will Copygram set SL/TP even if the master hides them?

A: If the master does not provide SL/TP, neither you nor any trade copier platform can set them. Always verify your signal provider’s SL/TP transparency before connecting.Q: What if my PC or VPS shuts down? Am I still protected?

A: Yes, if you use Copygram’s cloud automation and have copied SL/TP, your trades remain protected even when your device is off. Learn more here.Q: How do I check if my copier is syncing SL/TP for every trade?

A: Always review copier logs and position details in your terminal. With Copygram, enabled sync settings are displayed clearly during account setup. For step-by-step instructions, visit this guide.Q: Is copying SL/TP necessary for advanced/professional traders?

A: In rare cases experienced traders may choose otherwise. For 99% of users—including all beginners—SL/TP copying should be treated as mandatory.

📚 Recommended Reading

Conclusion: Stop Loss Integrity is Non-Negotiable for Automation

The trading landscape rewards discipline—and punishes hidden risk. Safety in automation is not optional; it’s the foundation for long-term success.

For beginners and pros alike:

Always copy SL/TP when using any trading copier—especially with Copygram.

Review your signal provider’s transparency on protective values before connecting.

Remember: Trade integrity = stop loss integrity. One unchecked setting can cost you your entire account.

For seamless, secure automation, activate SL/TP sync, and never second-guess the need for visible, server-side protective levels. Copygram makes it easy—prioritize safety, always.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles