Scaling Up: How to Merge Multiple Funded Accounts into One ‘Super Account’

Education

Jan 3, 2026

3 Min Read

Unlock the power of scaling prop firm capital! Discover the strategies, math, and step-by-step Copygram configuration to merge multiple funded forex accounts—creating your own 300k+ 'super account.' Learn optimal lot sizing, risk, and automation for portfolio trading success.

Unleashing Scale: Why Combine Your Funded Accounts?

For successful prop firm traders, the ability to scale up capital can be the difference between steady gains and exponential growth. Imagine having three $100k funded accounts. By merging them into a unified ‘super account’, you harness true institutional firepower—accessing more capital, placing larger trades, and achieving greater risk diversification.

✅ Streamline execution—no more juggling multiple MT4/MT5 terminals & logins.

✅ Boost efficiency—coordinate strategies, manage lot sizing, and automate risk controls from one dashboard.

✅ Maximize profits—open bigger positions while respecting prop firm limits.

Let’s break down how to merge, manage, and optimize your portfolio using Copygram—the industry’s premier trade copier for scaling prop firm operations.

Merging the power of multiple funded accounts yields a strong, unified portfolio.

The Power of Multiplication: Lot Sizing Math Explained 🧮

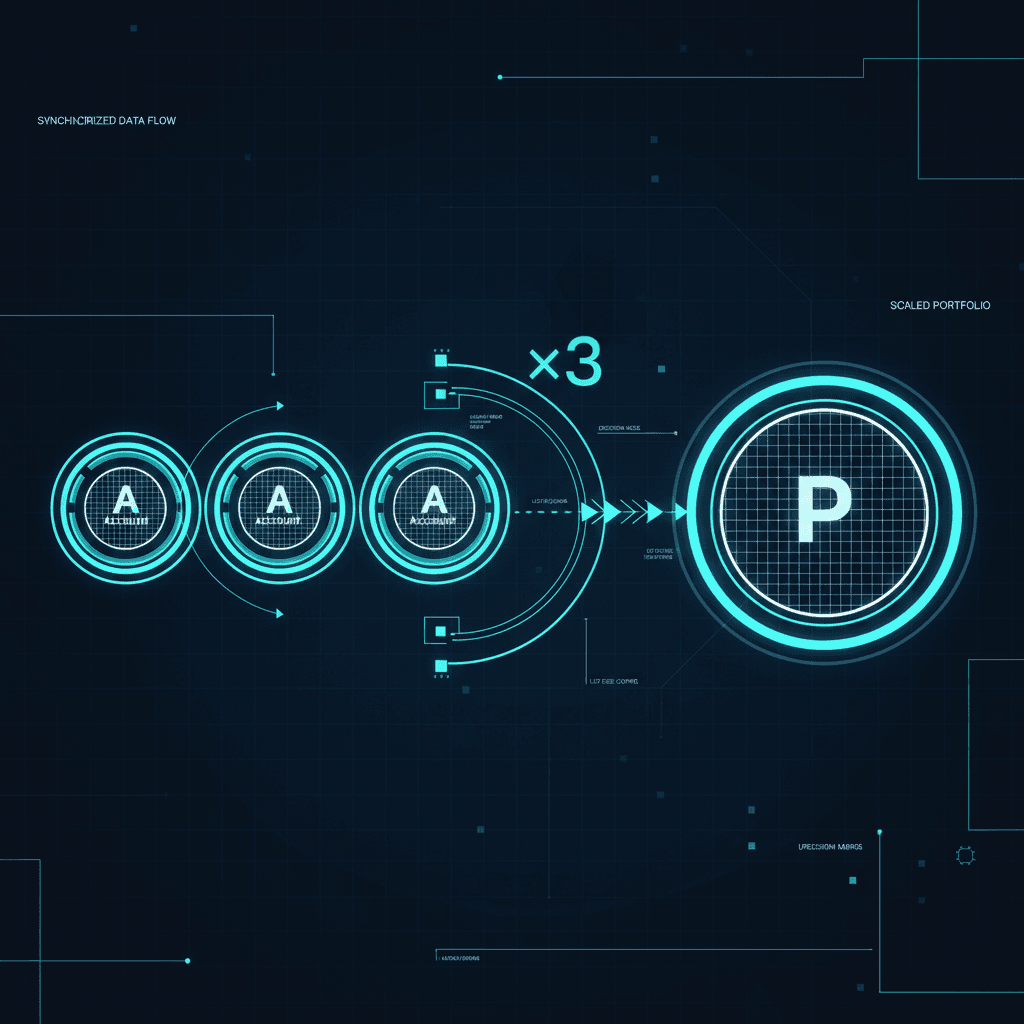

When managing multiple accounts, understanding lot sizing is core to your success. Consider this foundational scenario:

Accounts | Capital per Account | Total Capital | Safe Lot Size (example) |

|---|---|---|---|

1 | $100,000 | $100,000 | 1.0 |

3 | $100,000 | $300,000 | 3.0 |

Key takeaway: Lot sizing should scale in direct proportion to capital. If you normally trade 1.0 lot on a $100k account, combining three accounts allows you to safely trade 3.0 lots aggregate—as if you have a single $300k account.

This is lot size multiplication in action. Get it right and you’re instantly operating at institution-level scale 🚀.

💡 Key Takeaway

Always adjust your lot size based on total effective capital, not just per-account limits. This ensures consistent risk and compliance with prop firm rules. Copygram’s Auto Lot Multiplier can automate this calculation for you!

Precision and scale: Lot size math and account synchronization visualized.

Step-by-Step: Merging Your Accounts in Copygram

Copygram makes it easy to configure multiple funded accounts as a single, cohesive trading portfolio. Here’s how you do it:

Connect all funded account logins (MetaTrader/MT4/MT5) to Copygram’s platform.

Create a portfolio group: In Copygram, use the Portfolio feature to group selected accounts under one umbrella.

Enable Auto Lot Multiplier: Set your desired base lot size per $100k and activate ‘Auto Lot Multiplier’ so Copygram automatically multiplies your trade size based on the number of linked accounts.

Sync risk management settings (including max loss/daily loss) across all grouped accounts for consistent risk exposure.

Activate instant trade copying: With one click, Copygram will mirror trades—scaling lot sizes in real time, with zero slippage or duplication errors.

Need more? Dive into our dedicated guides for each prop firm (like Funded Trading Plus or The Trading Pit) for prop-specific config examples.

Copygram’s automation brings all your funded accounts into one streamlined, scalable dashboard.

Portfolio Trading Strategies: Advanced Tactics for the Super Account

Now that your capital is aggregated, how do you deploy it? Here are proven tactics for trading with your new ‘super account’:

Basket Trading: Launch harmonious strategies across all accounts simultaneously for enhanced risk spreading and correlation benefits.

Time Diversification: Trade different sessions (London, NY, Asia) with capital blocks split by time—great for reducing drawdowns.

Asset Class Blending: Use Copygram to mix FX, indices, and commodities in a synchronized approach—true multi-asset diversification.

Selective Scaling: Boost position size only for selected high-conviction trades (using Copygram filters and advanced trade management features).

💡 Pro Tip

With portfolio trading, discipline and record-keeping are essential. Use Copygram’s analytics suite to monitor aggregate P&L, risk stats, and trading history across all merged accounts in real time.

FAQ: Scaling, Compliance, and Troubleshooting

Q: Can I merge funded accounts from different prop firms?

A: Yes. Copygram supports all major prop firm brokerages and can consolidate any accounts you connect, as long as each account is eligible under its firm’s terms.

Q: How does Copygram avoid overtrading or breaching max daily loss?

A: Copygram’s risk sync instantly calibrates your trading size and risk limits across all connected accounts—minimizing human error. Real-time monitoring protects against accidental breaches.

Q: Will Copygram duplicate trades and cause overexposure?

A: No, Copygram’s smart copier recognizes the portfolio context and merges trade signals—preventing overlap or trade duplication, even with multiple accounts on the same broker.

Q: Do I need coding skills to set this up?

A: Not at all! Copygram is designed for zero-coding, fast configuration.

Ready to Command Institutional Scale?

Mastering the art of scaling prop firm capital is a mark of elite traders in 2024. Merging your funded accounts with Copygram lets you manage up to $300k, $500k, or even $1M as a true super account. Multiply your edge, automate your workflow, and trade with the power of a prop desk—all from a single dashboard.

Want to learn more? Explore our exclusive guides for each prop firm:

Funded Trading Plus Review Copygram Guide | The Trading Pit Review Pass Challenge With Copygram | Top One Trader Review Pass Challenge Copygram

Ready to start? Get started with Copygram today and experience the true power of merged portfolio trading.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles