Understanding Slippage and Latency: Why Your Copied Trades Might Enter Differently

Education

Dec 9, 2025

3 Min Read

Discover what slippage is, why copy trading sometimes leads to different entry prices, and how latency impacts your trades. Learn actionable solutions—like Copygram’s lightning-fast cloud tech—to minimize slippage and optimize execution speed for MT4, MT5, and beyond.

Trade Copying Isn’t Always Copy-Paste: The Slippage & Latency Paradox

Have you ever noticed your slave account entering trades at a slightly different price than your master account? 🤔 Whether you’re using MT4, MT5, or any popular platform, this discrepancy is often rooted in two main culprits: slippage and latency. Understanding these issues isn’t just an exercise in technical jargon—it’s crucial for maximizing your trading performance and protecting your capital.

In this deep dive, we’ll unravel:

What slippage really means in the world of trading

How latency can disrupt even the best copy trading setups

Why a master trade and its copied version might never be exactly the same

Practical, actionable fixes—especially leveraging Copygram’s ultra-fast cloud-based execution

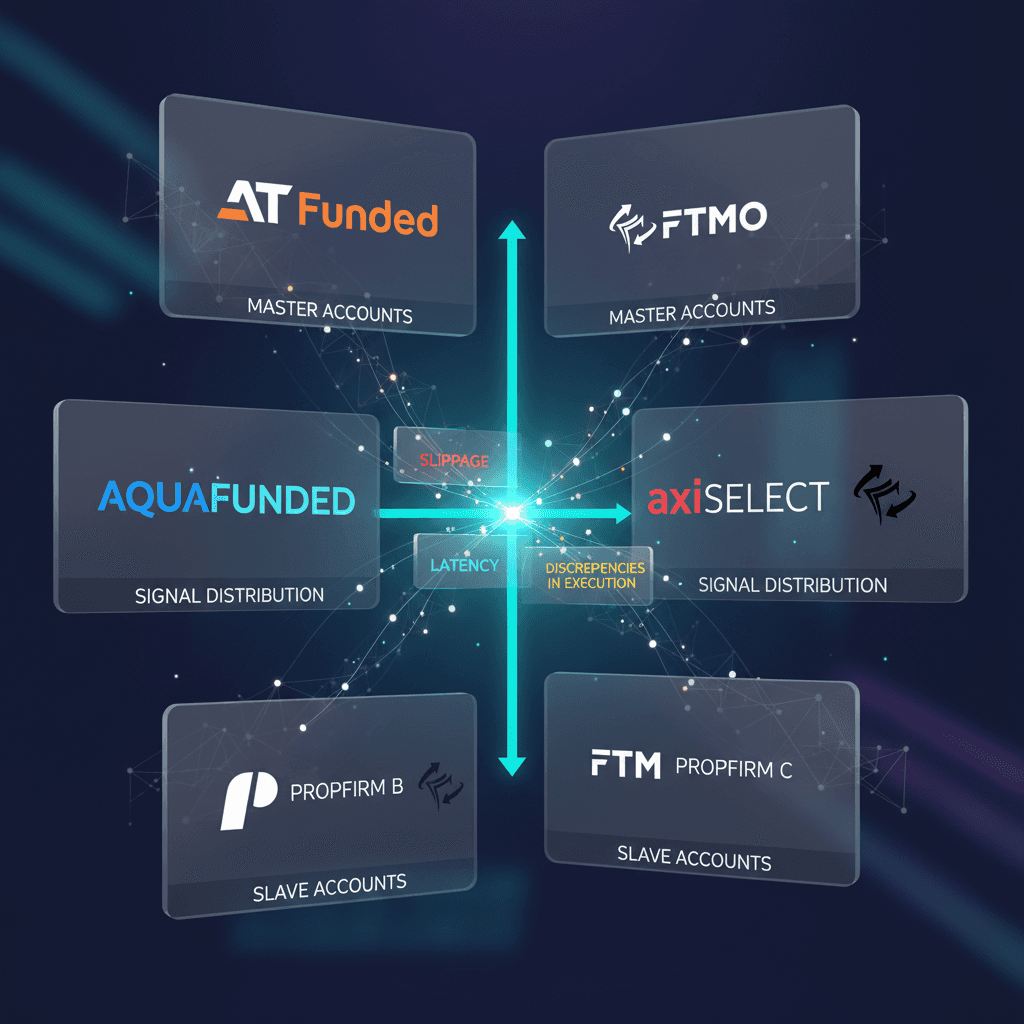

Trade journey visualized: from master to slave—every stage is a chance for discrepancies to occur.

What Is Slippage in Trading? 📉 From Theory to Real-World Trades

Slippage occurs when a trade is executed at a different price than expected—usually due to fast-moving markets, liquidity gaps, or technical delays. In copy trading, even the tiniest delay between the master and slave account can result in a different entry price.

Key causes of slippage:

Market Volatility: Sudden news or events trigger sharp price movements, making it hard for any system to keep up.

Liquidity: Thin order books, especially on exotic pairs, mean there might not be enough volume at your desired price.

Broker Execution: Some brokers simply process orders slower or have wider spreads, causing slippage.

Latency: The time it takes for trade signals to travel—especially in multi-platform setups like MT4/MT5—impacts final execution price.

Example: Suppose your master account initiates a EUR/USD buy at 1.1000. But by the time the copy signal reaches the slave account, the best available price might be 1.1003—a 0.3 pip slippage.

Why does it matter? Over time, even small slippage can erode your profits, particularly for high-frequency or scalping strategies.

Broker spreads, volatility, and internet speed each contribute to slippage, often stacking their effects.

💡 Key Takeaway

Slippage is unavoidable in fast markets—but choosing the right technology and broker can dramatically minimize its impact on your trading results.

Latency Unveiled: How Trade Copier Speed Shapes Your Entry Price

Latency is the delay between when a trade is triggered on the master account and when it’s executed on the slave account. Even milliseconds matter in forex, crypto, or indices trading.

Why does latency happen in copy trading?

Physical distance: If your master and slave terminals are on different continents, signal travel takes longer.

Internet speed: Home or office network lag can bottleneck trade execution.

Broker server speed: Not all brokers have equally fast infrastructure or data centers.

Trade copier technology: Older or poorly optimized copiers (especially local/PC-based) introduce extra delays compared to cloud-based systems.

Pro Tip: For fastest results, use a cloud-based trade copier like Copygram to reduce trade copier latency to a bare minimum—often less than 50 ms even across multiple brokers and platforms.

Read more: Local vs. Cloud-Based Trade Copiers—Why Copygram Cloud Wins

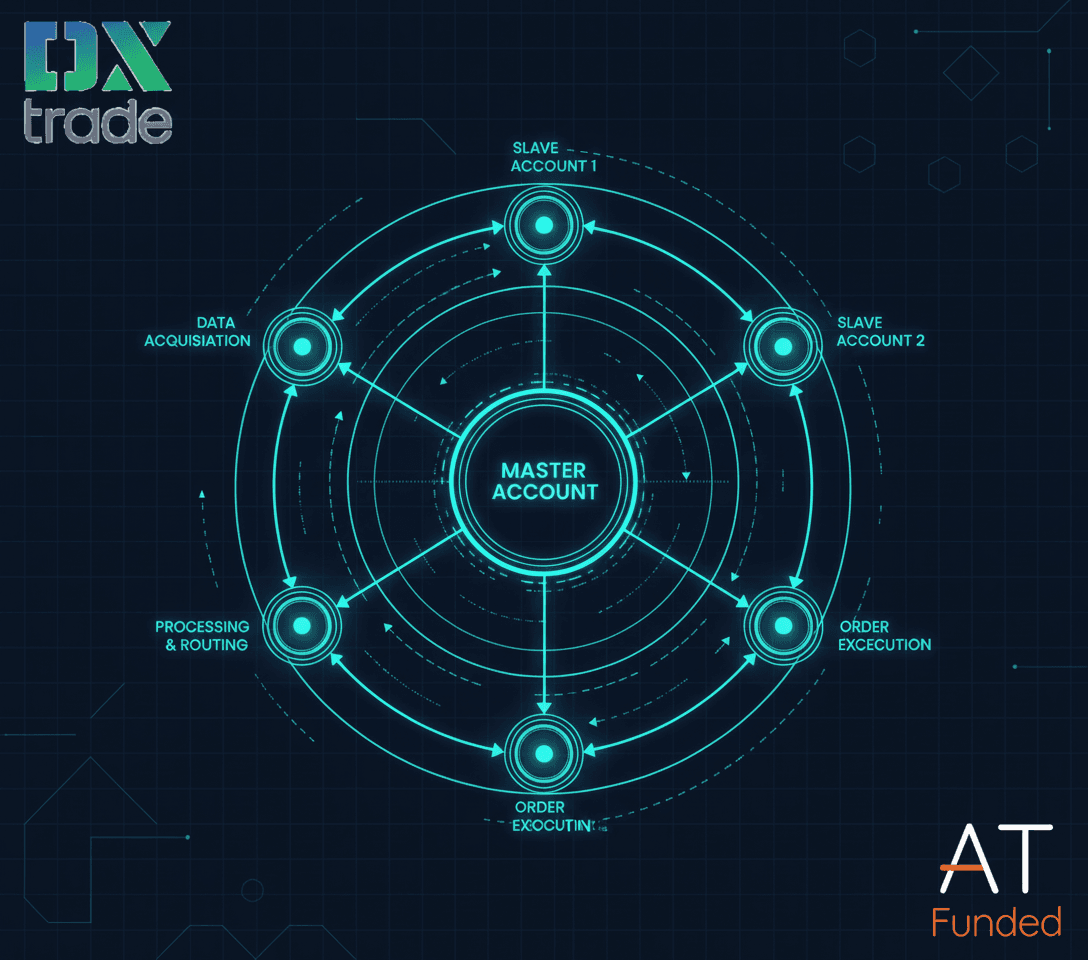

Copygram’s cloud execution drastically reduces latency between master and slave accounts—no matter where you or your broker are.

Pinpointing Price Discrepancies: Why MT4/MT5 Trades Don’t Match

Even if you use the same broker or platform, you may see minor pricing differences. Here’s why:

Broker spreads: Even with identical accounts, brokers can change their spreads moment to moment.

Liquidity sources: Your master and slave might access different liquidity pools at the moment of trade.

Slippage compounding with latency: If both slippage and latency occur, the price may move twice before the trade lands.

Server synchronization: Out-of-sync servers can ‘misreport’ the real price in that split second.

Action Step: If you notice a persistent issue, run a test with both accounts on the same server, broker, and internet connection. If the issue disappears, you’ve identified the culprit.

Want to fix pricing differences on MT4/MT5? Ensure both accounts:

Use the same broker and server (if possible)

Operate during peak liquidity hours

Minimize running background apps that could slow your internet

Choose a high-speed trade copier like Copygram

🔎 Did You Know?

Copygram’s proprietary technology is engineered to handle execution across 12,000+ user accounts with industry-leading speed and reliability. See it in action.

Copygram: Your Edge Against Slippage & Latency

Not all trade copiers are created equal. Copygram leverages a global network of cloud servers, sophisticated engineering, and continuous optimization to ensure:

Super-low latency: Cloud-based infrastructure with direct broker connections eliminates intermediate delays.

Advanced order routing: Smart algorithms choose the fastest and most reliable route for every trade.

Seamless multi-broker & multi-platform support: Copy trades across MT4, MT5, and more—simultaneously.

Enterprise-grade reliability: 24/7 uptime and redundancy for uninterrupted signal delivery.

Result: Your copied trades are as close to the original as possible—even in volatile conditions.

For a deeper technical breakdown, check out our expert guide on cloud vs. local trade copiers.

🚀 Take Action

Ready to experience near-instant trade copying with minimal slippage? Join Copygram now and trade with an edge.

FAQs: Slippage, Latency, and Copy Trading Execution

Q: Is slippage always bad? Can it work in my favor?

A: Slippage is neutral—it simply means a different price than requested. Sometimes, you might get a better price than expected (positive slippage), but most traders remember the negative kind.

Q: What’s a realistic expectation for trade copier latency?

A: Quality cloud copiers like Copygram achieve 20–70ms latency (milliseconds), while PC-based solutions can be 200ms+ or worse.

Q: Why does my copied trade sometimes not open at all?

A: This usually happens due to low liquidity, max slippage settings, or broker restrictions. Check platform logs for more info.

Q: Is there a way to completely eliminate slippage?

A: No system can guarantee zero slippage, but using top-tier tech and brokers can minimize it to negligible levels.

Summary Table: How to Minimize Slippage & Latency in Copy Trading

Factor | What You Can Do |

|---|---|

Broker Spreads | Use ECN brokers with tight, transparent spreads |

Latency | Adopt cloud-based copiers (like Copygram) for ultra-fast execution |

Internet Speed | Use wired connections and minimize background activity |

Market Volatility | Avoid trading major news releases when possible |

Trade Copier Quality | Choose a proven platform with robust infrastructure |

Next Steps: Level Up Your Copy Trading

• Diversify your strategies like a hedge fund

• Explore Telegram-based trade copying

• Pass prop firm challenges with smarter execution

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles