The Psychology of "Hands-Off" Trading: Overcoming the Urge to Intervene

Education

Dec 22, 2025

3 Min Read

Discover the psychological traps of hands-off copy trading. Learn to overcome FOMO, build discipline, and trust the algorithm with Copygram's unique approach to 'set and forget.' Essential reading for traders seeking a winning mindset.

1. Craving Control: Why "Hands-Off" Feels So Hard 🎛️

Automated and copy trading promise freedom, efficiency, and access to expert strategies. But for most traders—novice and experienced alike—the idea of truly letting go and not intervening in live trades is psychologically daunting. Why do we feel the urge to interfere?

Need for control: Humans are hardwired to seek control in uncertain situations (see: Illusion of Control).

Fear of losing (FOMO): The pain of missed opportunity or loss hurts more than the satisfaction of gains (loss aversion/bias).

Ego & identity: Traders often equate market outcomes with personal worth, making detachment difficult.

Feeling anxiety as a copied trade moves against you? The urge to intervene isn’t a flaw—it's a natural cognitive response!

Over-managing trades can create invisible walls between you and your trading goals.

2. The True Cost of Intervention: When "Helping" Hurts Your Edge

Let’s break down what happens when you manually close, adjust or override copied trades based on emotion—particularly panic. Even a single intervention can invalidate a winning strategy’s statistical edge. Here’s why:

You break systematic logic: Every successful algorithm or expert system is built on a backtested premise, not gut feelings.

Losses get locked in: Panic-closing often realizes small losses that the system might have recovered by following the plan.

Wins are cut short: Winning trades sometimes need time or room—manual exits crush potential returns.

Slippage & costs: Unplanned exits can increase slippage and fees (Education Understanding Slippage Latency Copy Trading).

Panic isn’t just costly—it’s destructive to compounding returns and plan integrity!

💡 Key Takeaway

Intervening in automated trades often converts successful long-term strategies into a chaotic series of emotional reactions. Real discipline means letting the numbers do their work—even when nerves scream otherwise.

Automated trading is a constant battle between trust and temptation to interfere.

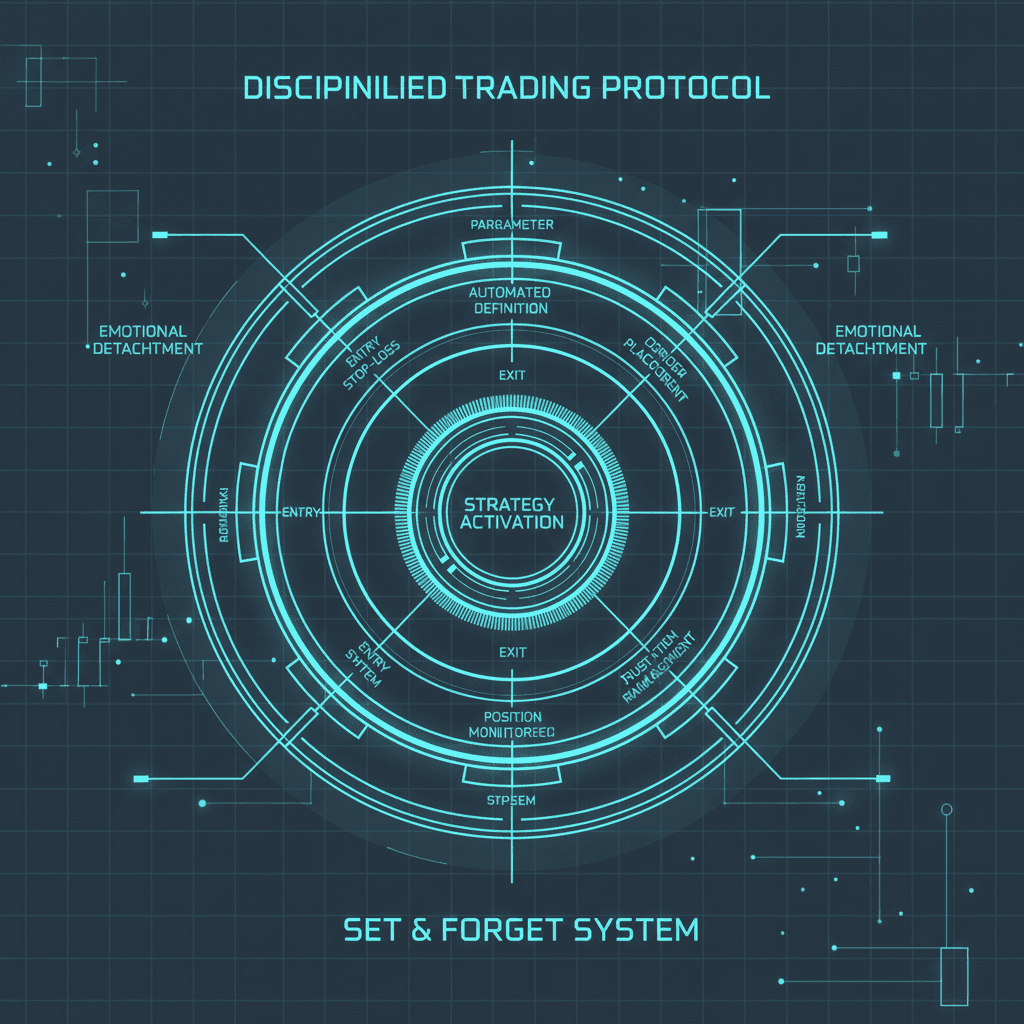

3. The Discipline Equation: Mental Training for "Set and Forget" Results ⏳

So, how do top traders and disciplined investors build the resolve to truly let systems work? The "set and forget" mindset is developed, not innate. Here are frameworks and mental techniques proven to work:

Pre-Commitment: Decide on your rules and risk before enabling automation—write them down. Trust your prep, not your panic.

Automation Agreements: Set strict personal rules for when (if ever) you’re allowed to override. (Pro tip: If you’re adjusting a strategy, tweak the rules, not the active trades.)

Reframe losses: Accept that all strategies have drawdowns. Label them as "costs of doing business," not failures.

Track outcomes: Keep a journal. Log every time you feel tempted—and whether you intervened. Awareness builds discipline.

BONUS: Remove "Portfolio Peeking": Studies show checking results too often stokes anxiety and short-termism. Set review times weekly or monthly!

Discipline is engineered: create your plan, then step back and let automation work.

4. Copygram’s Advantage: Healthy Distance and Reliable Execution

Copygram is more than a trade copier—it’s a behavioral edge for disciplined traders. Here’s how Copygram helps you conquer psychological pitfalls and maintain optimal distance:

Automated, Rules-Based Execution: Copygram enforces strategy logic consistently, preventing impulse overrides.

Transparent Monitoring: Monitor all trades, strategy performance, and risk in one unified dashboard—without the urge to micromanage.

Delayed Emotional Reactivity: By routing trade execution through Copygram (not directly via broker apps), you build a buffer between decision and action—empowering logical thinking over panic.

Custom Limits and Notifications: Set risk parameters, get notified on key events—not every tick. This reduces unhealthy obsession with short-term swings.

Ready to build real discipline? Leverage Copygram’s technology to reinforce your psychological edge and avoid the classic mistakes of hands-on trading.

💡 Quick FAQ: Common Hands-Off Trading Worries

Q: What if the system is wrong?

A: No system or expert wins every trade. Stick to pre-defined risk limits and use statistical data, not one-off events, to drive decisions.Q: Should I turn off automation during market turmoil?

A: Not unless your backtesting or plan says so. Constant tweaking ruins strategic edge.Q: Isn’t checking often being "responsible"?

A: Surprisingly, constant checking amplifies stress, not results. Set a review schedule!

5. From Emotional to Elite: The Long-Term Payoff of "Set and Forget"

Mastering the hands-off approach takes practice—but the payoff is immense. Traders who resist the urge to over-manage their strategies benefit from:

Stronger compounding: Letting edge play out across many trades builds exponential returns.

Reduced emotional exhaustion: More time, less stress, better focus.

More objective learning: Reviewing pure, untainted strategy data sharpens skill faster than reactive tweaking.

A sustainable trading lifestyle: The freedom that automation promises is only possible if you’re willing to let go.

Conclusion: In the world of hands-off, rules-based trading, your greatest challenge isn’t the market—it’s your own psychology. Let Copygram and sound mental discipline become your partners on the path to elite, sustainable returns.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles