Partial Closes and Trade Copying: Handling Complex Trade Exits with Confidence

Education

Dec 24, 2025

3 Min Read

Discover how partial closes work in MT4 & trade copying systems. Learn the logic behind copying partial exits, Copygram’s precise handling, and strategies for scaling out and managing complex trade exits efficiently.

Understanding Partial Closes: The Foundation of Flexible Trade Management 🏦

Partial closes—closing only a portion of your open position instead of the entire trade—are a cornerstone of risk management and sophisticated trading strategies like scaling out. On platforms like MT4, this feature empowers traders to lock in profits, reduce exposure, and adapt to changing markets in real time. But, a common pain point emerges when trade copying enters the scene: Do copiers like Copygram reflect these nuanced exits on follower (slave) accounts?

MT4 partial close: Close part (e.g., 50%) of your trade volume; keep the rest running.

Scale out trading strategy: Gradually reduce exposure as price action evolves, rather than one full exit.

This opening sets the stage for a deeper dive into the copying mechanics, technical challenges, and Copygram's solution—ensuring no trader or strategy is left behind.

Partial closes are like balancing two sides of a scale—strategy and execution must remain in perfect harmony.

MT4 Partial Close Logic: How It Works and Why It Matters ⚙️

In MT4, a partial close is performed by closing a selected portion of an open position’s lot size. For example, from a 1.00 lot trade, you might close 0.50 lots, leaving 0.50 lots running. The closed portion books P&L while the remainder stays open with the same ticket ID. This action is available for manual discretion and for EAs (expert advisors).

Reduces risk without fully exiting the market.

Enables dynamic scaling out or in based on price movement.

Requires brokers and copying systems to handle fractional volume updates flawlessly.

But does MT4’s internal logic always translate cleanly to trade copier platforms? Let's investigate that crucial bridge.

The Complexity of Copying Partial Exits: Challenges in the Real World 🔄

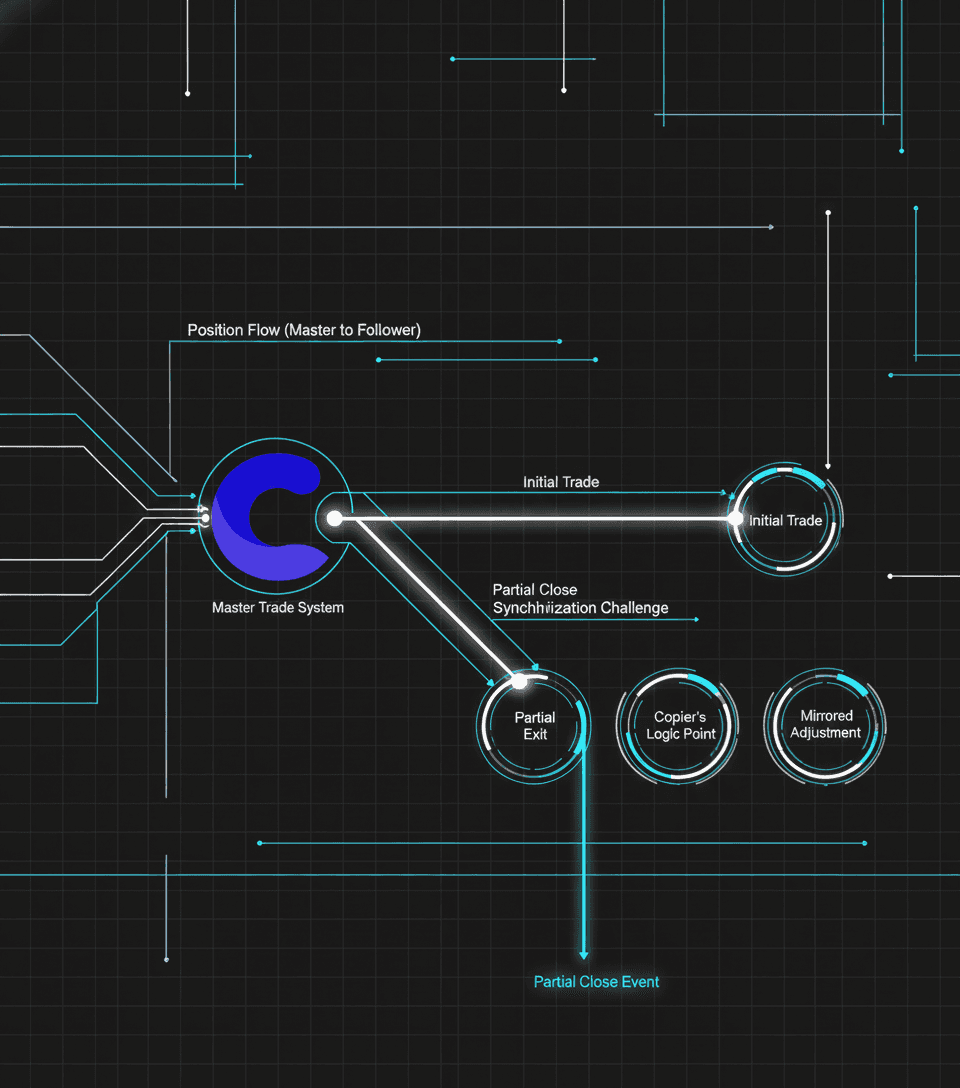

Here’s where many traders get tripped up: standard trade copying is straightforward when every exit is full and final. But when a master account performs a partial close, how does the copier ensure the slave account perfectly mirrors the volume adjustment? Mismatches can cause significant deviations, incorrect risk, and unexpectedly large (or small) losses and profits on the follower’s end.

Scenario | Master Account | Follower Account |

|---|---|---|

Full Close | Closes all 1.00 lot | Closes all 0.20 lot |

Partial Close (50%) | Closes 0.50 lot; 0.50 remains | Closes 0.10 lot; 0.10 remains |

Trade copying path: each node must faithfully transmit the updated volume for ideal outcomes.

💡 Key Takeaway

If your copier doesn’t support granular partial close logic, follower accounts will deviate from your intended strategy. Even a small mismatch can undermine months of careful planning!

Copygram’s Solution: How Exact is Your Partial Close Replication? 🟦

Copygram stands at the frontier of advanced trade replication by ensuring:

Every partial close performed on your MT4 master account is mirrored at the precise same proportional volume on each slave account—regardless of account size, starting balance, or broker.

Real-time detection of partial close events down to 0.01 lots

Dynamic calculation for each follower’s scale and starting volume

Automatic correction for any transmission lag or desynchronization

Works seamlessly across MT4, MT5, and multi-platform environments

🛡️ Why It Matters

Your trade copying is only as trustworthy as its ability to handle nuance. In Copygram, when you close 50% of a 1-lot trade, your follower—even with a significantly smaller account—closes exactly 50% of their local volume, maintaining perfect risk and strategy integrity.

Troubleshooting: What If Partial Close Volumes Don’t Match?

If you ever notice mismatched remaining positions between master and slave, consider:

Minimum lot size limitations: Some brokers restrict min trade volume to 0.01 lots or higher, rounding may thus occur.

Latency: High server/ping times can delay the partial close signal transmission.

Configuration: Ensure the copying ratio and settings in Copygram are correct for the follower.

Different platforms: Mixing MT4/MT5 or third-party brokers with different precision or lot rules can create rare mismatches.

Best practice: regularly reconcile open trades across all linked accounts. If persistent issues arise, consult the Copygram knowledge center or contact support for personalized troubleshooting.

Scale Out Trading: The Power of Partial Exits in Advanced Strategies 🚀

Scaling out—systematically reducing position size as the trade moves in your favor—is among the most powerful ways to manage risk and maximize returns.

Copygram’s support for scale out trading strategy means:

Partial closes are accurately mirrored, even across multiple take-profit targets.

Your followers experience the same progressive profit protection as you do on the master account.

Position sizing adapts automatically, removing tedious manual adjustments or oversight.

Whether you’re scaling out at Fibonacci levels, custom pivots, or arbitrary percentages, Copygram’s handling of complex exits ensures your intent is faithfully replicated with zero slippage or missed opportunities.

For more on strategy, see real-world scaling and exit analyses, such as our Trading Ideas Microsoft Msft Weekly Stock Analysis Outlook Week 2 November 2025.

📝 Frequently Asked Questions (FAQ)

Q: If I partially close 50% of a trade on MT4, will Copygram do the same for my follower accounts?

A: Yes. Copygram calculates the proportional lot size and closes the exact same percentage, regardless of account size differences.

Q: Are there any risks or limitations I should watch for with partial closes and copying?

A: Only broker minimum lot constraints or rare latency issues; otherwise, Copygram ensures uncompromised accuracy.

Q: Can I use scale out strategies or multiple partial closes?

A: Absolutely. Copygram is engineered to support all scaling and step-out tactics with precise mirroring on all linked followers.

Best Practices: Flawless Partial Close Management with Copygram ✅

Always verify your broker’s minimum trade size and rules before partial closing.

Regularly sync account settings and check for configuration mismatches in Copygram.

Use scaling strategies to lock in gains while letting profits run—but confirm each partial close is reflected on all followers.

Leverage Copygram’s knowledge center for deep dives and troubleshooting tips.

Ready to master complex exits? Copygram is built for pro-level, precision trade copying—ensuring every micro-move in your strategy is faithfully executed across your community.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles