Micro-Account Strategy: Testing Waters with Cent Accounts

Education

Jan 22, 2026

3 Min Read

Unlock ultra-low-risk forex trading. Discover how cent accounts ($10 = 1,000 cents) empower beginners to test EAs, strategies, or copy trades in real time with micro-lot precision. Step-by-step Copygram guide included!

📉 What Are Cent Accounts? The Beginner’s Secret to Safe Forex Testing

Cent accounts—often called micro or nano accounts—are special forex trading accounts where balances are displayed in cents, not dollars.

Example: Deposit $10, your trading balance is shown as 1,000 cents.

These accounts allow traders to take ultra-small positions (micro-lots, even nano-lots), enabling:

✅ Live market experience with almost no real risk

✅ The ability to test trading robots (EAs) or copy strategies

✅ True psychology of live trading, minus the stress of high stakes

For beginner traders and those seeking advanced, low-risk testing, cent accounts are a game changer.

Cent accounts multiply small deposits into workable trading balances, ideal for live testing.

🔍 Why Choose a Cent Account? The Big Benefits of Micro-Account Testing

Before risking big, smart traders start small. Here’s why cent accounts are among the most powerful live testing tools in forex:

🧪 Test Expert Advisors (EAs) with real money—no more simulation or guesswork.

🔄 Experience true market execution—spread, slippage, and liquidity affect you, even at tiny scale.

💸 Ultra-low capital requirement—start with as little as $1–$10.

💪 Build discipline and emotional control—real losses/gains, but pocket change risk.

🛡️ Test risk management techniques—adjust lot size/downsize until it’s perfect.

🤖 Copy strategies safely—outsource performance, keep your risk tight.

Cent Account Feature | Advantage |

|---|---|

Micro/Nano Lot Sizes | Risk just pennies per trade |

Live Market Data | Experience real slippage/spreads |

Real Psychology | Train discipline under live pressure |

Low Entry Barrier | Try strategies with only $10–20 |

Micro-account testing offers layers of safety and transparency—perfect for new or cautious traders.

💡 Key Takeaway

Cent accounts empower traders with the safety net they need to master strategy execution, EA performance, and live discipline—all without risking significant capital.

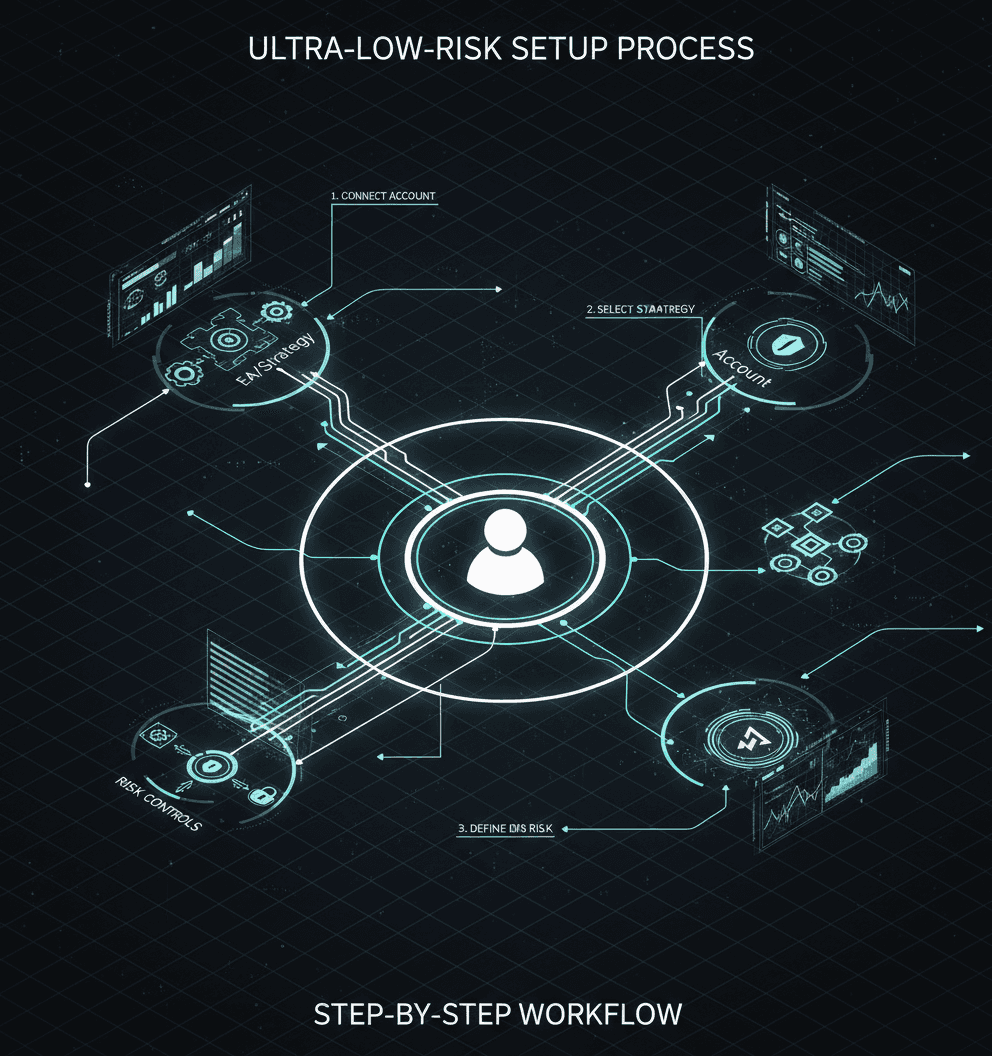

⚙️ From Theory to Practice: Step-by-Step Guide to Using Copygram with Cent Accounts

Ready to test your EA or copy popular traders—with truly minimal risk? Copygram’s support for cent accounts makes this transition seamless.

How it Works:

Open a cent account with a recommended forex broker. Ensure they are reliable and have tight spreads (see next section for tips).

Fund the account with a small sum—$10–20 is plenty for testing.

Log into Copygram and link your cent account as a copier account.

Select your source account (master account/EA or signal trader).

Configure your copy settings—enable micro lot copying, set risk/scaling to the absolute minimum.

Begin copying trades and monitor results in real time.

Analyze performance—was the strategy stable? Did the EA/strategy handle live market conditions well?

Tip: Many users test first on demo, then cent, then graduate to standard lots as skill and confidence grow.

Seamlessly link your cent account to Copygram and test live strategies or EAs at micro scale.

🏦 Finding the Right Cent Account Broker – Critical Safeguards for Beginners

Not all cent account brokers are created equal. Here’s what you need to check:

Regulation: Pick only regulated brokers to safeguard your funds.

Execution Speed: Fast, reliable order execution keeps tests realistic.

Low Fees/Spreads: High fees can ruin results. Always compare!

MT4/MT5 Compatibility: Ensure the broker supports the platform your EA or Copygram uses.

Clear Cent Balances: The account should display in cents for accurate micro-scale testing.

If in doubt, consult community reviews, or explore major forums like Forex Peace Army for broker reputations.

💡 Key Takeaway

Selecting the right broker ensures your micro testing is fair, fast, and protected—never compromise on safety.

🧭 Common Questions – Cent Accounts, Copygram & Low-Risk Testing (FAQ)

How is a cent account different from a demo account?

Cent accounts use real money, meaning market conditions and psychology are authentic. Demo accounts, while helpful, use virtual balances and rarely match real execution exactly.

What is the smallest amount I can use for live EA/strategy testing?

Most brokers let you open with $1–$10. You can risk mere pennies per trade!

Will Copygram copy live trades to my cent account accurately?

Yes! Copygram excels at syncing trade signals from a master account into your cent account, with full support for micro and nano lot conversion to maintain low risk.

Can I scale up later?

Absolutely. Once your strategy or EA proves profitable and steady on your cent account, migrate to a standard or mini account for higher stakes.

💡 Key Takeaway

Cent accounts are the ultimate bridge from demo to confident, profitable live trading—unlock them with Copygram’s flexible copier platform!

🚀 Putting It All Together: Start Your Forex Journey Safe & Smart

Whether you’re aiming to test an intricate EA or want to copy top-performing strategies risk-free, micro-account trading via Copygram is your on-ramp to mastery.

Remember:

✔️ Always start with safe, small sums—let the real lessons begin with cents, not dollars!

✔️ Use cent account testing to perfect your risk management and emotional control.

✔️ Scale up only when results are stable and repeatable.

✔️ Copygram’s micro lot and cent account support take the hassle—and the fear—out of live testing. Learn more here.

Want more strategic trading wisdom? Explore our latest guides and news on our news blog.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles