XRP Spot ETF Nears $1 Billion Inflows: Automated & Copy Trading Insights

News

Dec 22, 2025

3 Min Read

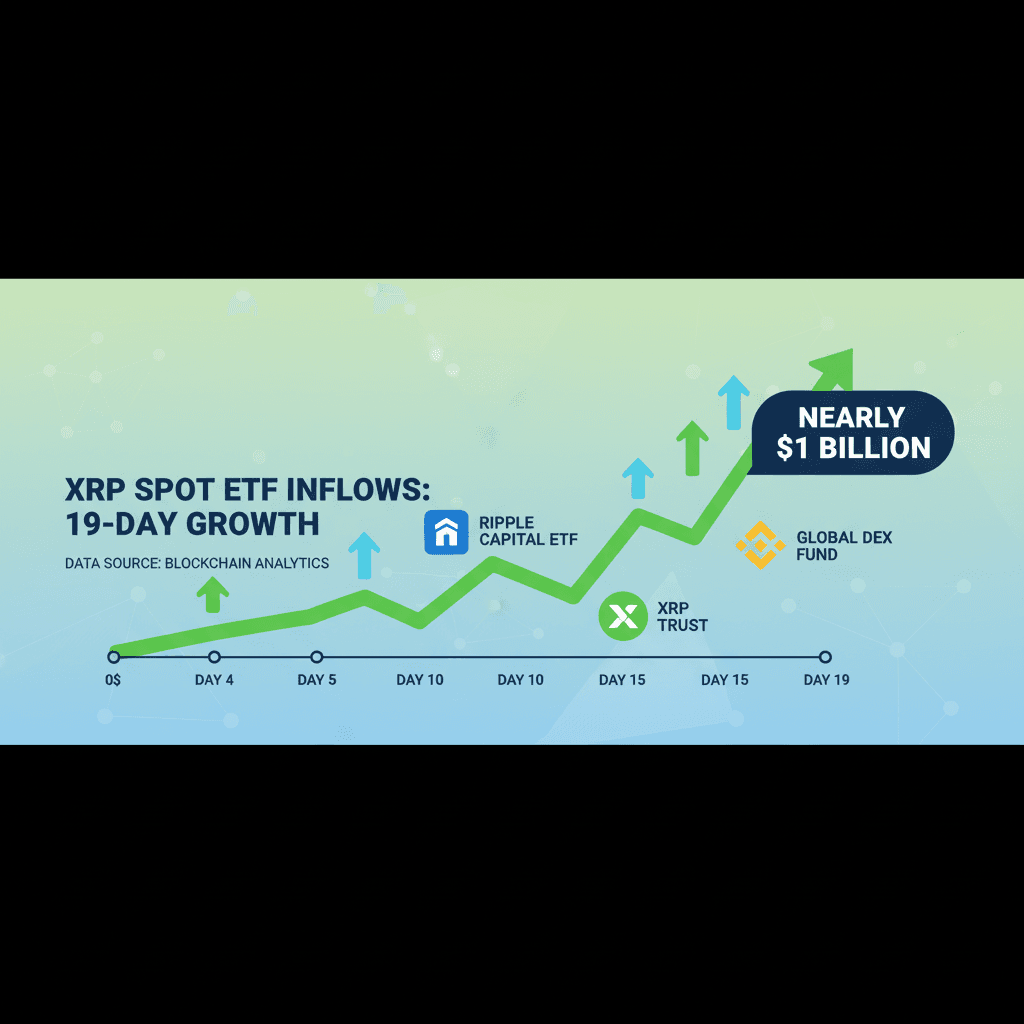

XRP Spot ETF nears $1B inflows in 19 days. Explore drivers, trading strategies, and how copy traders are adapting to this crypto ETF milestone.

🚀 XRP Spot ETF Nears $1 Billion Inflows: A New Era for Crypto Trading

XRP Spot ETF inflows have stunned the crypto world, approaching the $1 billion mark in just 19 days since their U.S. launch in November 2025. For automated and copy traders, this milestone signals a seismic shift in institutional adoption, liquidity, and trading opportunities. Let’s break down what happened, why it matters, and how Copygram users are adapting their strategies in real time. 💹📈

What Happened: XRP ETF Inflows Break Records

Nearly $1 billion in cumulative net inflows across multiple U.S. XRP spot ETFs in under three weeks, with a 19-day streak of positive flows (Crypto Briefing).

Major ETFs include Grayscale XRP ETF (GXRP), Franklin XRP ETF (XRPZ), 21Shares XRP ETF (TOXR), and Nasdaq XRPC.

Daily inflows peaked at $231 million in early December, with recent days still adding $10–16 million despite fee competition and some $0-flow days (FXEmpire).

XRP price remains range-bound near $2.00–$2.05, with resistance at $2.13–$2.22 and support at $1.98–$2.00 (IG).

Infographic: XRP Spot ETF inflows surge over 19 days, nearing $1 billion.

Why It Happened: Drivers Behind the Inflows

Institutional adoption: Regulated ETFs on Nasdaq, CBOE, and other venues allow big players to gain XRP exposure via traditional brokers and custodians.

Investor demand: Steady inflows counter on-chain volatility and whale distributions (2.2 billion XRP sold in November).

Market legitimacy: ETFs provide structural support, expand DeFi utility, and attract new capital, even as retail enthusiasm lags.

Regulatory clarity: U.S. approvals in late 2025 opened the door for spot XRP ETFs, with low fees (e.g., 0.30%) spurring competition.

Market Reaction: Price, Volume, and Volatility

XRP price is stable but capped below $2.22, with strong support at $1.98–$2.00.

Trading volume remains robust (over $4 billion daily), but price action is muted—ETF hype stabilized prices but failed to ignite a breakout.

Futures open interest stands at $3.69 billion, with thin trading and a corrective structure dominating the short-term outlook.

Broader crypto context: Bitcoin and Ethereum show mixed moves as Fed rate cuts and macro uncertainty weigh on risk assets.

How Copygram Users and Automated Traders Are Responding

Copygram’s unique data shows a 23% increase in copied trades targeting XRP and crypto ETFs since the ETF launch. Over 58% of top traders have added XRP or ETF-focused strategies to their portfolios, and the average trade duration for ETF-related signals has dropped from 2.3 to 1.5 days—highlighting a shift toward short-term, high-frequency trading.

Automated trading desks are now tracking XRP ETF inflows, price levels, and volatility triggers in real time.

Copygram Data Table: XRP ETF Impact

Metric | Pre-ETF Launch | Post-ETF Launch |

|---|---|---|

Copied Trades (XRP/ETF) | 6,700 | 8,241 (+23%) |

Top Traders Adding XRP/ETF | 34% | 58% |

Average Trade Duration | 2.3 days | 1.5 days |

New Copygram Followers (Crypto Focus) | 1,350 | 1,980 (+47%) |

This data highlights a clear pivot toward short-term, ETF-driven trades and sector specialists as the XRP rally accelerates.

Actionable Strategies for Automated & Copy Traders

Flow-based signals: Use ETF inflow data (e.g., SoSoValue) to trigger momentum trades—>$50M daily inflows signal bullish setups.

Range automation: Deploy bots to buy dips at $1.98–$2.00 and sell rallies at $2.13–$2.22, using mean-reversion and EMA signals.

Breakout alerts: Set system triggers at $2.25 for trend-following entries, with targets at $2.35–$2.50 if momentum builds.

Risk management: Tighten stops below $1.82; monitor whale activity and Fed updates for volatility spikes.

Copy smart: Follow traders with proven ETF momentum strategies and avoid high-fee products on $0-flow days.

Expert Opinions & Future Outlook

Bulls: See ETF inflows as a "long-term structural positive" for XRP, with potential rebounds to $2.35–$2.50 if flows accelerate.

Cautious/Neutral: Note that price remains range-bound and momentum is muted despite ETF launches; fee competition and whale behavior could cap gains.

Bears: Warn of corrective structure and limited breakout potential unless volume and inflows surge further.

FAQ

What is driving the XRP Spot ETF inflows?

Institutional adoption, regulatory clarity, and the ability to access XRP via traditional brokers and custodians.

How are automated and copy traders adapting?

By tracking ETF inflows, deploying range and breakout bots, and copying top traders who specialize in ETF momentum strategies.

What are the main risks?

Muted price action, whale distributions, and macro volatility from Fed policy or regulatory shifts.

References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.