Hedging 101: Can You Hold Buy and Sell at the Same Time?

Education

Jan 13, 2026

3 Min Read

Discover the essentials of Forex hedging: Can you hold buy and sell trades simultaneously? Clear explanations of US FIFO rules vs. global regulations, broker compatibility, hedging vs. netting, and how trade copiers like Copygram manage it all. Includes visual guides, broker tips, and actionable advice for US and non-US clients.

The Hedging Question: Can You Really Hold Buy and Sell Positions Simultaneously?

Hedging is a hot topic in forex trading, especially when it comes to holding both buy (long) and sell (short) positions on the same currency pair at the same time. Many traders want to use this strategy for risk management or to lock in profits while keeping a position open. But can you actually do this in practice? The answer depends on your broker, your account type, and crucially, where you live.

Let’s untangle forex hedging rules, the US FIFO rule, broker compatibility issues, and what trade copying users must know to stay compliant and maximize their trading strategies.

A visual breakdown of forex trading rules and broker restrictions around hedging and simultaneous buy/sell orders.

💡 Key Takeaway

Regulations and broker setups can make or break your hedging strategy in forex. US traders face one set of rules (FIFO, hedging ban), while traders elsewhere enjoy more flexibility. Copy trading and trade copiers have to adapt—know your account limitations!

US FIFO Rule vs. Global Rules: Why It Changes Everything

The FIFO rule (First-In, First-Out) is a strict regulatory requirement enforced by the US National Futures Association (NFA) and CFTC. Under FIFO, US forex brokers must close trades in the same order they were opened—no exceptions. This means you cannot open a new opposing trade (i.e., hedge) on the same currency pair unless you close the earlier position first.

FIFO applies to all US-regulated brokers. If you’re a US resident or trading at a US broker, hedging is blocked.

Rest of World (ROW): Most non-US brokers allow hedging, where you can hold both buy and sell on the same instrument concurrently.

Global traders can use both netting and hedging systems, but must check broker rules. US traders must follow FIFO and netting only. This impacts every automated strategy, including copy trading platforms.

📝 FAQ: What happens if I try to hedge with a US broker?

If you attempt to open simultaneous buy and sell trades (hedging) on a US broker, the platform will automatically close the earlier trade per FIFO. You won’t be able to keep both open—your trades will simply net off.

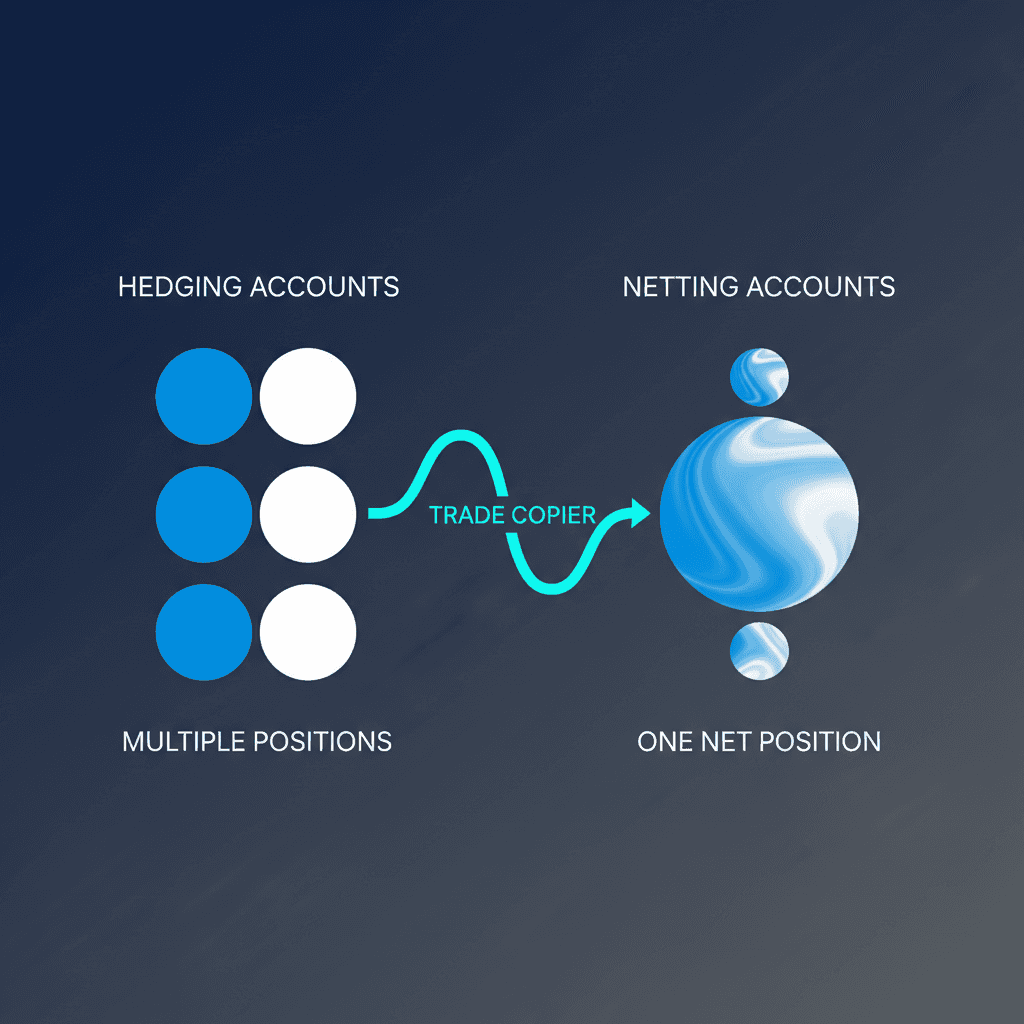

Hedging vs. Netting: How account structure affects your ability to hold buy and sell trades at the same time.

Hedging vs. Netting: The Practical Impact on Your Trading

Understanding hedging and netting is essential. Hedging accounts allow multiple positions (buys and sells) simultaneously on the same symbol, keeping them separate. Netting accounts combine all positions into one net figure—the sum of all trades, with direction determined by which side has greater volume.

Feature | Hedging | Netting (FIFO) |

|---|---|---|

Can hold buy & sell? | ✅ Yes | ❌ No, positions are merged |

Popular in | Europe, Asia, Oceania | USA, select brokers |

Copy trading impact | Follows signal trades precisely | May require trade reversal/closing |

Platform examples | MT4, cTrader (most brokers) | US brokers, MetaTrader with netting setup |

Key reminder: If you’re in the US (or using a US-regulated broker), your account will always be netting-only. Hedging is a privilege available to non-US traders on compatible platforms and brokers.

🙋 Q&A: What if I want to copy trades but my broker only allows netting?

Many US traders use copy trading to follow global strategies. However, trade copiers must adapt: If a trade signal calls for opening an opposite order (e.g., a buy when you’re already holding a sell), the copier will close the earlier trade—matching FIFO requirements, not true hedging.

Broker Compatibility: Who Supports Hedging? (With Table)

Not all brokers are created equal. Even outside the US, some may enforce netting—especially those that are subsidiaries of US-based institutions or follow specific regulatory frameworks. Always check these factors:

Broker headquarters & license: US, EU, offshore?

Account type: Check for explicitly labeled "hedging allowed" accounts.

Platform: MT4 (usually supports hedging), MT5 can be either depending on setup.

Customer support: Ask if FIFO rule is active.

Broker Type | Hedging Allowed? | Notes |

|---|---|---|

US-regulated brokers | ❌ No | Subject to FIFO, netting only |

EU brokers (not US-owned) | ✅ Often | Check account & platform type |

Offshore brokers | ✅ Yes | Review reputation & regulation |

If you plan to use copy trading platforms internationally, always ensure your account supports the trading strategies you want—otherwise, you could face forced trade closures or mismatched results.

💡 Pro Tip

Before connecting your account to a trade copier, double-check your broker’s hedging and FIFO policy. This step can prevent many headaches later!

How Trade Copiers Like Copygram Handle US FIFO and Hedging

Trade copiers automate position copying, so compliance with regulation is critical. When it comes to US clients or any netting-only account, innovative copiers like Copygram implement specific logic:

If a new buy order is signaled but you’re already short, Copygram first closes the sell, then executes the buy—preserving FIFO compliance.

Your trade log reflects only compliant, netted positions—never both sides at once on US brokers.

Copygram’s advanced tech checks your broker setup and automatically adjusts the copying logic per regulation.

This ensures you never fall afoul of US law, and global users can copy pro strategies as intended—learn more about cross-broker copying here.

🚦 Action Steps for Traders

US clients: Stick to netting, never expect both buy/sell open. Copygram keeps you compliant automatically.

Non-US traders: Check broker/account compatibility to enjoy true hedging.

Always ask your broker about their hedging policy before connecting any trade copier.

Look for competent support and regulatory transparency from both your broker and trade copier provider.

Bottom Line: Context and Account Type Matter Most!

The ability to hedge in forex (hold buys and sells at once) is a powerful but highly regulated tactic. For US traders, FIFO and netting rules mean you cannot truly hedge—only net your positions. Elsewhere in the world, with the right broker and platform, you can enjoy full hedging freedom. Your broker choice, regulation, and trading goals should directly inform your setup and strategy.

For those using trade copying, advanced solutions like Copygram can adapt to almost any setup, but it’s ultimately your responsibility to know your broker’s policies.

Ready to level up your strategy and avoid regulatory pitfalls? Explore Copygram today for cutting-edge compliance and automation.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles