Handling Market Gaps and Rollover: Best Practices for Overnight Copying

Education

Dec 27, 2025

3 Min Read

Discover best practices for handling market gaps, rollover, forex swap spreads, and overnight copying risks. Learn how Copygram ensures 24/7 reliability during liquidity droughts and weekends.

Navigating the Night: Why Market Gaps and Rollover Matter

The global forex market operates nearly 24/5, but when it closes, unique risks emerge for traders—especially those copying trades or holding positions overnight. Two critical events—market rollover (the daily swap time) and weekend gaps—can trigger unexpected changes in spread, swap fees, and trade pricing.

Understanding these moments is vital for anyone leveraging copy trading platforms like Copygram. Here, we'll decode how forex swap spreads and rollovers operate, what happens to your trades during thin liquidity, and how to safeguard your capital with smart copying practices.

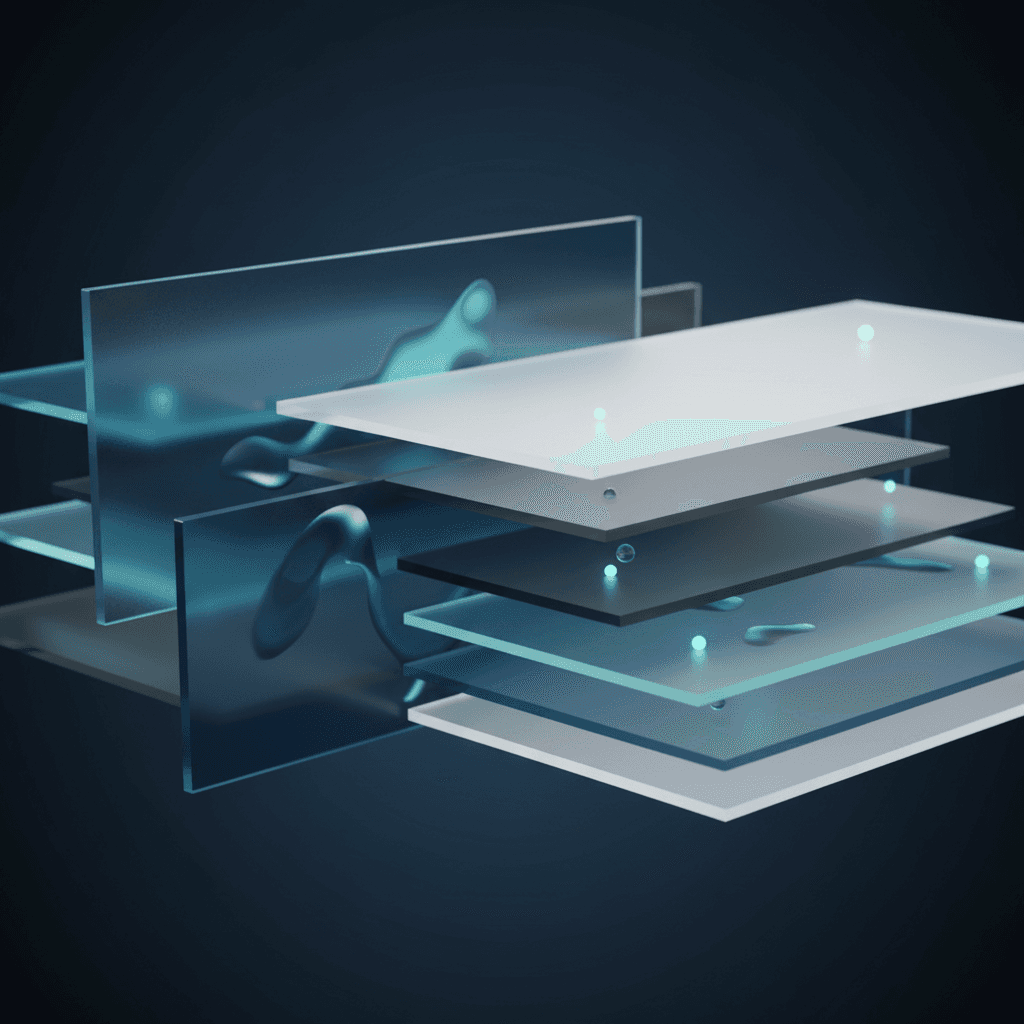

Hidden dangers often lurk during market rollovers and weekend gaps—visualized as turbulence below a calm surface.

Market Rollover Unplugged: Swap Spreads & Overnight Costs Explained 🔍

Market rollover refers to the point each trading day when open positions are transferred to the next day—with it comes the calculation of swap fees and an often dramatic change in spreads.

Swap Fees (Overnight Rate): Charged or credited depending on the interest rate differential between two currencies.

Spread Widening: Liquidity thins out at rollover (typically 5pm–6pm NY time), causing the bid/ask gap to spike.

Increased Slippage: Orders placed or closed near rollover can be filled at unexpected prices due to the spread expansion.

For traders using copy trading services, these moments of volatility can dramatically affect copying accuracy, TP/SL execution, and the cost of holding trades overnight.

Table: Rollover Impact on Forex Trades

Event | Effect on Spreads | Impact for Copy Traders |

|---|---|---|

Daily Rollover (Swap Time) | Spreads can widen up to 5-10x normal size | Potential for higher entry/exit slippage, |

Holding Trades Overnight | Swap applies; spreads narrow after rollover clears | May incur ongoing swap fees; less risk if trades avoided at rollover |

Interconnected mechanics: swap rates, spreads, and trading gaps form key elements of overnight risk.

💡 Key Takeaway

Avoid entering or closing copy trades within 15 minutes of rollover to reduce spread-based slippage and swap surprises. Understanding your broker’s swap policy is critical for accurate overnight copying.

The Hidden Threat: Weekend Gaps & Unpredictable Price Leaps

When the market closes—Friday to Sunday—global events can cause prices to reopen far from their previous close. This is the notorious weekend gap. News, political events, and announcements released after market close can trigger large, instant price movements at Sunday’s open.

Gaps can lead to instant stop-out or large losses if trades are left unprotected.

Insurance for retail forex rarely covers gap risk.

Liquidity is extremely thin at market open, magnifying slippage and spread spikes.

Smart copying requires a clear gap risk plan: Know exactly how your platform manages open positions when the market reopens.

For a deeper look at how market news and global volatility impact copying systems, see our News Us Stock Markets Record Highs Us China Inflation.

🛡️ Practical FAQ: Overnight & Gap Risks, Answered

Q: What is the largest danger in holding trades over the weekend?

A: The risk of sudden gap moves at the open—potentially resulting in stop-outs or massive slippage. Most platforms, including Copygram, recommend closing precarious trades by Friday close unless you’re prepared for significant risk.

Q: How does Copygram minimize slippage during swaps and gaps?

A: Copygram constantly monitors for widening spreads and uses proprietary algorithms to delay copying for brief periods after major market events, giving you cleaner executions when possible.

Q: How can I track swap and gap-related costs?

A: Always check your broker’s swap table; Copygram feeds in live swap rates from most connected brokers in real-time for your convenience.

Q: Are there automated tools to manage gap and rollover exposures? A: Yes! Look for copy trading strategies with built-in time filters and trade-pause logic for high-risk times (Copygram enables this per trader or follower configuration).

Copygram 24/7: How Seamless Copying Stays Reliable During Rollover and Gaps

The real test for any copy trading solution is not when markets are normal, but when things go wrong—liquidity disappears, spreads widen, and volatility explodes. Copygram's infrastructure is architected for exactly these moments:

24/7 Uptime Monitoring: Advanced monitoring ensures fast reaction to broker outages or price feed issues in real-time.

Automated Slippage Guard: Adaptive algorithms slow or pause copying during extreme volatility, rollover, and gap times.

Custom Time Filters: Letting you (or your lead trader) block trade copying around known risk windows (like major market rollovers).

Transparent Swap Rate Display: See real-time swap costs before copying a signal—no more hidden overnight charges.

Copygram's high-tech blueprint: Designed for steadfast reliability and risk control—day and night.

🚦 Action Steps: Protecting Yourself With Best Practices

Check Swap/Spread Schedules: Know your broker’s rollover times and anticipate cost spikes every day.

Use Time Filters: Configure Copygram to pause new copying near rollover and before the weekend to avoid extra risk.

Review Your Positions Friday: Close out susceptible trades before weekend gaps, unless you're using explicit gap-risk management strategies.

Evaluate Lead Traders: Only follow signal providers who have a proven record of handling gap and rollover risk prudently.

Stay Updated on News: Monitoring news and global events is still crucial (see latest market insights).

Summary: Mastering Overnight Copying in a Volatile World

Handling rollover and weekend gap risks is essential for every copy trader. By understanding swap spreads, gap dynamics, and leveraging Copygram’s cutting-edge controls, you can operate confidently even when the market gets wild.

Want to dig deeper into trade execution logic? Read our related article on pending orders versus market execution.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles