Pending Orders vs. Market Execution: How Copiers Handle Limit Orders

Education

Dec 22, 2025

3 Min Read

Explore the technical nuances of copying pending orders vs. market execution in forex with MT4 copiers. Learn how Copygram manages limit, stop, and market orders, handles volatility, minimizes latency, and empowers traders with advanced copy settings.

Understanding Forex Order Types: The Foundation for Accurate Copying

In forex trading, precision starts with choosing the correct order type. The two primary options are pending (limit/stop) orders—waiting for the price to reach a milestone—and market execution, which enters at the prevailing price. How do MT4 and modern trade copiers treat these different orders? What risks and opportunities do they present, especially for those using advanced copiers like Copygram?

Pending Orders: Include limit (buy/sell at better price) and stop (buy/sell once price passes a trigger) types.

Market Execution: Enters instantly at current price—fast, but can be affected by spreads and slippage.

💡 Key Takeaway

Selecting the right order type (pending vs. market) impacts entry price, slippage, and copy accuracy. Copiers must translate these nuances seamlessly.

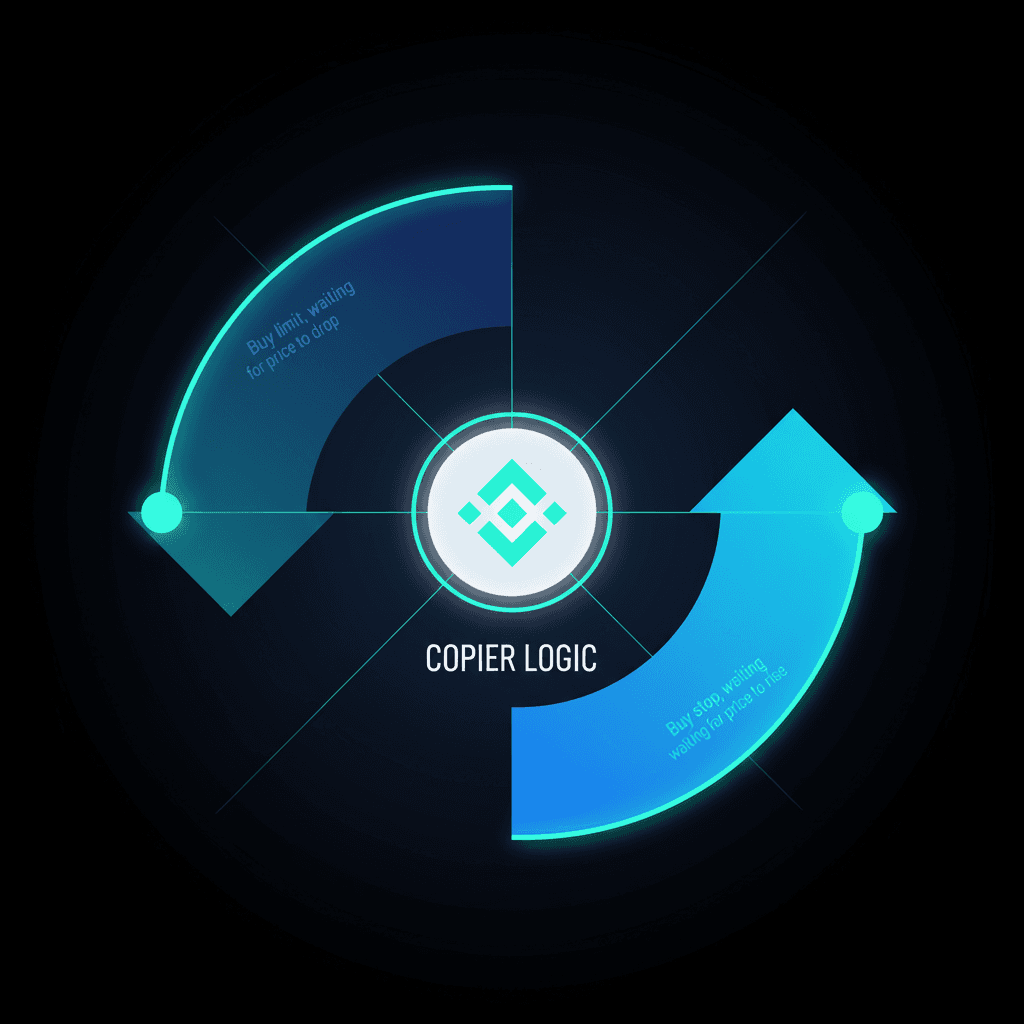

Visualizing the difference: Limit orders wait for price retracements, stop orders anticipate breakouts. Copygram adapts intelligently to both types.

Copy Pending Orders MT4: Decoding Copier Logic for Limit and Stop Orders

Copying pending orders in MT4 is nontrivial—especially for copiers handling multiple followers with varied broker setups. Here’s how it works in theory and practice:

Order Replication: The copier detects when a signal provider opens a limit/stop order and replicates it on the follower’s account with corresponding parameters.

Broker Compatibility: If follower and provider use different brokers or instruments, copiers like Copygram use symbol mapping, lot size conversion, and slippage guards.

Synchronization: If the provider modifies or deletes the pending order, the copier updates followers instantly, ensuring clean alignment.

💡 Key Takeaway

High-quality trade copiers like Copygram manage pending orders meticulously, tracking modifications in real time and adapting seamlessly to broker differences.

Order Type | How It’s Copied (MT4) | Risks |

|---|---|---|

Buy Limit / Sell Limit | Placed as pending at specified price. Copier must watch for price trigger and possible modification. | Price gaps, requotes, modifications not syncing. |

Buy Stop / Sell Stop | Placed above/below market. Copier tracks trigger and broker rules. | Trigger price invalid, execution rejection, latency on activation. |

Market Execution | Executed immediately at current market price. | Slippage, spread widening, volatility risks. |

Learn more about robust copier architecture in our comparison of local vs cloud-based trade copying.

Market Execution Latency: The Silent Risk in Copy Trading 🚦

Latency—the delay between the master placing a trade and the copier replicating it—is a devil in the details. Milliseconds matter, especially for market execution during news or sudden spikes. Fast order copying is only as good as the weakest digital link.

Latency and slippage: Advanced copiers like Copygram optimize transmission and reaction speed for higher copy accuracy.

Pending orders experience less time pressure but risk price gaps when triggered during volatility.

Market execution is highly sensitive to latency—fast-changing prices can cause slippage or entry at unintended levels.

Copygram employs ultra-low latency cloud infrastructure to reduce this risk and offers trader-side settings to define max allowed slippage.

💡 Did You Know?

According to Investopedia, even 100-200 ms extra latency during a news event can mean a very different fill price for volatile pairs like GBP/USD or XAU/USD.

Advanced Copy Settings in Copygram: Power Tools for Order Type Optimization

Copygram delivers a suite of features to ensure smart, flexible copying of both market and pending orders. Let’s break down the features that put pro traders in control:

Custom Copy Rules: Copy only market orders, only pending, or both—per your risk appetite and strategy.

Price Tolerance: Set max allowed deviation (slippage control) for market orders; auto-reject if the price is too far from the master.

Pending Order Adjustments: Define if your limit/stop orders copy as is, or convert to instant execution if the signal price is already touched on your broker.

Symbol Mapping: Seamless mapping for pairs with alternate symbols (e.g., EURUSDc vs EURUSD).

Trade Protection: Built-in filters to skip copying during volatility spikes or major news (based on user settings).

💡 Key Takeaway

These features empower advanced users to minimize copy errors, maximize fill accuracy, and stay protected during fast market moves—making Copygram a pro-grade solution for any trader.

Curious how volatility impacts copy trading outcomes? Explore our research on market volatility and copier performance.

Copygram’s Approach: Modifying, Syncing, and Managing Orders in Real Time ⚡

Order changes are inevitable: masters adjust prices, cancel, or partially fill pending orders. Copygram is engineered for real-time sync and error-proof updates:

Instant Modifications: If a master trader modifies a limit price, all follower accounts update instantly—no manual intervention.

Smart Cancel/Close: Cancelled master pending orders are also removed from all child accounts, preventing accidental fills.

Partial Fill Handling: Copygram tracks partial executions (e.g., only half of a limit order fills) and matches follower positions where possible.

Failure Alerts: If an update can’t be copied (broker restrictions, symbol not found), Copygram notifies users and records details for review.

Ultra Fast Cloud Sync: All of this happens with sub-second cloud updates—vital for accuracy during volatile sessions.

Copygram: Synchronizing order states, from initial placement to complex modifications, faster than ever before.

Q&A: Mastering Copying - Frequently Asked Questions

Q: What’s the biggest risk when copying market execution orders?

A: Slippage during volatility, often due to latency. Copygram’s infrastructure minimizes—never fully eliminates—this, and lets you set max slippage rules.

Q: Is it safer to copy pending (limit/stop) orders?

A: Somewhat—there’s less rush, but risks remain if market jumps over your trigger (“gap”). Advanced copiers help with real-time updates, so triggers aren’t missed.

Q: How does Copygram compare to local copiers for pending orders? A: Cloud-based systems like Copygram are generally faster, more robust, and better at syncing order modifications in real time versus local, computer-based tools. Q: What’s the best practice for copying in high volatility?

A: Use copy settings to avoid or restrict copying during major news and set reasonable slippage limits. Consider partial automation and manual checks during top-tier releases.

Final Thoughts: Master Limit & Market Copying, Minimize Execution Surprises 🎯

Whether you’re a signals provider or a follower, understanding buy limit vs buy stop copying, mastering order type mechanics, and leveraging Copygram’s advanced control panel is essential for consistent trade performance.

Take control, reduce copy errors, and enjoy more precise, lower-latency fills by harnessing the power of a pro-grade platform like Copygram.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles