Emergency Protocols: What to Do When the Internet Goes Down?

Education

Jan 22, 2026

3 Min Read

Discover strategic protocols to safeguard your trades during internet or power outages. Learn why cloud-based trading with Copygram guarantees safety, automation, and unmatched uptime—even when disaster strikes.

The Nightmare Scenario: When Your Internet Vanishes Mid-Trade

Picture this: You’re in the middle of a critical trade. Suddenly, your home internet drops or a local power outage plunges your setup into darkness. For traders relying on local trade copying solutions, this isn’t just inconvenient—it’s a potential disaster. Open positions linger, risk escalates, and before you can say disaster recovery, your portfolio could suffer.

🛑 Local Automation Failure: Without power or connectivity, locally run trading bots or copy tools simply stop. Open trades remain unmanaged.

⏰ No Order Execution: Conditions can change rapidly. Missed stop-losses or take-profits are costly mistakes in volatile markets.

💸 Lost Opportunity: The inability to react or manage your risk—especially for high-frequency trading or scalping—means opportunity goes out the window.

Unstable local trading vanishes during outages, while cloud systems like Copygram keep running seamlessly.

For a real-world look at trading risks when local connectivity fails, read our deep-dive on master account disconnect protocols.

Why Most Disaster Recovery Plans Fail for Local Traders

Traditional trading disaster recovery strategies often focus on data backup or hardware redundancy—a great start, but not enough. When it comes to power outages or connectivity blackouts, only proactive, cloud-based redundancy truly keeps trades safe and active.

Manual Intervention Risks: Most home traders need to reboot, reconnect, and manually resume after an outage—by then, damage may be done.

Hardware Limitations: Even backup power supplies (UPS) or dual internet links can fail, or may not kick in fast enough for high-frequency systems.

Software Gaps: Many local copiers lack robust failover protocols, and don’t re-sync states perfectly.

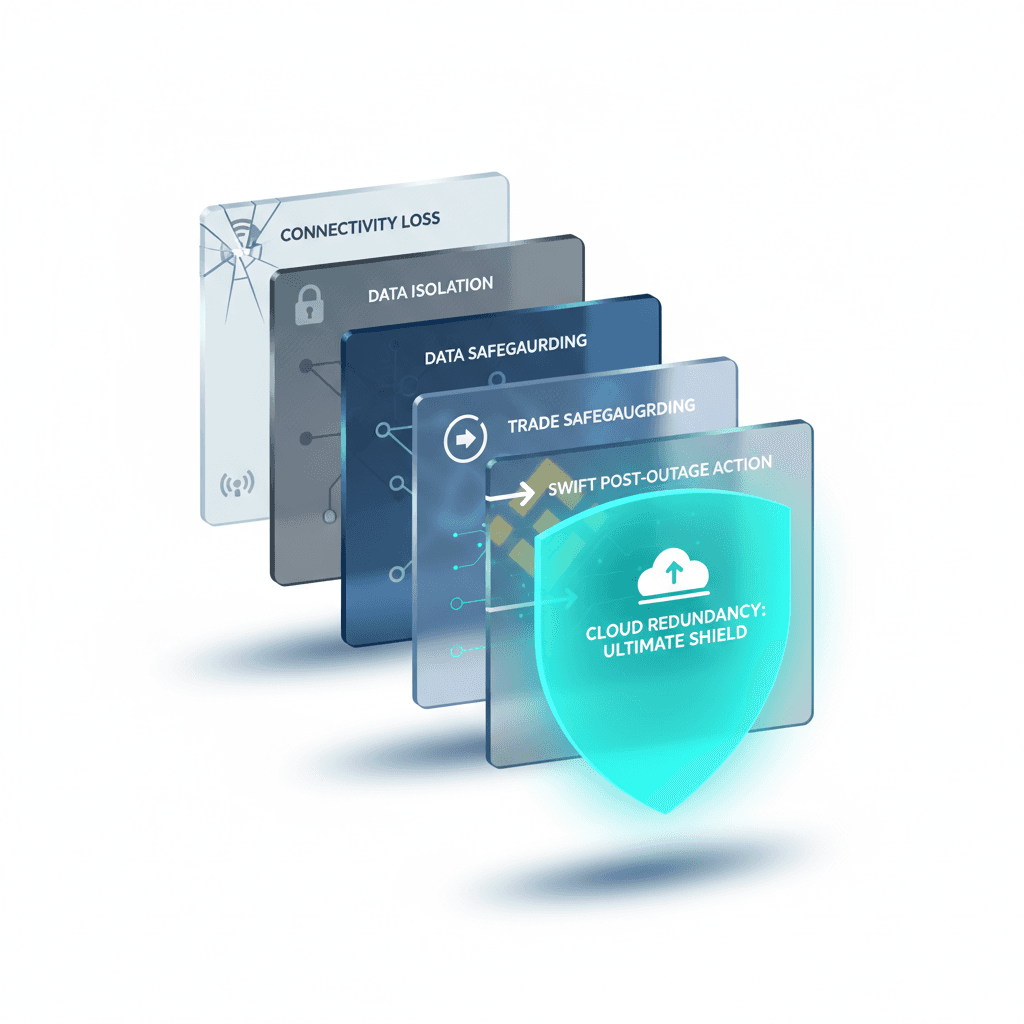

Effective disaster recovery flows from local failure to ultimate security via robust cloud redundancy.

💡 Key Takeaway

Relying solely on local disaster recovery leaves critical gaps. Cloud redundancy bridges those gaps—ensuring trade safety in true emergencies.

Cloud Redundancy in Action: How Copygram Safeguards Your Trading

With Copygram’s cloud engine managing your trades, your automation continues even if your personal internet or power fails. Here’s why this matters:

🌐 Independent Operation: Orders, risk management, and automation logic run on Copygram’s remote servers—fully insulated from local disruptions.

🔒 Automatic Failover: Sophisticated cloud infrastructure maintains uptime and quickly reroutes tasks should any server node falter.

📈 Trade Continuity: Whether you’re asleep, traveling, or facing a blackout, trades are managed and executed as if nothing happened.

For a complete side-by-side breakdown of local vs. cloud-based copiers, explore why Copygram’s cloud power is a game-changer.

Local Trade Copier | Copygram Cloud Trade Copier |

|---|---|

Requires your PC, internet, and power to stay on 24/7 | Runs 100% in the cloud—even if your devices are offline |

Manual recovery needed after outages | No action needed: cloud automation resumes instantly |

High risk of missed trades during blackouts | No missed trades—protection through global server network |

Limited by local hardware | Scalable, enterprise-grade redundancy and speed |

Action Plan: Step-by-Step Protocols for Trading in a Crisis

When the unexpected strikes, rapid response is critical. Here’s an actionable checklist to maximize your trading survival odds:

Assess Your Trading Infrastructure: Know whether you rely on local tools, cloud automation, or a hybrid approach.

Prepare Backup Plans: Invest in backup power (UPS), mobile hotspots, and, if possible, secondary internet connections.

Enable Cloud Automation: Switch critical trade management and copying tasks to a platform like Copygram well before a crisis.

Practice Failover Drills: Test how your systems react if you unplug your internet or cut power unexpectedly.

Monitor and React: Use mobile alerts and status dashboards to spot (and react to) outages or disconnects instantly.

Document and Review: After an incident, review what failed and improve your protocols.

💡 People Also Ask: Is There Ever a True 'Set & Forget'?

With Copygram’s deep cloud infrastructure, your trades are managed even when your screens are dark. But reviewing protocols and staying aware is always smart.

Safety in Automation: Building Resilient Trading Systems

Even with cloud technologies, resilient trading means proactively layering protections:

🛡️ Regularly back up trading notes, configs, and API keys (securely, off-site where possible).

👨💻 Use multifactor authentication for trading accounts to prevent unauthorized recovery attempts after a crisis.

📊 Monitor out-of-band communications (like SMS or push notifications) to detect downtime rapidly.

🔁 Always keep cloud credentials and primary contacts current—stalled alerts are no-alerts!

Learn more about Copygram’s all-weather automation and uninterrupted trade copying.

Copygram Uptime: Putting It All Together for Crisis Confidence

Copygram’s track record of continuous uptime isn’t marketing hype—it’s usage-proven, engineered for true trading resilience. With thousands of users worldwide, Copygram’s cloud is built to stay live, secure, and reliable even while local setups flounder. When trouble strikes, Copygram ensures that crystal-clear execution flows on, so you’re never left in the dark.

🔄 Global Data Centers: Multiple locations mean failover and always-available access.

🔔 Proactive Monitoring: Automated health checks and alerting ensure downtime is rapidly detected and mitigated.

💼 Trusted by Pros & Novices: Everyone benefits from enterprise-grade protection—regardless of account size.

🚀 Ready for the Next Crisis?

Don’t leave your trading to chance. Discover the Copygram difference and future-proof your trading desk now.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles