🎉 Flash Sale: 50% OFF on All Yearly Plans! 🎉 Unlock incredible savings with code NEWYEAR2026. This amazing offer expires soon!

12,000+ traders already with us

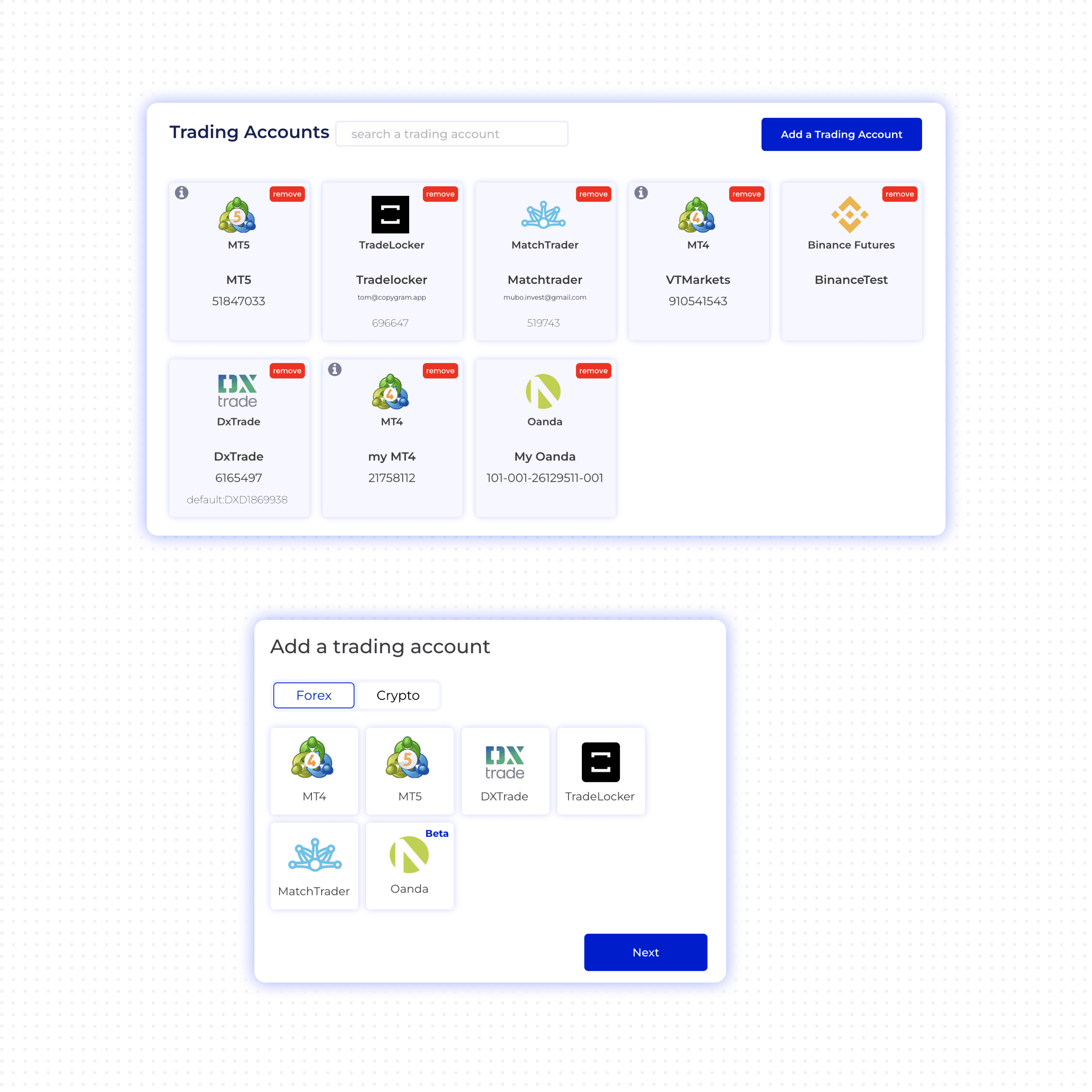

Seamless integration with leading platforms!

Features

All Your Trades, One Place

Manage your entire trading ecosystem from a single, unified platform. No more juggling tools—everything you need is right here.

Innovative Room Concepts

Create your own trading environment with our Rooms feature, designed for ultimate flexibility and customization. Set up a dedicated space for your trading activities where you can manage multiple accounts seamlessly. Once the room is activated, all trades executed by the sender are automatically copied to each receiver account in real time. Enjoy the benefits of synchronized trading without the hassle.

Unlimited Rooms

Multiple Platforms

Endless Possibilities

User-Friendly Interface

Advanced Logs

A Wealth of Features

Customize your trading account settings to suit your strategy. Adjust key parameters like Money and Risk Management, Time Settings, Symbol Matching, Signals Percentage Lot per Take Profit (TP) and many more. Gain full control over your trades and enhance your performance with personalized configurations!

Money & Risk Management

Symbol Suffix Detection

Time settings

Advanced Telegram & Telegram settings

Insightful Room Logs

Gain valuable insights with our detailed room logs. Track every trade and decision made within your rooms, allowing for thorough analysis and performance evaluation. Stay on top of your trading activities and refine your strategies with ease!

Type of orders

Execution reports

Detailed insights

Trades Status

Smart Alerts

Stay updated with our powerful alerts and notifications feature. Receive instant updates via email or Telegram for every trade that arrives in your room, ensuring you never miss an opportunity.

Seamless Integrations

Copygram offers diverse platform integrations, enabling effortless connection and automation of your trading activities. Link Telegram, TradingView, and more to streamline processes and enhance your strategies.

Insights at a Glance

Our user-friendly dashboard provides a comprehensive view of your trading activities, offering valuable insights and analytics to enhance your strategies.

Telegram to MT4 & MT5

Copy trades from any Telegram channel directly to your Metatrader accounts. This integration allows for real-time execution of trading signals, enhancing your trading efficiency without manual effort.

Telegram to Metatrader

TradingView to DxTrade

Seamlessly copy trades from TradingView to your Dxtrade account. This automation ensures quick execution of your trading signals, allowing you to act instantly on your strategies!

TradingView to DxTrade

Telegram to Binance Futures

Effortlessly copy trades from any Telegram channel to your Binance Futures account. This automation ensures instant execution of crypto signals.

Telegram to Binance Futures

Metatrader to TradeLocker

Automate trades from your MetaTrader account to TradeLocker. This integration ensures quick execution of your trading strategies, allowing you to manage your trades effortlessly!

Metatrader to TradeLocker

Telegram to Oanda

Seamlessly transfer trades from any Telegram channel to your Oanda account. This automation allows you to receive and execute trading signals instantly, ensuring you never miss an opportunity.

Telegram to Oanda

Metatrader to MatchTrader

Automate trades from your MetaTrader account to MatchTrader. This integration enables swift execution of your strategies, ensuring seamless trade management across platforms!

Metatrader to MatchTrader

Metatrader to Binance Futures

Automate trades from your MetaTrader account to Binance Futures. This integration allows for rapid execution of your trading strategies, helping you respond instantly to opportunities!

Metatrader to Binance Futures

TradingView to Metatrader

Copy trades from TradingView to your MetaTrader account. This integration allows for rapid execution of your trading signals, enabling you to implement your strategies instantly!

TradingView to Metatrader

Metatrader to Tradovate

Automate trades from your MetaTrader account to Tradovate. This integration allows for rapid execution of your trading strategies, helping you respond instantly to opportunities!

Metatrader to Tradovate

TradingView to Tradovate

Copy trades from TradingView to your Tradovate account. This integration allows for rapid execution of your trading signals, enabling you to implement your strategies instantly!

TradingView to Tradovate

Telegram to Tradovate

Effortlessly copy trades from any Telegram channel to your Tradovate account. This automation ensures instant execution of Telegram signals.

Telegram to Tradovate

Explore Endless Possibilities

More Automations

Level Up with AI!

Old School vs. Copygram

Why stick with outdated methods when you can breeze through your work with AI? Let us show you how our smart tech leaves the old way in the dust.