JPMorgan Chase (JPM) Weekly Analysis & Outlook – Week 1 January 2026 (Week 1)

Ideas

Jan 3, 2026

3 Min Read

In-depth weekly analysis of JPMorgan Chase (NYSE:JPM) for Week 1 of January 2026: technical chart review, latest news, macroeconomic impacts, and actionable trading scenarios. Stay informed with support/resistance, volume, MACD, and more.

Welcome to our comprehensive weekly analysis of JPMorgan Chase (NYSE:JPM) for Week 1 of January 2026 (Week 1), where we break down the latest technical signals, fundamental drivers, and actionable scenarios for traders and investors. This week’s review draws on recent price action, macroeconomic developments, and news flow to help you navigate the evolving landscape for one of the world’s most influential financial institutions. (Date: December 29, 2025)

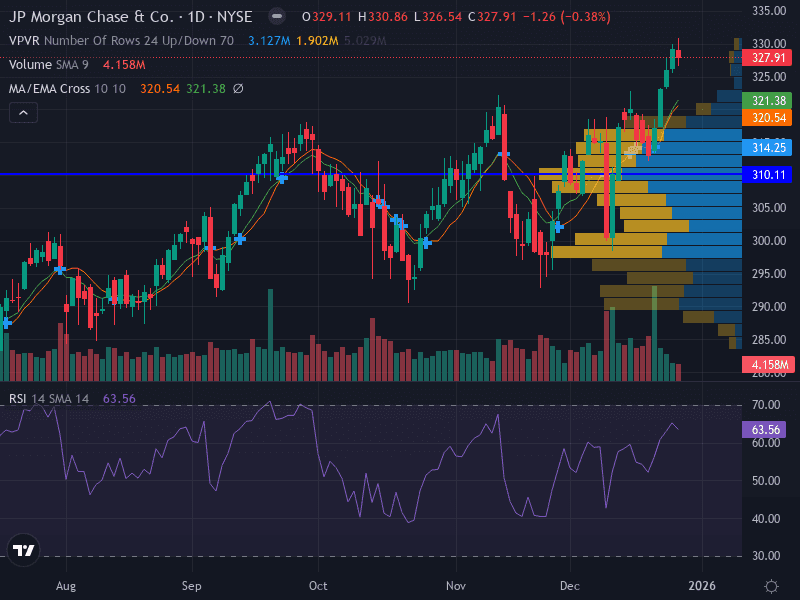

📊 Chart Overview & Technical Summary

Bias: Bullish – Price is above key moving averages with strong upward momentum.

Support Levels: 320.54 (major), 314.25 (minor)

Resistance Levels: 330.86 (major/recent high), 335.00 (minor)

Trend: Uptrend – Price is above 10- and 20-day EMAs; consistent higher highs and higher lows.

Momentum: RSI at 63.56 (bullish, not overbought); MACD increasing (bullish).

Pattern: Ascending channel, recent breakout above 320.00.

Volume: Increasing on upward moves, decreasing on pullbacks (healthy accumulation).

📰 Latest News & Fundamental Drivers

Date | Headline | Summary | Source |

|---|---|---|---|

Dec 22–29, 2025 | JPMorgan Explores Crypto Trading for Institutions | JPMorgan is reportedly considering offering cryptocurrency trading to institutional clients, signaling a potential expansion into digital assets for large-scale investors. | |

Dec 22–29, 2025 | Fed Cuts Rates by 25bps at December Meeting | The Federal Reserve cut rates by 25 basis points at its final 2025 meeting, impacting the banking sector’s net interest margins and lending outlook. | |

Dec 22–29, 2025 | JPMorgan’s Post-Rate-Cut Strategy Analyzed | Industry commentary highlights JPMorgan’s positioning and strategy in the new post-rate-cut environment, focusing on capital markets and net interest income. |

🔎 Technical Analysis

Support & Resistance:

Major Support: 320.54

Minor Support: 314.25

Major Resistance: 330.86

Minor Resistance: 335.00

Trend: The uptrend is well established, with price above both the 10- and 20-day exponential moving averages. The market structure is defined by higher highs and higher lows, confirming bullish sentiment.

Pattern: An ascending channel is present, and the recent breakout above 320.00 is a bullish technical signal. This breakout, supported by volume, suggests strong institutional participation.

Momentum: The RSI at 63.56 indicates bullish momentum, but not yet overbought. The MACD is increasing, confirming upward momentum and trend strength.

Volume: Volume analysis shows increasing activity on upward moves and lighter volume on pullbacks, a classic sign of healthy accumulation and trend sustainability.

📈 Technical Table Overview

Indicator | Current Value | Interpretation |

|---|---|---|

RSI | 63.56 | Bullish, not overbought |

MACD | Increasing | Bullish momentum |

10-day EMA | Above price | Uptrend confirmed |

20-day EMA | Above price | Uptrend confirmed |

Volume | Rising on rallies | Accumulation |

🧮 Fundamental & News Impact

Crypto Expansion: JPMorgan’s exploration of crypto trading for institutions could open new revenue streams and enhance its competitive positioning among global banks. This move, if realized, may attract institutional capital and reinforce JPMorgan’s innovation leadership.

Fed Rate Cut: The Federal Reserve’s 25bp rate cut is a significant macro driver. Lower rates generally compress net interest margins for banks but can also stimulate lending and capital markets activity. JPMorgan’s diversified business model positions it to adapt to this environment.

Strategic Positioning: Industry commentary this week emphasizes JPMorgan’s resilience and adaptability in the post-rate-cut era, with analysts highlighting its robust capital position, strong balance sheet, and ability to capture market share in volatile conditions.

🚦 Scenarios for the Upcoming Week

Scenario | Trigger/Signal | Actionable Levels | Probability |

|---|---|---|---|

Bullish 📈 | Continuation above 328.00, sustained volume, MACD/RSI remain bullish | Entry: 328.00 | High |

Neutral ⏸️ | Sideways action between 320.54 and 330.86, low volume, mixed momentum | Range: 320.54–330.86 | Moderate |

Bearish 📉 | Breakdown below 314.00, reversal in MACD/RSI, high volume on declines | Entry: Below 314.00 | Low |

Risk Management Tips

Risk no more than 1% of capital per trade.

Use ATR (Average True Range) for dynamic stop-loss placement.

Monitor news flow for unexpected macro or regulatory developments.

📝 Summary & Outlook

JPMorgan Chase enters the first week of January 2026 with a bullish technical setup, supported by positive momentum and constructive news flow. The recent Fed rate cut and the bank’s potential expansion into institutional crypto trading are key themes to watch. While the uptrend remains intact, traders should monitor support at 320.54 and resistance at 330.86–335.00 for actionable opportunities. As always, prudent risk management is essential in the current market environment.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Please consult a qualified financial advisor before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles