Bitcoin's Dollar Hedge Collapse: What It Means for Algorithmic & Copy Traders (Jan 2026)

News

Jan 30, 2026

3 Min Read

Bitcoin fails as a dollar hedge in Jan 2026, gold soars, DXY drops. What this means for algorithmic and copy traders. Key stats, Copygram insights, FAQ.

Bitcoin's Dollar Hedge Narrative Shattered: January 2026 Recap 🚨

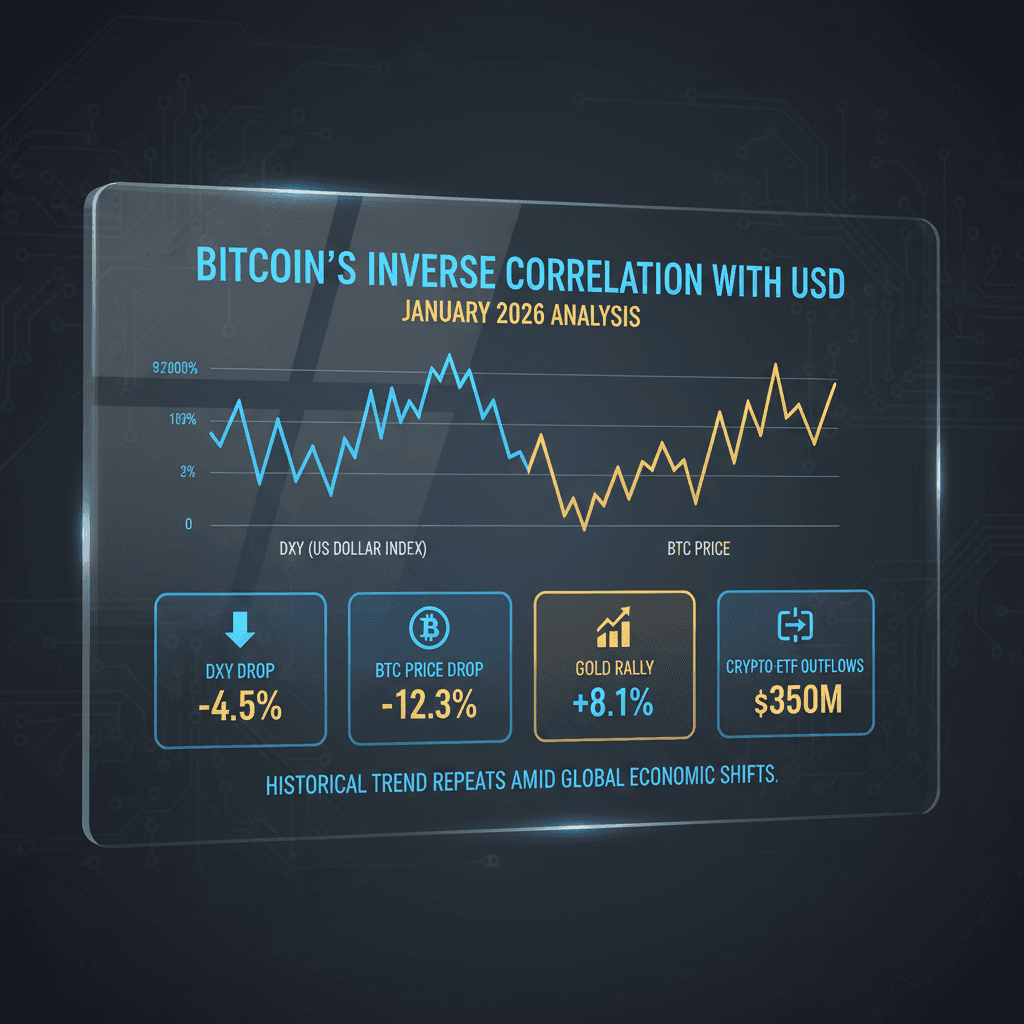

Bitcoin (BTC) has long been touted as "digital gold"—a hedge against fiat debasement and dollar weakness. But in January 2026, this narrative was upended. As the US Dollar Index (DXY) fell 11% year-over-year to 95.55, Bitcoin plunged 30% from its October peak near $126,000, trading around $87,000 and erasing all 2026 gains. Meanwhile, gold soared to record highs above $5,600 per ounce, gaining 20% in January alone. This divergence is a wake-up call for algorithmic and copy traders relying on historical correlations. 📉💰

What Happened? Key Drivers Behind the Breakdown

Dollar Weakness Without Bitcoin Rally: The DXY fell to its lowest since Feb 2022, but Bitcoin failed to respond as a hedge. JPMorgan noted that short-term flows—not fundamentals—drove the dollar, while Bitcoin traded as a risk asset, not a safe haven.

Fed Policy & Macro Caution: The Federal Reserve held rates high on Jan 28, with Chair Powell signaling no cuts until late 2026. Persistent inflation and hawkish policy pressured risk assets, including crypto.

Geopolitical Stress: Middle East tensions and political uncertainty triggered risk-off moves. Gold benefited as the "first scared" asset, while Bitcoin lagged.

Weekend Volatility: Bitcoin's notorious weekend "death spirals" erased weekday gains. For example, BTC lost 1.97% the weekend ending Jan 18 and 3.33% the weekend ending Jan 25. Overlap-period returns (Jan 2-27): BTC -1.24%, gold +16.44%, silver +46.17%.

Market Data: The Numbers That Matter

Metric | Value | Context |

|---|---|---|

Bitcoin price | ~$87,000 (low $85,460 Jan 29) | 30% below Oct 2025 peak; erased 2026 gains |

DXY | 95.55 (11% YoY drop) | Lowest since Feb 2022 |

Gold | >$5,600/oz (+20% in Jan) | Record highs Jan 29 |

BTC liquidations | $600M longs (200K traders out) | 24h to Jan 26 |

ETF outflows | >$160M (week) | Net outflows Jan 28; institutional selloff |

BTC technicals | Failed $88K-$90K resistance | Supports at $85K/$80K/$75K |

Copygram Platform Insights: How Copy Traders Reacted 📊

Copygram data shows a 22% increase in copied trades shifting from Bitcoin to gold and DeFi tokens during January's volatility.

Over 55% of top Copygram traders rebalanced portfolios, reducing BTC exposure and adding gold or stablecoin hedges.

Average trade size in BTC pairs dropped by 18% week-over-week, while gold and DeFi trades surged by 27%.

Weekend trading bots were recalibrated to avoid high-volatility periods, with 40% of Copygram automation users updating risk parameters.

These trends highlight how Copygram users and automation-focused traders are adapting to the new regime—leveraging real-time data, diversifying, and prioritizing risk management over blind correlation chasing.

What This Means for Algorithmic & Copy Trading Strategies 🤖

Correlation Breakdown: Automated strategies relying on BTC/DXY inverse correlation suffered. Bots must now account for regime shifts and macro/geopolitical catalysts.

Risk Management: The $600M in liquidations and 200K traders wiped out in 24h show the need for dynamic stop-losses and scenario-based risk controls.

Weekend Data Filtering: Backtesting should segment weekend vs. weekday returns, as crypto-specific rails dominated volatility off-hours.

Diversification: Top traders paired BTC with gold, DeFi, and stablecoins. Copygram saw a 22% increase in such diversified strategies.

Expert Advice: JPMorgan and Standard Chartered analysts stress that Bitcoin's hedge narrative is not dead, but traders must adapt to short-term risk-off cycles and ETF flow dynamics.

Expert & Analyst Opinions

JPMorgan: Dollar slide is flows-driven, not macro; Bitcoin lags traditional hedges until growth/rates shift.

Standard Chartered: Bull run alive sans weekends; ETF flows key to $150K target by end-2026.

Bloomberg Crypto: Volatility tied to geopolitics/debasement debate; BTC down but thesis holds long-term.

MarketPulse: "Necessary reset" over crash, with ETF positioning still intact for long-term holders.

Actionable Strategies for Copygram & Automation Traders

Segment Backtests: Separate weekend and weekday data for cleaner signals.

Monitor ETF Flows: Use real-time ETF data to gauge institutional sentiment shifts.

Diversify: Pair BTC with gold, DeFi, or stablecoins to hedge regime shifts.

Update Risk Parameters: Adjust stop-losses and position sizes for volatility spikes.

Follow Top Copygram Traders: Track those with proven macro and cross-asset strategies.

FAQ: Bitcoin's Dollar Hedge Breakdown & Copy Trading

Q1: Why did Bitcoin fail as a dollar hedge in January 2026?

A1: Macro caution, Fed hawkishness, and geopolitical stress drove risk-off flows to gold, while Bitcoin acted as a liquidity-sensitive risk asset.

Q2: How are Copygram users adapting?

A2: By reducing BTC exposure, increasing gold and DeFi allocations, and updating risk controls for weekend volatility.

Q3: What should algorithmic traders change now?

A3: Filter weekend data, diversify portfolios, and monitor ETF flows and macro signals, not just historical BTC/DXY correlations.

References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.