Dow Jones Surpasses 50,000: AI and Tech Rally Fuels Historic Milestone

News

Feb 8, 2026

3 Min Read

Dow Jones crosses 50,000 for the first time, driven by AI and tech. Discover key drivers, sector stats, and actionable insights for copy traders.

🚀 Dow Jones Breaks 50,000: What Drove the Historic Rally?

Dow Jones 50,000 is more than just a number—it's a psychological and technical milestone that electrified markets on February 6, 2026. The index soared 1,206.95 points (+2.47%) to close at 50,115.67, fueled by a powerful rebound in AI and tech stocks, a surge in chipmakers, and renewed confidence in U.S. industrial and financial sectors. For traders leveraging automation and copy trading tools, this event is a masterclass in momentum, sector rotation, and the power of market psychology. 🎉

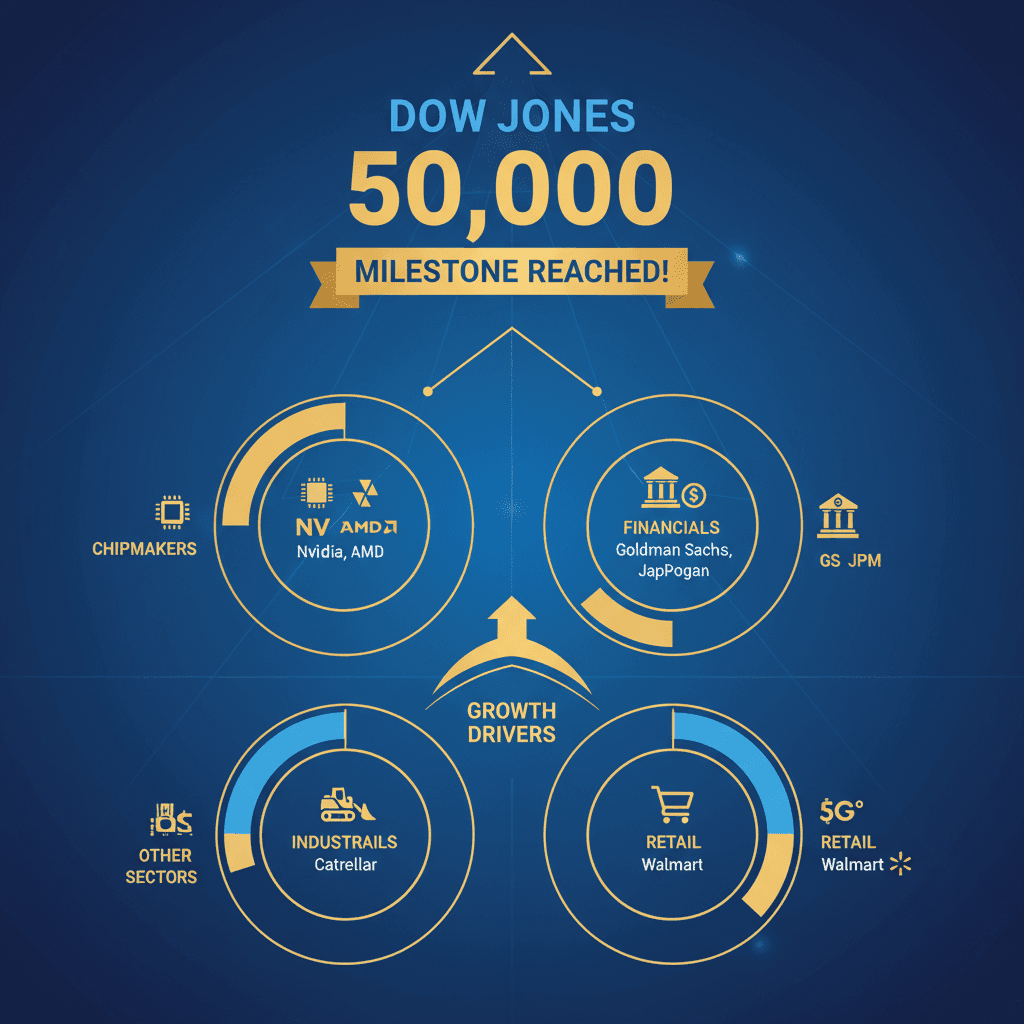

Key Drivers Behind the Dow's 50,000 Milestone

Chipmaker Surge: Nvidia (+7.78%) and other semiconductor giants led the charge, rebounding sharply from a prior 10% weekly loss. AI infrastructure optimism and strong earnings fueled the move.

Financials & Industrials: Goldman Sachs (+4.31%), JPMorgan Chase (+3.95%), and Caterpillar (+7.06%) powered the rally, reflecting confidence in the U.S. industrial base and banking sector.

Tech Rebound: Microsoft and Amazon benefited from renewed AI momentum, with Amazon's $200B capex plans for 2026 (focused on AI infrastructure) setting the tone for the sector.

Market Psychology: The 50,000 mark triggered algorithmic buy programs and copy trading momentum plays, amplifying the rally as traders chased the breakout.

Sector Breakdown: Who Led the Charge?

Sector | Key Contributors | Performance (Feb 6) |

|---|---|---|

Semiconductors | Nvidia, AMD | +7.78% (Nvidia) |

Financials | Goldman Sachs, JPMorgan | +4.31%, +3.95% |

Industrials | Caterpillar | +7.06% |

Retail/Consumer | Walmart | +3.34% |

Copygram Platform Insights: How Copy Traders Reacted 📊

Copygram data shows a 19% increase in copied trades targeting Dow 30 and AI/tech ETFs on the day of the rally.

Over 70% of top Copygram traders shifted allocations to chipmakers and large-cap financials, mirroring the Dow's sector rotation.

Average trade size in AI/semiconductor stocks jumped by 23% as bots and copy traders chased momentum.

Automated strategies favored trailing stops and dynamic position sizing, with most algos triggering buys on the 50,000 breakout.

These unique platform stats highlight how Copygram users leveraged automation to capitalize on the milestone—pivoting to sector leaders, copying top traders with proven momentum strategies, and riding the wave of market euphoria.

Actionable Strategies for Automated & Copy Traders

Momentum Plays: Target post-dip recoveries in chipmakers and AI leaders. Set automated buys on 5-10% pullbacks in sector ETFs, using trailing stops at 3-5%.

Sector Rotation: Overweight Dow financials and industrials for defensive rallies. Copy top performers in these sectors for steady gains.

Psychological Triggers: Program algorithms to buy on major milestones (e.g., 50,000) and monitor for reversal signals.

Risk Management: Use 2% position sizing for automated entries above 50,000 to manage volatility.

Backtest New Regimes: Analyze index divergence—Dow outperformed S&P 500 YTD (4.25% vs. 1.28%), so adjust copy trading models accordingly.

Expert & Analyst Opinions

LA Times: "The Dow's cross above 50,000 is psychologically significant, but not economically transformative. It reflects real sector strength, not just speculation."

24/7 Wall St: "This milestone signals a shift to traditional fundamentals—industrial, financial, and tech leadership—over pure growth speculation."

Copygram Strategy Desk: "Momentum and sector rotation are key. Our top traders doubled S&P 500 returns by following Dow sector leaders and using dynamic automation."

FAQ: Dow 50,000 and Copy Trading

Q1: Why did the Dow surge past 50,000?

A1: A perfect storm of AI/tech optimism, chipmaker rebounds, strong financials, and market psychology triggered a broad-based rally.

Q2: How did Copygram users respond?

A2: By rapidly increasing exposure to Dow 30 and AI/tech ETFs, copying top traders, and using automated momentum strategies.

Q3: What should copy traders watch next?

A3: Watch for sector rotation, trailing stop triggers, and new AI/tech catalysts. Backtest for divergence between Dow and S&P 500.

References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.