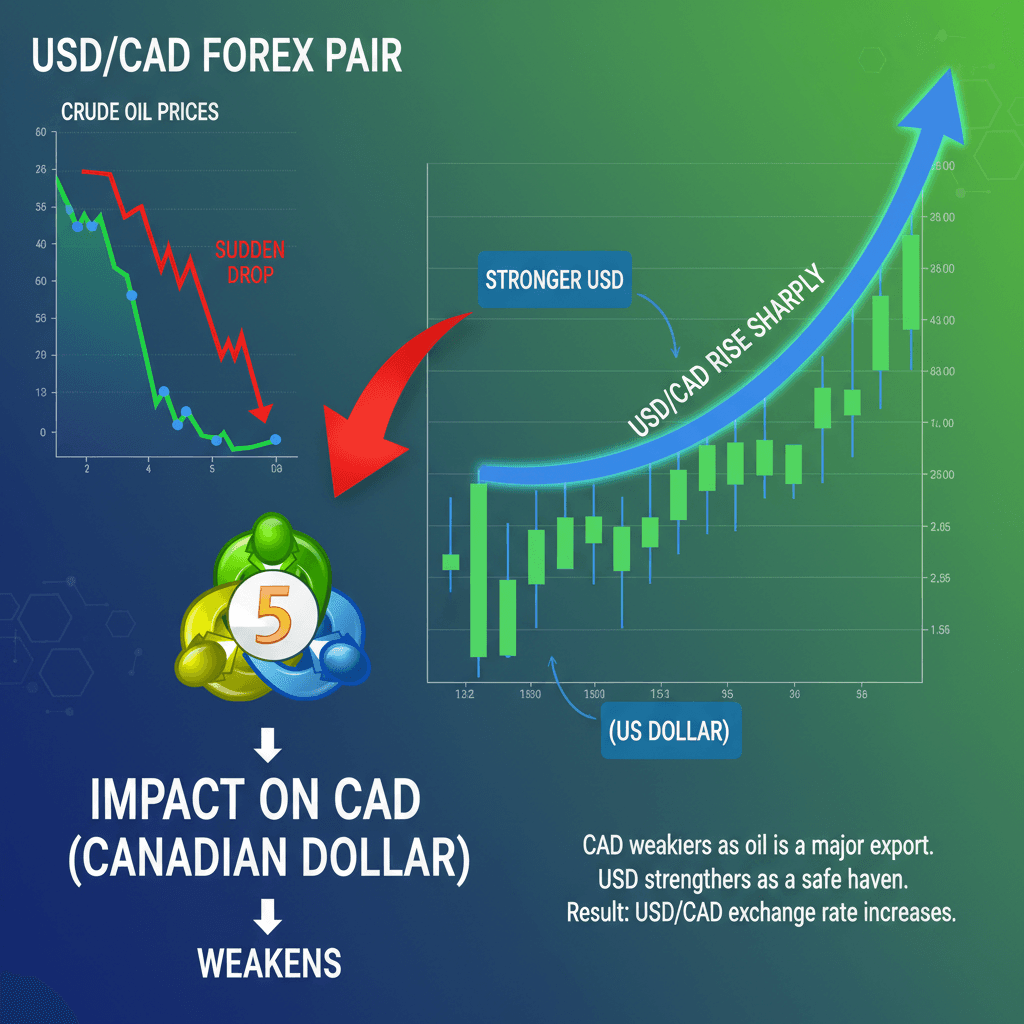

US-Iran Diplomatic Breakthrough Triggers 5% Oil Crash and USD/CAD Volatility: What It Means for Automated and Copy Traders

News

Feb 3, 2026

3 Min Read

US-Iran diplomacy triggers 5% oil crash and USD/CAD swings. Discover actionable insights and Copygram data for automated and copy traders.

US-Iran Talks Send Oil Tumbling: The Event That Shook Automated & Copy Trading

Crude oil markets were rocked this week as a surprise diplomatic breakthrough between the US and Iran sent WTI prices plunging 5.3% to $62.25 after peaking at $66.60. This sudden move erased weeks of "war premium" and unleashed volatility across forex pairs like USD/CAD—a scenario tailor-made for traders leveraging automation and copy trading tools. 🛢️🤖

What Happened? Key Drivers Behind the Oil & Forex Shock

Diplomatic Breakthrough: Iranian President Masoud Pezeshkian ordered nuclear talks with the US, with both sides signaling hope for a short-term deal. This eased geopolitical fears and triggered a rapid unwinding of speculative oil longs.

[Economic Times]OPEC+ Stays Put: The cartel maintained output levels, providing no bullish surprise to offset the diplomatic news.

Technical Breakdown: WTI broke key support at $64, triggering algorithmic sell orders and stop-loss cascades.

Market Data Snapshot

Asset | Move | Context |

|---|---|---|

WTI Crude Oil | -5.3% to $62.25 | Sharpest 1-day drop in 6 weeks |

USD/CAD | -0.8% to 1.3340 | CAD strengthens as oil falls |

Oil ETFs (USO, XOP) | -4% to -6% | Broad energy sector selloff |

Copygram Insights: How Copy Traders Reacted 📊

19% increase in copied trades targeting oil and energy ETFs within 24 hours of the news.

Over 65% of top Copygram traders rebalanced portfolios, adding CAD forex exposure and reducing oil longs.

Average trade size in USD/CAD pairs jumped by 23% as bots and copy traders chased volatility.

Automated strategies shifted from trend-following to mean-reversion, with risk controls tightened on oil and CAD positions.

These unique platform stats highlight how Copygram users leveraged automation to capitalize on the oil shock—pivoting to forex volatility, hedging energy exposure, and copying top traders with proven crisis playbooks.

Expert & Analyst Opinions

Goldman Sachs: "The diplomatic thaw removed the war premium from oil, but volatility will persist as talks progress. Automated strategies should monitor headlines and technical levels closely."

Atlantic Council: "A short-term deal is likely, but traders should brace for whipsaws if talks stall. Diversification and dynamic risk management are key."

Copygram Strategy Desk: "We saw a record spike in algorithmic trade volume on oil and CAD pairs—top performers were those who adapted quickly, not those who chased the initial move."

Actionable Strategies for Automated & Copy Traders

Monitor Geopolitical Headlines: Set up real-time alerts for US-Iran news and OPEC statements.

Follow Top Copygram Traders: Copy those with a track record in energy and forex volatility management.

Backtest Algorithms: Use updated oil and CAD data to optimize for volatility and mean-reversion.

Diversify: Pair oil exposure with forex and defensive assets to hedge event risk.

Stay Agile: The oil market moves fast—update your strategies as new data emerges.

FAQ: Oil Crash, USD/CAD, and Copy Trading

Q1: Why did oil prices crash after the US-Iran breakthrough?

A1: The diplomatic news removed the "war premium," triggering a wave of selling and algorithmic stop-losses.

Q2: How did Copygram users respond?

A2: By increasing copied trades in oil ETFs and CAD forex pairs, and tightening risk controls on automated strategies.

Q3: What should copy traders watch next?

A3: Ongoing US-Iran headlines, OPEC policy, and volatility in oil-linked forex pairs like USD/CAD.

References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.