Ethereum (ETHUSD) Weekly Analysis & Outlook – Week 2 December 2025

Ideas

Dec 9, 2025

3 Min Read

Comprehensive weekly analysis of Ethereum (ETHUSD) for Week 2 December 2025. Includes technical chart, latest news, support/resistance, and actionable trade scenarios for crypto traders.

Ethereum (ETHUSD) enters Week 2 of December 2025 in a state of consolidation, with price action hovering between major support and resistance levels. This in-depth analysis covers technicals, news catalysts, and actionable scenarios for the week ahead. (Week of December 8, 2025) 🚀

📰 Latest News & Market Catalysts (Past 7 Days)

Bearish Breakdown Below $3,000: On December 1, ETHUSD fell sharply below $3,000, with a 5.5% drop in 24 hours, driven by technical breakdowns and macroeconomic fears. [DailyForex]

Macroeconomic Headwinds: Rising expectations of a Bank of Japan rate hike (mid-December) triggered risk-off sentiment across crypto markets, as investors unwound Yen carry trades. [DailyForex]

Analyst Projections: Some analysts forecast a potential bullish correction toward $3,475, but warn of further downside if resistance holds. [Forex24]

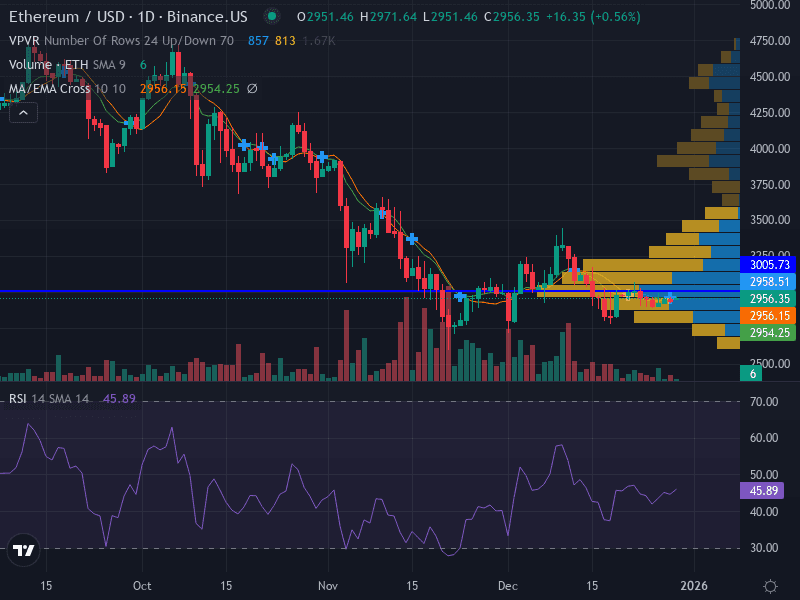

📊 Technical Analysis

Aspect | Details |

|---|---|

Trend | Sideways/Neutral – ETHUSD is consolidating between the 9- and 21-day EMAs, with no clear directional breakout. |

Support Levels | Major: $2,971.23 |

Resistance Levels | Major: $3,074.61 |

Chart Pattern | Consolidation pattern, price hovering near support/resistance. No clear breakout yet. |

Momentum (RSI) | 47.84 (Neutral – neither overbought nor oversold) |

MACD | Not provided, but price action and volume suggest indecision. |

Volume | Decreasing on recent moves, indicating lack of strong conviction from bulls or bears. |

Key Chart Takeaways

ETHUSD is consolidating, with price action trapped between $2,971 (major support) and $3,074 (major resistance).

Volume is declining, which often precedes a larger move but currently signals indecision.

Momentum is neutral, with RSI near 48 and no clear overbought/oversold signals.

Break above $3,075 could trigger a bullish breakout; a close below $2,971 would likely accelerate bearish momentum.

🔎 Fundamental & News Impact

Ethereum’s price action this week is heavily influenced by macroeconomic uncertainty, especially the anticipated Bank of Japan rate hike, which has led to risk-off sentiment in global markets. Crypto-specific news has been relatively muted, with most attention on technical breakdowns and the potential for a short-term correction. On-chain activity remains subdued, and ETH’s relative weakness versus Bitcoin (ETH/BTC ratio at yearly lows) adds to the cautious outlook.

📈 Actionable Scenarios for the Week

Scenario | Trigger/Signal | Potential Move | Risk Management |

|---|---|---|---|

Bullish | Break and close above $3,075 (major resistance) | Target $3,150–$3,475; further upside possible if $3,475 breaks | Stop-loss below $3,030; risk 0.5–1% of capital |

Bearish | Weekly close below $2,971 (major support) | Target $2,800, then $2,150 if selling accelerates | Stop-loss above $3,050; risk 0.5–1% of capital |

Neutral/Range | Price remains between $2,971 and $3,075 | Choppy, low-conviction trading; consider waiting for breakout | Reduce position size, avoid overtrading |

🛠️ Trade Ideas

Aggressive Bullish: Buy above $3,075, stop-loss at $3,030, target $3,150–$3,475.

Conservative Bullish: Wait for a pullback to $3,040–$3,050, buy with stop-loss at $2,990, target $3,100.

Bearish: Sell/short if weekly close is below $2,971, target $2,800–$2,150.

📅 Weekly Outlook Table

Date | Event | Potential Impact |

|---|---|---|

Dec 8–12 | Consolidation near key levels | Watch for breakout or breakdown |

Dec 18–19 | Bank of Japan rate decision | Could trigger volatility in crypto markets |

⚠️ Risk Management & Final Thoughts

ETHUSD is at a crossroads: a breakout or breakdown is likely to set the tone for the rest of December.

Traders should use tight stop-losses and avoid overleveraging, especially with macro events on the horizon.

Monitor volume and momentum for early signs of a directional move.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Please conduct your own research and consult a professional before making investment decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles