Cardano (ADAUSD) Weekly Analysis & Outlook – Week 52, December 2025

Ideas

Dec 22, 2025

3 Min Read

In-depth weekly analysis for Cardano (ADAUSD) on BinanceUS for Week 52, December 2025. Includes technical chart, news summary, support/resistance, trade ideas, and actionable scenarios for traders.

Welcome to our comprehensive weekly analysis for Cardano (ADAUSD) on BinanceUS, covering Week 52 of December 2025. In this post, we’ll break down the latest price action, technical chart structure, key news, and provide actionable trade scenarios for the week ahead.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Trading cryptocurrencies involves significant risk.

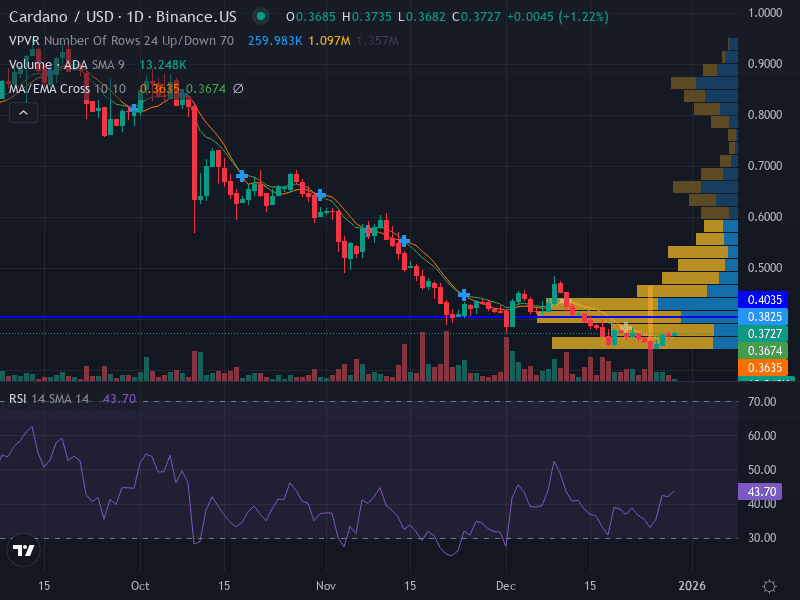

📊 Cardano (ADAUSD) Weekly Chart Overview

Trend: Bearish — Price remains below the 10-week SMA, forming lower highs and lows.

Pattern: Descending channel, with consistent lower highs and lower lows.

Momentum: RSI at 37.54 (bearish, but not oversold), declining momentum.

Volume: Increasing on downward moves, decreasing on rallies — signaling strong selling pressure.

Key Level | Type | Value (USD) | Significance |

|---|---|---|---|

0.3678 | Support (Major) | $0.3678 | Recent weekly low, critical for downside risk |

0.3600 | Support (Minor) | $0.3600 | Potential bounce zone |

0.3784 | Resistance (Minor) | $0.3784 | 10-week SMA, near-term resistance |

0.4101 | Resistance (Major) | $0.4101 | Recent swing high, trend reversal trigger |

📰 Latest News & Market Context (Dec 15–21, 2025)

Price Action: ADA traded between $0.37 and $0.41, with a 5.22% drop after failing to break $0.40 resistance. [Phemex]

Sentiment: Extreme fear dominates (Fear & Greed Index: 20), with only 37% green days in the last 30. [CoinCodex]

Analyst Views: Most analysts expect sideways or bearish movement, with no major short-term catalysts. Some mention a vague "buy signal," but details are lacking. [BTCC]

🔎 Technical Analysis

Support/Resistance: The $0.3678 level is critical; a break below could accelerate losses toward $0.36 or lower. Resistance at $0.3784 (10-week SMA) and $0.4101 (major swing high) must be reclaimed for any bullish reversal.

Pattern: The descending channel highlights persistent selling. Each rally attempt is met with higher volume on down days, confirming bearish control.

MACD: Negative and widening, confirming the downtrend. No bullish crossover in sight.

Volume: Spikes on declines, suggesting capitulation risk if support breaks.

📈 Fundamental & News Impact

There were no major news events or catalysts for Cardano on BinanceUS in the past week. The lack of positive developments, combined with low on-chain activity and leverage-driven volatility, has left ADA vulnerable to further downside. Analyst consensus for December 2025 is cautious, with most expecting continued range-bound or bearish price action unless a surprise catalyst emerges.

🗺️ Possible Scenarios for the Upcoming Week

Scenario | Probability | Key Trigger | Actionable Levels | Risk Management |

|---|---|---|---|---|

Bearish Continuation | High | Break below $0.3678 | Sell at $0.3650, SL $0.3750, Target $0.3550 | Risk 0.5–2% per trade; use ATR(14-week) for stops |

Bullish Reversal | Low | Weekly close above $0.4101 | Buy at $0.4120, SL $0.3980, Target $0.4300 | Reduce position size; wait for confirmation |

Neutral/Sideways | Moderate | Range between $0.3678–$0.4101 holds | Range trade: Buy dips near $0.3700, sell rallies near $0.4100 | Quick stops; avoid overtrading |

🔔 Key Takeaways

ADAUSD remains in a well-defined downtrend with strong resistance at $0.3784 and $0.4101.

Bearish continuation is the most probable scenario unless a significant catalyst appears.

Traders should watch for a breakdown below $0.3678 or a reversal above $0.4101 for directional cues.

Risk management is crucial — avoid oversized positions and use stop-losses.

📅 Weekly Outlook Summary

With no major news or bullish catalysts, ADAUSD is likely to remain under pressure. The technical setup favors bears, but oversold conditions could spark a short-term bounce if sentiment shifts. Stay vigilant, manage risk, and be prepared for volatility as the year closes.

For more weekly crypto analysis, stay tuned to our blog. Trade safe! 🚦

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles