Bitcoin (BTCUSD) Weekly Analysis & Outlook – Week 2 December 2025

Ideas

Dec 9, 2025

3 Min Read

In-depth weekly analysis of Bitcoin (BTCUSD) on Binance.US for Week 2 December 2025: chart review, support/resistance, news impact, and actionable scenarios. Stay updated with BTC trends and trading strategies.

Welcome to our comprehensive weekly analysis of Bitcoin (BTCUSD) on Binance.US for Week 2 of December 2025! This post delivers a deep dive into BTC’s price action, technical structure, fundamental drivers, and actionable trading scenarios for the week ahead.

Let’s break down the latest developments, chart insights, and what traders should watch for in the coming days. 🚀📉

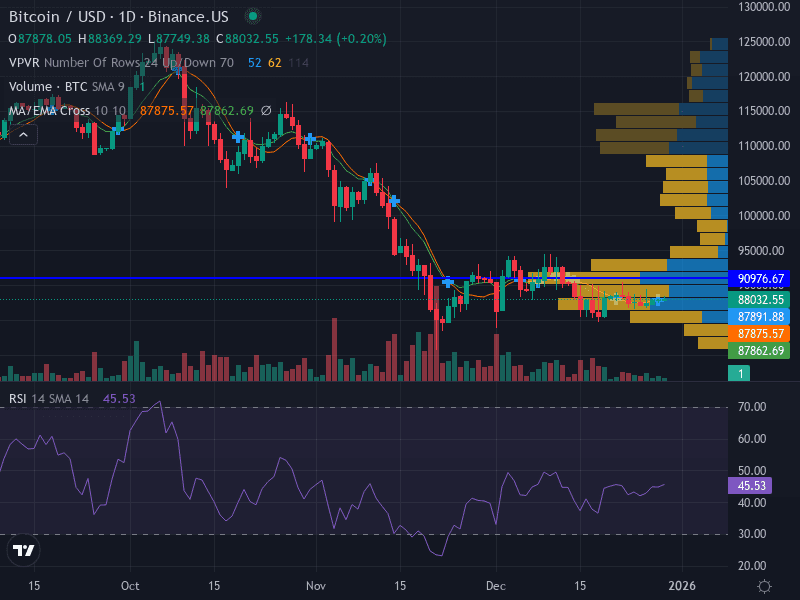

1. Weekly Price Chart Overview

(See chart above for full technical visualization with volume and MACD)

Current Trend: Neutral, with price consolidating in a well-defined range.

Key Support: $90,412 (major), $85,000 (minor)

Key Resistance: $90,650 (major), $111,487 (major, high-volume node)

Volume: Decreasing on both up and down moves, indicating a lack of strong conviction from buyers or sellers.

Momentum: RSI at 44.99 (neutral to slightly bearish), MACD neutral.

Pattern: Range-bound, forming a consolidation structure between major support and resistance.

2. Latest News & Short-Term Catalysts (Past 7 Days)

Date | Headline | Summary | Source |

|---|---|---|---|

2025-12-06 | Market Update: BTC Trades Near $89,600 | Bitcoin traded between $88,000 and $92,000, with a slight downtrend of 1.85%. The broader crypto market saw a 2% dip in 24 hours. | |

2025-12-02 | Binance.US Flash Pump | BTC price briefly spiked to $138,000 due to a liquidity glitch, then normalized. Highlights ongoing liquidity challenges on Binance.US. | |

2025-12-04 | Analysts Eye New ATH in December | Binance CEO and analysts predict a possible new all-time high (ATH) above $130,000 in December, contingent on breaking $92,000 resistance. |

3. Technical Analysis

Support Levels: $90,412 (major, recent swing low), $85,000 (minor)

Resistance Levels: $90,650 (major, recent highs), $111,487 (major, high-volume node)

Trend: Sideways/consolidation. Price is between the 20- and 50-day EMAs, lacking clear direction.

Momentum: RSI at 44.99 (neutral, slightly bearish bias). MACD is neutral, not signaling strong momentum.

Volume: Decreasing, suggesting a wait-and-see approach by market participants.

Pattern: Range-bound. No clear breakout or breakdown; price action is coiling for a potential move.

Technical Table

Indicator | Value | Interpretation |

|---|---|---|

Support (Major) | $90,412 | Strong buying interest; recent swing low |

Support (Minor) | $85,000 | Potential bounce zone if major support fails |

Resistance (Major) | $90,650 | Key level to break for bullish momentum |

Resistance (Major) | $111,487 | High-volume node; significant if broken |

RSI | 44.99 | Neutral to slightly bearish |

MACD | Neutral | No strong momentum |

Volume | Decreasing | Lack of conviction; possible volatility ahead |

4. Fundamental & News Impact

Liquidity Events: The recent flash pump to $138,000 on Binance.US highlights ongoing liquidity and infrastructure concerns. Traders should remain cautious of sudden price anomalies.

Macro Factors: U.S. inflation data and the Federal Reserve’s rate outlook remain key macro drivers. Any dovish signals or rate cuts could boost BTC’s appeal as a hedge.

Regulatory Developments: Proposed U.S. legislation on crypto ETFs and public investment could provide regulatory clarity and attract new capital.

Sentiment: Despite the current cooling period, sentiment remains cautiously optimistic. Analysts and Binance’s CEO see potential for a new ATH if $92,000 is broken and held.

5. Actionable Scenarios for the Upcoming Week

Scenario | Trigger/Confirmation | Action | Target | Stop Loss |

|---|---|---|---|---|

Bullish | Break and close above $90,650 | Buy on breakout above $90,700 | $95,000 (initial), $111,487 (extended) | $89,000 |

Bearish | Rejection at $90,650 resistance | Short near $90,650 | $85,000 | $92,000 |

Neutral | Price remains between $90,412 and $90,650 | Wait for clear breakout or breakdown; avoid new positions | N/A | N/A |

Risk Management: Risk no more than 1% of capital per trade. Use ATR or volatility-based stops. Remain flexible and adjust to new data.

Invalidation: A close above $111,487 would shift the bias to bullish for the medium term.

6. Summary & Takeaways

Bitcoin (BTCUSD) is consolidating in a tight range, with key levels at $90,412 (support) and $90,650 (resistance). The market is waiting for a decisive move, with macro and regulatory catalysts in play. Traders should watch for a breakout above $90,650 for bullish momentum, while a rejection could see a retest of $85,000. Neutrality prevails until a clear direction emerges. 📊🕰️

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading cryptocurrencies involves risk.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles