Bitcoin (BTCUSD) Weekly Analysis & Outlook – Week 1, December 2025

Ideas

Jan 3, 2026

3 Min Read

In-depth weekly analysis of Bitcoin (BTCUSD) for Week 1, December 2025: chart review, latest news, technical and fundamental insights, and actionable scenarios for traders.

Welcome to our comprehensive weekly analysis of Bitcoin (BTCUSD) for Week 1, December 2025. This post covers the latest price action, essential news, technical and fundamental insights, and actionable scenarios for the upcoming week. Whether you’re a trader or investor, this guide will help you navigate the current Bitcoin landscape with clarity and discipline. (Week number and date: Week 1, December 29, 2025)

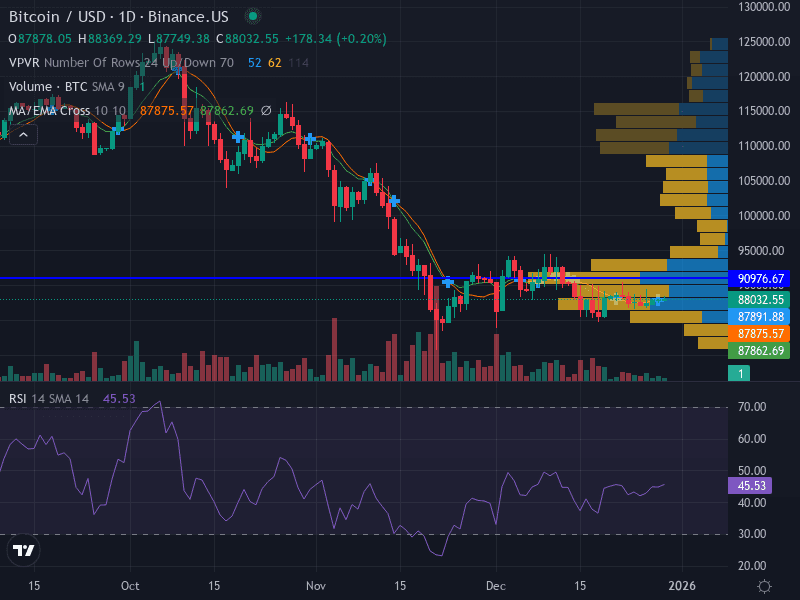

📈 Price Chart Overview

See full-width chart above for reference (includes volume and MACD).

Trend: Sideways, consolidating between moving averages.

Momentum: Bearish momentum moderating, RSI at 45.53 (neutral).

Pattern: Range-bound, consolidation phase.

Volume: Decreasing during consolidation, signaling indecision.

📰 Latest News & Short-Term Catalysts (Past 7 Days)

Date | Headline | Summary | Source |

|---|---|---|---|

2025-12-26 | $23B Options Expiry | Massive options expiry triggered volatility, with traders watching $80k–$82k as key support. Early bullish signals suggest a possible recovery, but risk of sharp moves remains. | |

2025-12-25 | Binance Flash Crash | BTC briefly dropped to $24,000 on Binance’s USD1 pair before rebounding above $87,000. Isolated event, but highlights exchange-specific risks. | |

2025-12-22 | Year-End Profit Taking | Analysts attribute recent weakness to profit-taking and low liquidity, amplifying price swings around major expiries and holidays. |

🔎 Technical Analysis

Support Levels:

Major: 87,875.57 (recent swing low)

Minor: 87,862.69

Short-term: 80,000–82,000 (as flagged in news coverage)

Resistance Levels:

Major: 90,976.67 (upper consolidation boundary)

Breakout trigger: 93,000 (sustained move above could shift bias bullish)

Trend: Sideways, consolidating near the 10-day SMA. No clear directional bias.

Momentum: RSI at 45.53 indicates neutral momentum. MACD shows bearish momentum is moderating, with potential for a shift if volume increases.

Volume: Decreasing during consolidation, suggesting market indecision and potential for a breakout once volume returns.

Pattern: Range-bound, with price oscillating between key support and resistance.

📊 Fundamental & News Impact

Options Expiry: The $23B expiry on Dec. 26 created significant short-term volatility, as market makers unwound positions and liquidity thinned. This event is a major driver of recent price swings.

Exchange-Specific Risks: The Binance flash crash (to $24,000) was an isolated event, but it highlights the need for traders to use consolidated price indexes and be wary of exchange anomalies.

Profit Taking & Liquidity: Year-end profit-taking and low liquidity have amplified market moves, making the environment more prone to sharp swings and potential whipsaws.

Macro Backdrop: Analysts are split, with some expecting a bullish reversal toward $100k, while others warn of deeper pullbacks if key supports fail. Macro liquidity and potential US policy moves remain background drivers.

🛠️ Actionable Scenarios for the Upcoming Week

Scenario | Trigger/Confirmation | Key Levels | Potential Target | Risk Management |

|---|---|---|---|---|

Bullish 🟢 | Breakout above 90,976.67 with strong volume | Above 93,000 (sustained) | 94,000+ | Stop below 89,500; risk 1–2% capital |

Bearish 🔴 | Rejection at resistance or breakdown below 87,875.57 | Below 87,875; watch 80,000–82,000 | Test of 82,000 or lower | Stop above 90,000; risk 1–2% capital |

Neutral/Range 🟡 | Consolidation between 87,875 and 90,976 | Range-bound | Scalp small moves; avoid large positions | Use ATR(14) for dynamic stops |

Key Points for Traders

Expect continued volatility as options expiry effects settle and liquidity remains thin.

Monitor key support (80,000–82,000) and resistance (90,976.67–93,000) for breakout/breakdown signals.

Use consolidated price indexes for execution to avoid exchange-specific anomalies.

Risk management is critical: limit exposure and use dynamic stops.

Stay alert for macro headlines and further exchange updates.

📅 Weekly Outlook Summary

Bias: Neutral to cautious bullish if 93,000 is reclaimed; bearish if 87,875 fails.

Confidence: Low — sideways movement and mixed indicators suggest uncertainty.

Watch for: Volume spikes, options expiry aftershocks, and macro news flow.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading cryptocurrencies involves significant risk.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles