Crypto Fund Trader In-Depth Review: Your Guide to Getting Funded with Copygram

Prop Firms

Nov 23, 2025

In-depth Crypto Fund Trader review. Learn challenge rules, funding, and how Copygram automates your path to getting funded. Step-by-step setup guide.

Crypto Fund Trader (CFT) has rapidly emerged as a top choice for traders seeking flexible, crypto-centric proprietary trading opportunities. With its innovative funding models, Bybit integration, and support for platforms like MT5 and MatchTrader, CFT offers a unique environment for both aspiring and experienced traders. In this guide, we’ll break down everything you need to know about CFT’s challenges, rules, and reputation—and show you how Copygram can be your secret weapon to pass their evaluation and thrive as a funded trader.

Crypto Fund Trader: Key Features & Benefits

Two Evaluation Models: Choose between a classic two-phase challenge or a one-phase instant funding option.

Huge Asset Diversity: Trade over 715+ crypto pairs, plus forex, indices, commodities, and stocks.

Flexible Rules: No time limits, no max lot size, and copy trading is allowed.

Fast Payouts: Withdrawals processed in 8–24 hours.

Institutional-Grade Execution: Partnership with Bybit for deep liquidity and advanced tools.

Scaling Plan: Grow your allocation up to $300,000 for consistent performance.

Supported Platforms: MT5, MatchTrader, Bybit, and CFT’s proprietary platform.

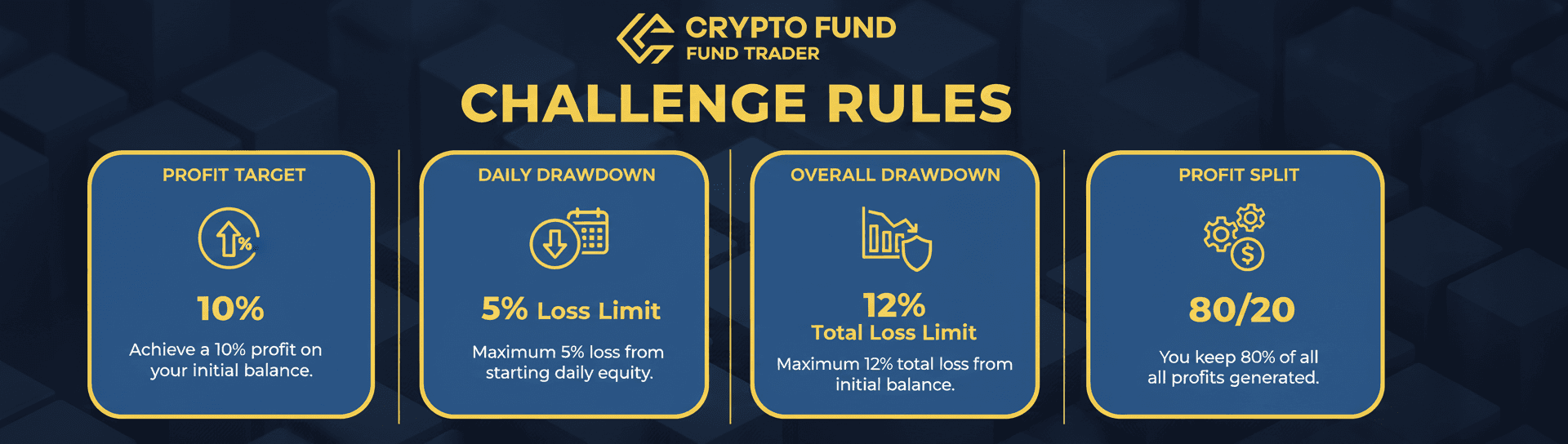

Crypto Fund Trader Challenge Rules (2025)

Below is a quick comparison of the two main evaluation models at CFT:

Model | Profit Target | Daily Drawdown | Total Drawdown | Min Trading Days | Time Limit | Leverage |

|---|---|---|---|---|---|---|

Two-Phase | 8% (Phase 1), 5% (Phase 2) | 5% | 10% (static) | 5 | Unlimited | 100:1 |

One-Phase (Instant) | 10% | 4% | 6% (trailing) | 3 | Unlimited | 100:1 |

Profit Split: 80% standard, up to 90% for top performers

Account Sizes: $2,500 to $200,000 (evaluation); up to $300,000 with scaling

Pricing: Starts at $125 for $2,500 account; $475 for $10,000

Copy Trading: Allowed

Why Use Copygram to Pass the Crypto Fund Trader Challenge?

Passing a prop firm challenge is tough—only 5–10% of traders succeed (source). The key obstacles? Emotional trading, inconsistent risk management, and the challenge of executing a proven strategy day after day. Copygram solves these pain points by automating your trading, enforcing strict risk parameters, and letting you manage multiple accounts with ease.

Automate Your Edge: Run your best strategy on a master account and copy trades to your CFT evaluation account—no missed setups, no emotional mistakes.

Risk Management: Set Copygram’s risk controls to match CFT’s drawdown rules (e.g., 5% daily, 10% total for two-phase; 4%/6% for one-phase).

Multi-Platform Support: Copygram works seamlessly with MT5 and MatchTrader, both supported by CFT.

Efficiency: Manage several prop firm challenges at once, or scale up to funded accounts, all from a single dashboard.

How to Pass the Crypto Fund Trader Challenge with Copygram: Step-by-Step

Open Your CFT Evaluation Account: Sign up at Crypto Fund Trader and choose your preferred challenge (two-phase or instant funding).

Connect Your Platform: Set up your CFT account on MT5 or MatchTrader—both are fully supported by Copygram. (See our MT5 connection tutorial.)

Configure Copygram: Link your master account (where your proven strategy runs) and your CFT evaluation account as a receiver. Set risk parameters to match CFT’s drawdown rules.

Automate Your Trading: Let Copygram copy trades in real-time, ensuring consistent execution and adherence to your risk plan.

Monitor & Adjust: Use Copygram’s dashboard to track performance, tweak risk settings, and ensure you’re on track to hit profit targets without breaching drawdowns.

Scale Up: Once funded, continue using Copygram to manage your account, scale to higher allocations, or even run multiple prop firm accounts in parallel.

Frequently Asked Questions (FAQ)

Q: Is Copygram allowed by Crypto Fund Trader?

A: Yes, CFT allows copy trading and automation tools. Just ensure your trading complies with their rules (no latency arbitrage, etc.).Q: How do I set Copygram’s risk parameters for CFT?

A: Set daily and total loss limits in Copygram to match CFT’s rules (e.g., 5% daily, 10% total for two-phase).Q: Can I use Copygram with both MT5 and MatchTrader?

A: Absolutely. Copygram supports both platforms, letting you automate trading across CFT’s supported accounts.Q: What strategies work best for passing CFT’s challenge?

A: Consistent, low-risk strategies with strict risk management are best. Avoid high-frequency or arbitrage methods.Q: How fast are CFT payouts?

A: Payouts are processed within 8–24 hours after request.

References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles