Time-Based Filtering: Avoiding The "Toxic Hour" in Trading

Education

Jan 13, 2026

3 Min Read

Discover how to boost your win rate with time-based trading filters. Master forex market sessions, avoid the 'toxic hour,' and learn manual & automated scheduling tactics to optimize trading with Copygram.

The Hidden Dangers of the "Toxic Hour" ⏳

Every trader, seasoned or new, knows that not all hours in the trading day are created equal. There are specific times—often referred to as the "toxic hour"—when abnormal volatility, low liquidity, or erratic price action can ruin a perfectly good strategy.

These windows tend to crop up during certain forex market sessions: for instance, during the thin liquidity of the Asian session, right after the market open, or immediately before/after major economic news releases. Weak results in these hours can drag down your average win rate, ultimately compounding losses over time.

For traders relying on copy trading platforms or EAs, this becomes especially problematic—bad trades can keep getting repeated if you don't take back control with precise timing.

Smart traders recognize that not every hour is worth the risk—timing is power.

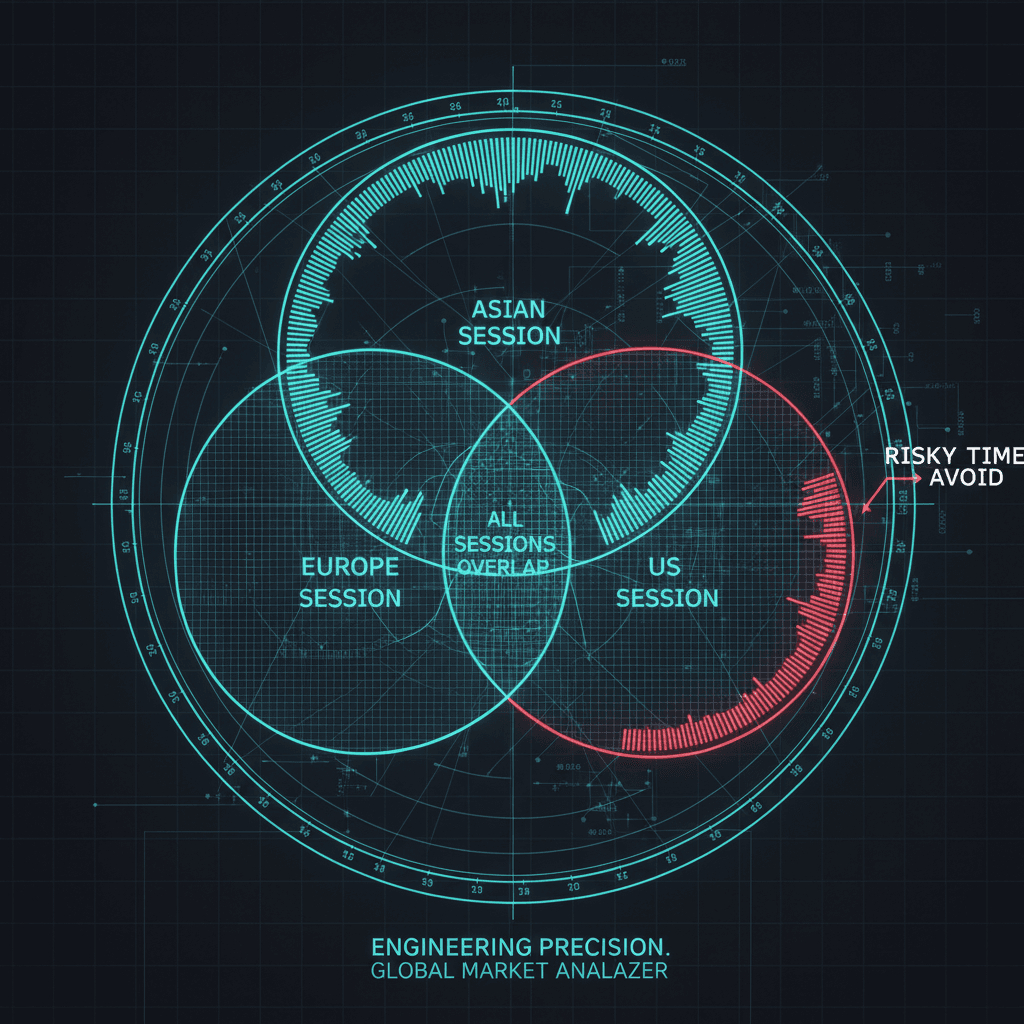

Why Forex Market Sessions Matter: Knowing When NOT to Trade 🌐

The forex market is unique in that it runs 24 hours a day, split into overlapping sessions: Asian (Tokyo), European (London), and US (New York). Each presents a different trading landscape:

Asian Session (Tokyo): Lower volatility, higher spreads, fewer breakout moves—strategies reliant on momentum or strong trends often underperform here.

European Session (London): High liquidity, tight spreads, and generally more reliable price action. Most optimal trading for many strategies.

US Session (New York): Volatility returns, overlaps with London for a few hours, provides high-volume and fast moves—potential for bigger wins, but also larger risks.

A time-based trading filter is your first line of defense against accidental exposure to statistically bad periods. It's not just theory—research (see Babypips Forex Sessions Guide) supports that avoiding low-liquidity or high-uncertainty periods like the "Asian lull" can boost win rates.

Visualizing risk: The Asian session’s lower volume means a higher chance of traps for many strategies.

💡 Key Takeaway

Some strategies naturally fail during certain sessions. Even if your system is winning overall, consistent exposure to these hours could wipe your edge. That’s why knowledge of market sessions is crucial for risk management and strategy optimization.

Practical Guide: Spotting and Excluding the "Toxic Hour" 📆

Smart traders don’t just guess when the "bad times" occur—they analyze, backtest, and act. Here’s how you can identify your strategy’s toxic hour and optimize timing:

Backtest Your System by Hour: Use your platform’s reporting features to break down win/loss by hour or session. Patterns become quickly apparent.

Watch Spreads & Volatility: Note spread spikes and price gaps. Toxic periods usually feature wild fluctuations or dead prices.

Cross-Reference News Calendars: Avoid trading right before/after major economic events—these are classic toxic times.

Create a Simple Table: Record results for each hourly window across a month to see where your edge holds or disappears.

Hour (GMT) | Win % | Observations |

|---|---|---|

00:00-01:00 | 44% | Asian session, low liquidity |

07:00-09:00 | 68% | London open, sharp moves |

13:00-15:00 | 63% | US overlap, high opportunity |

22:00-23:00 | 37% | Lethargic price action – avoid! |

Precision filtering in action: a visually excluded hour means risk is minimized and strategy edge is protected.

Manual vs. Automated Time-Based Filters: How Copygram Supercharges Your Control ⚙️

There are two main ways to "avoid the toxic hour": manually or automatically scheduling trade copying.

Manual Approach: Experienced traders may stop signals or copy trading scripts around these risky windows. Effective, but requires vigilance (and you can miss ideal restart windows).

Automated Scheduling: Copygram empowers users with automated time-based trading filters. You get the flexibility to schedule trading windows down to the hour—turning off copying during the noisy Asian session or right at the US market open, then resuming during proven high-probability hours.

Benefits of Copygram’s Scheduling:

Eliminate human error—always stick to your plan

Quickly update your schedule if patterns change

Coordinate team strategies across different time zones

Increase edge by consistently optimizing entry windows

💡 Key Takeaway

Automated filtering is the evolution of time-based risk management—consistency beats emotion, especially for busy or multi-account traders. Learn more about advanced risk management here.

Q&A: Your Top Time-Based Filtering Questions Answered ❓

Can I apply different filters for weekdays vs. weekends?

Yes! Copygram supports custom scheduling by day and hour, perfect for NFP Friday avoidance or Sunday night gaps.

What if my signal provider trades 24/5—can I still pause copying?

Absolutely. You control your time window. Copygram only copies trades within your pre-set times, regardless of provider activity.

Should I optimize my schedule often?

Review your results at least monthly, especially after major news events or if you change strategies. Patterns—and market behavior—can evolve with global macro shifts.

📝 In Summary: Turn the Clock in Your Favor

Most copy trading losses are not about the strategy—they’re about when you’re exposed! Use time-based filters, learn your market sessions, and leverage automated scheduling with tools like Copygram to transform your equity curve.

Remember: It’s not just what you trade, it’s when. Filter the toxic hours, and let your edge shine.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles