The Cost of Automation: Calculating Spread, Commission, and Subscription for Break-Even Trading

Education

Jan 13, 2026

3 Min Read

Discover exactly how to calculate your break-even point for automated and copy trading. We break down spreads, commissions, and subscription costs so you can confidently assess profitability and optimize your trading ROI.

Demystifying Trading Costs: Beyond What Meets the Eye

Automated and copy trading promise ease and professional strategies—but true trading profitability begins with a deep understanding of all costs involved. For both beginners and seasoned pros, misjudging the cost of trading can quietly erode hard-earned gains.

This guide will take you step by step through spread, commission, subscription fees, and how to tie them together for precise break-even analysis in forex, stocks, and crypto automation.

Why calculating the cost of automation is essential to long-term ROI

Hidden costs most traders overlook in automated platforms

How to calculate your precise break-even point 🔍

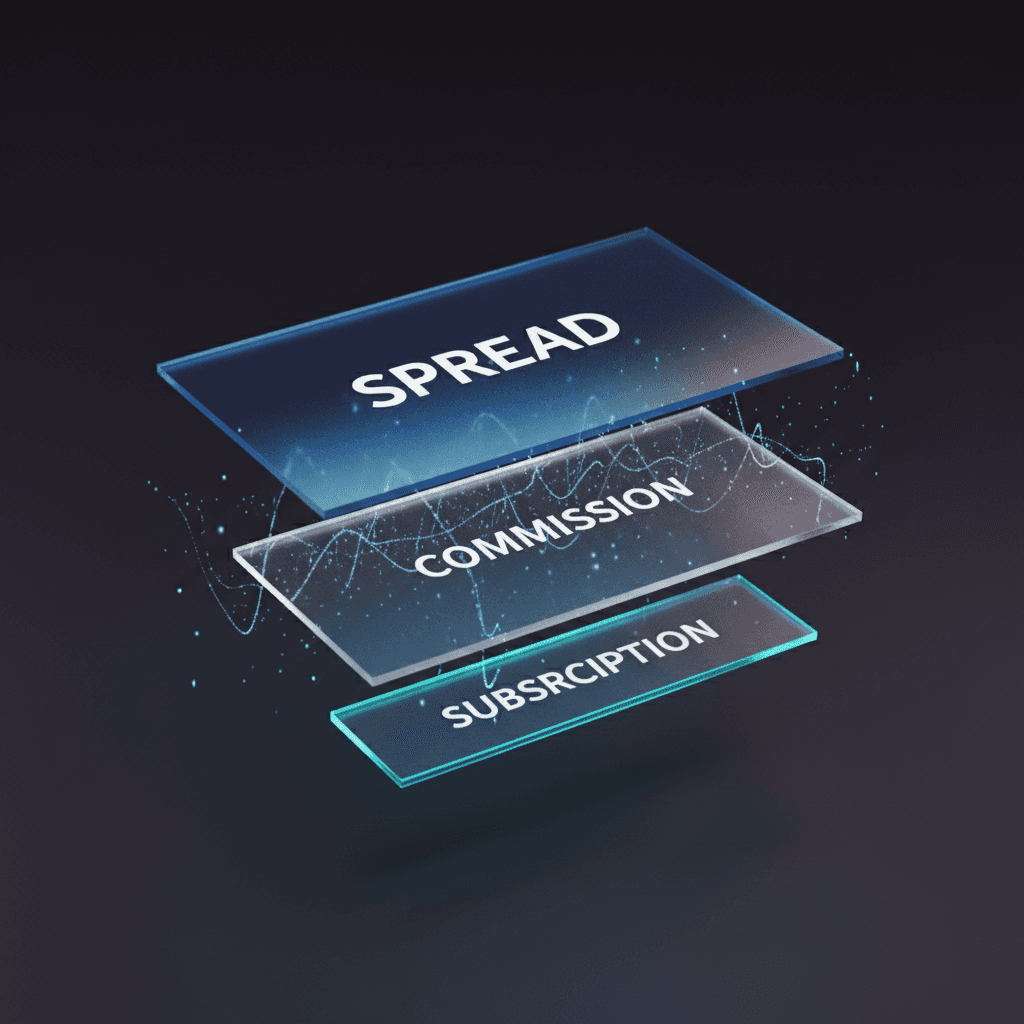

Each layer—spread, commission, and subscription—adds to your true trading costs.

Breaking Down Spread & Commission: Where Profits Start Slipping

Spread: The difference between the bid and ask price. Every trade opens slightly in the negative because of the spread 🧮.

Commission: The broker/platform fee per trade or per lot, which is charged in addition to or instead of the spread.

Let's see their combined impact with a quick example:

Trade Size (lots) | Spread (pips) | Commission | Total Cost |

|---|---|---|---|

0.10 | 1.2 | $0.70 | $1.90 |

1.00 | 1.0 | $7.00 | $10.00 |

Spread usually applies per side — calculate for both open and close!

Commission may be fixed or percentage-based.

For scalpers or high-frequency traders, these costs add up fiercely.

Calculation is a balancing act between all fee categories.

Subscription Fees: The Price of Accessing Premium Tools

Automated trading and copy trading platforms like Copygram usually require a recurring subscription fee. Whether monthly or annual, it’s a fixed cost regardless of your trading frequency.

Subscription fees cover:

Advanced trade replication technology

Continuous system updates and support

Strategy marketplace access

Security and compliance infrastructure

Remember:

Even if your trading is on pause, the subscription meter is running!

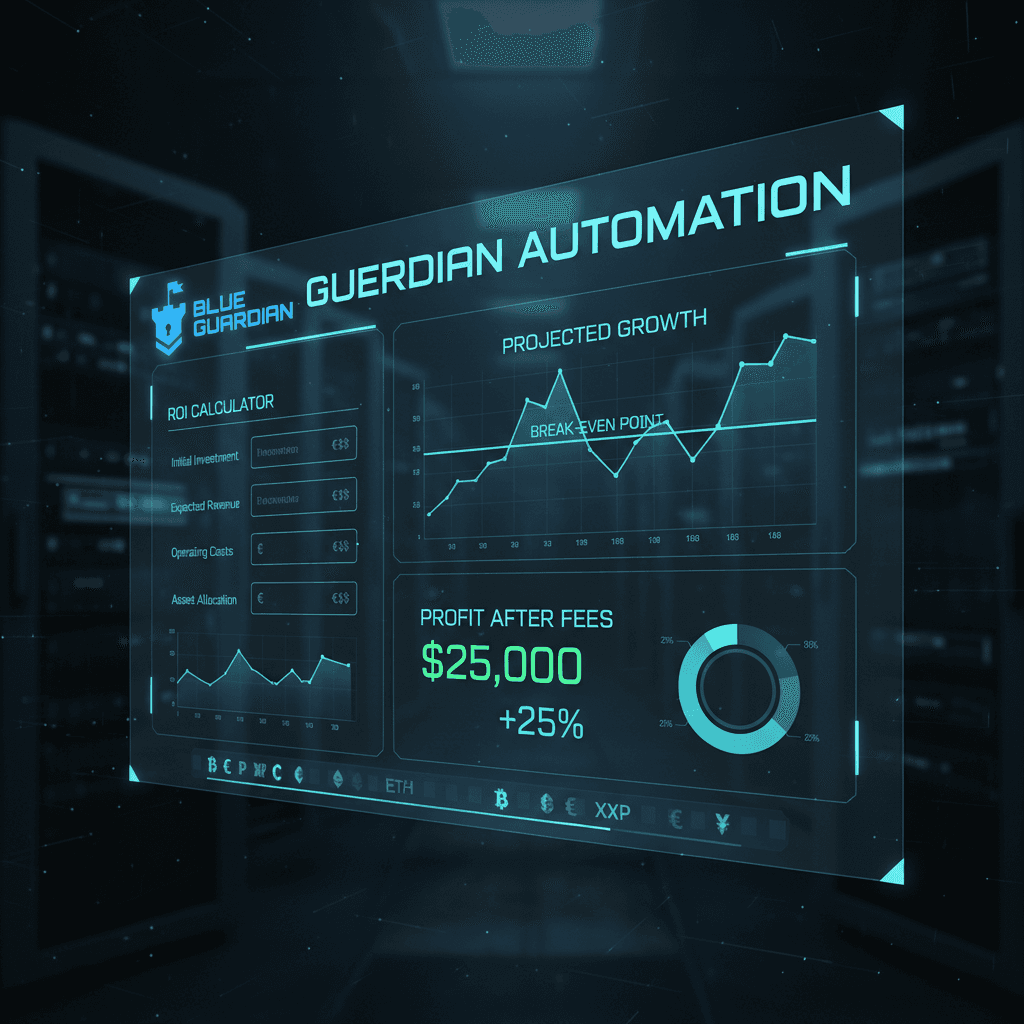

Dynamic digital dashboard making sense of total costs and break-even ROI.

How to Calculate Your Break-Even Point 📝

Here’s a step-by-step system to find how much profit your strategy must generate to cover ALL costs.

Let’s say:

Copygram Subscription: $50/month

Broker Spread: 1.2 pips/trade

Commission: $7/lot round-turn

Monthly Trades: 40 (0.1 lot each trade)

Step-by-Step Calculation:

Calculate Total Trading Fees (spread+commission):

(Commission per trade) x Number of trades + (Spread cost per trade) x Number of tradesAdd Monthly Subscription Cost.

Total Monthly Costs = Trading Fees + Subscription.

Break-Even (%) = (Total Monthly Costs / Account Size) x 100

Example calculation:

Commission: $7 x 4 lots traded monthly = $28

Spread (approx.): $1.20 x 40 = $48

Total Trading Fees: $76

Total Costs (add subscription): $76 + $50 = $126/month

If you have a $2,000 account:Break-Even % = ($126/$2,000) x 100 = 6.3% monthly

💡 Key Takeaway

Your strategy needs to make at least 6.3% ROI monthly just to break even. Every extra cost means your needed return goes higher. Calculators like this can help you model your unique scenario.

Automation in Action: Real-World ROI & Break-Even Case Studies

Curious if copy trading is profitable after all costs? Consider the difference in ROI between two traders:

Trader | Raw Profit | Total Costs | Net ROI |

|---|---|---|---|

A (Low Fees) | $500 | $75 | $425 |

B (Higher Fees) | $500 | $140 | $360 |

Those who monitor all costs consistently outperform. The best copiers choose platforms with transparent fees, flexible subscription plans, and robust analytics to stay agile.

Blueprint for Cost-Efficient Automation: Pro Tips & Next Steps

Track every cost 🕵️♂️: Use spreadsheets or dedicated break-even calculators

Choose platforms like Copygram that offer low, flat fees and granular reporting

Regularly review your trading volume versus subscription level to avoid overpaying

If your ROI is close to break-even, consider scaling or optimizing your strategy before adding capital

Don’t underestimate the impact of small pip increases in spread or tiny additional fees in copy trading

💡 Key Takeaway

Knowing your break-even point is the line between consistent profit and avoidable loss!

Master your cost analysis and you master your trading automation game.

Want real-world analysis? Check out the Trading Ideas Microsoft Msft Weekly Stock Analysis Outlook Week 1 November 2025 for practical breakdowns of strategy, risk and costs in action.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles