Microsoft (MSFT) Weekly Analysis & Trading Outlook – Week 49 December 2025

Ideas

Dec 4, 2025

3 Min Read

Comprehensive weekly analysis of Microsoft (NASDAQ: MSFT) for Week 49, December 2025. Includes technical chart review, latest news, support/resistance, and actionable trading scenarios.

Welcome to our in-depth weekly analysis of Microsoft Corporation (NASDAQ: MSFT) for Week 49, December 2025. This report delivers a comprehensive review of MSFT’s technical setup, fundamental news, and actionable scenarios for traders and investors. Let’s dive into what’s shaping Microsoft’s price action and what to expect in the coming week. 📈

Latest News & Fundamental Drivers 📰

Strong Q1 Earnings: Microsoft beat expectations with EPS of $3.72 (vs. $3.67 est.), revenue up 18% YoY to $77.67B, and net income at $27.7B. However, a $3.1B charge related to OpenAI partially offset results. [Source]

Dividend Increase: Quarterly dividend raised to $0.91/share (9.6% increase), payable December 11, 2025. [Source]

Insider Selling: CEO Satya Nadella and President Bradford L. Smith sold significant shares, signaling possible profit-taking after recent highs. [Source]

Analyst Actions: Mizuho downgraded to "hold"; Goldman Sachs maintains "buy" with $630 target. Consensus is still "Moderate Buy" but with increased caution.

Macro Tailwinds: Fed comments on potential December rate cut have boosted sentiment for growth stocks like MSFT.

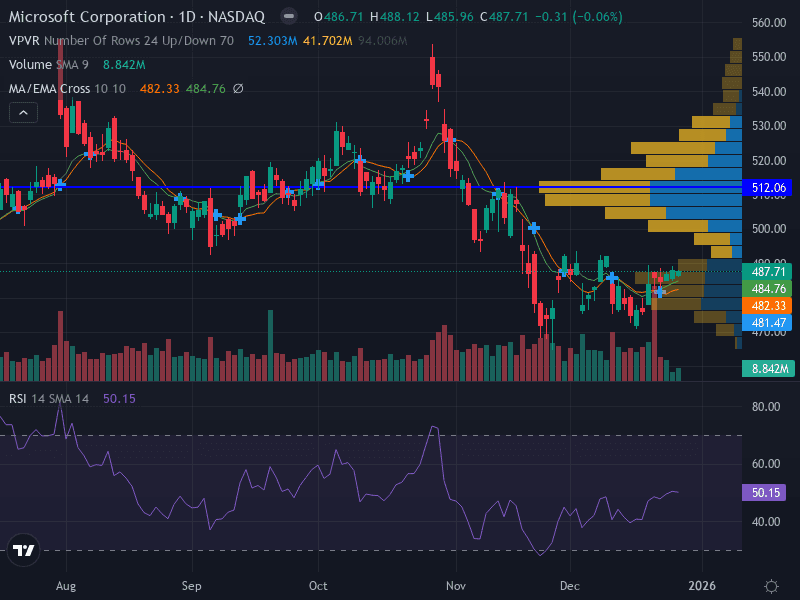

Technical Analysis: Chart Structure & Key Levels 🔍

Note: The chart below is a daily chart for Week 49, December 2025, with volume and MACD overlays. For weekly trend confirmation, align with higher timeframes.

Aspect | Observation |

|---|---|

Trend | Long-term uptrend remains intact, but short-term volatility after earnings. Price rebounded from a 6% dip post-earnings. |

Support Levels | $465 (recent low), $450 (major support), $430 (weekly base) |

Resistance Levels | $495 (recent high), $504 (all-time high zone), $520 (psychological) |

Volume | Spike in volume during the sell-off post-earnings, followed by stabilization as buyers stepped in. |

MACD | MACD line remains above zero but shows a bearish crossover, signaling caution for aggressive longs. |

Pattern | Potential bullish flag forming after sharp earnings dip and rebound. Watch for breakout or breakdown. |

Technical Summary

MSFT is consolidating after a sharp earnings-driven pullback, with buyers defending the $465-$470 zone.

MACD momentum is waning, but not yet decisively bearish. Volume suggests institutional interest on dips.

Price action is coiling between $465 support and $495 resistance. Breakout or breakdown likely to set the tone for December.

Fundamental & News Impact 💡

AI & Cloud Growth: Azure’s 37% projected growth and heavy AI investment continue to underpin MSFT’s long-term bullish thesis.

Dividend Growth: The 9.6% dividend increase signals confidence in cash flow and shareholder returns.

Insider Selling: Recent executive sales may raise short-term caution, but are not unusual after strong rallies.

Macro Factors: Potential Fed rate cuts are a tailwind for large-cap tech, supporting higher valuations.

Actionable Scenarios for Week 49 (December 1–7, 2025) 🎯

Scenario | Key Levels | Potential Action |

|---|---|---|

Bullish 🐂 | Break above $495, target $504–$520 | Momentum traders can look for a breakout entry above $495 with stops below $485. Watch for confirmation with volume and MACD turn. |

Bearish 🐻 | Break below $465, target $450–$430 | If price loses $465, short-term traders may target $450, with stops above $475. MACD confirmation and volume spike would strengthen this scenario. |

Neutral/Range 🤝 | $465–$495 | Expect choppy action within this band. Range traders can fade extremes, buying near $465 and selling near $495, with tight stops. |

Risk Management & Position Sizing 🛡️

Given recent volatility, consider reducing position size or using options to manage risk.

ATR (Average True Range) for the week is elevated; use wider stops to avoid whipsaw.

Align trades with higher timeframe trends for best probability setups.

Summary Table: Key Drivers & Levels

Driver | Impact |

|---|---|

Q1 Earnings Beat | Positive, but offset by OpenAI charge |

Dividend Hike | Positive for long-term holders |

Insider Selling | Short-term caution |

Fed Rate Cut Hopes | Positive for tech stocks |

MACD Bearish Crossover | Short-term caution for aggressive longs |

Conclusion & Outlook for Week 49

Microsoft (MSFT) enters December 2025 with a robust fundamental backdrop, but faces short-term technical uncertainty after a post-earnings pullback. The $465–$495 range is critical: a breakout could reignite bullish momentum, while a breakdown may invite further profit-taking. Traders should watch volume and MACD signals closely, manage risk, and align trades with the prevailing trend. Long-term investors can view dips as potential accumulation opportunities, given Microsoft’s strong cash flow, dividend growth, and AI/cloud leadership.

This analysis is for informational purposes only and does not constitute investment advice. Please consult your financial advisor before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles