Microsoft (MSFT) Weekly Analysis & Outlook – Week 50, December 2025

Ideas

Dec 9, 2025

3 Min Read

In-depth weekly analysis of Microsoft (NASDAQ: MSFT) for Week 50, December 2025: chart, technical/fundamental review, news impact, and actionable trading scenarios.

Welcome to the comprehensive weekly analysis for Microsoft (NASDAQ: MSFT) for Week 50, December 2025. This report covers the latest technical chart insights, fundamental news, and actionable trading scenarios to help you navigate the week ahead. 📊💡

Summary of Latest News & Catalysts (Past 7 Days)

AI Sales Target Revision: Microsoft’s stock dropped over 2% after the company revised its AI sales growth targets, citing sales staff missing goals for the fiscal year ending June. This raised concerns about the pace of real-world AI adoption despite heavy investments. [Economic Times]

Strong Q1 2025 Earnings: Fiscal Q1 2025 results highlighted robust AI product momentum, especially in Commercial Copilot and M365 suites. Microsoft Teams usage remains at all-time highs, and the company expects improved AI supply in H2 FY25. [Microsoft Investor]

Cloud & AI Leadership: The 2025 annual report showed a 23% YoY increase in server/cloud revenue (Azure up 34%), with Copilot AI users exceeding 100 million monthly. Analysts project strong EPS growth and maintain a "Strong Buy" consensus. [Annual Report]

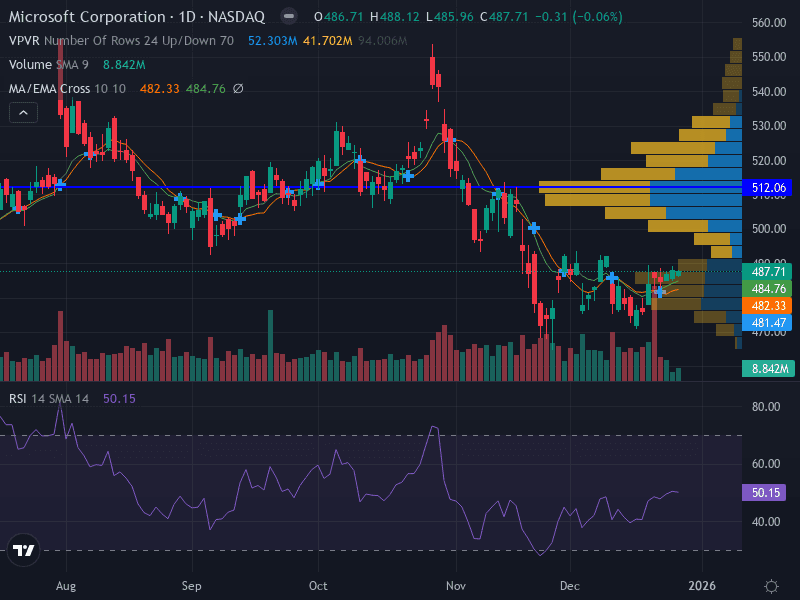

Technical Analysis

Aspect | Details |

|---|---|

Trend | Sideways (neutral) – Price oscillating around 9 & 21 EMA, no clear direction |

Support Levels | 481.91 (major), 463.00 (minor) |

Resistance Levels | 512.06 (major), 487.76 (minor) |

Momentum | RSI 42.08 (mildly bearish, not oversold); MACD neutral, suggesting range-bound market |

Volume | Decreased during recent sideways movement |

Pattern | Developing sideways range between 463.00 and 512.06 |

Chart Insights 📈

MSFT is in a consolidation phase, trading between key support at 481.91 and resistance at 512.06.

MACD and RSI both indicate a lack of strong momentum, reinforcing the neutral bias.

Volume has tapered off, often a precursor to a breakout or breakdown from the current range.

Fundamental & News Impact

AI Growth: Despite the short-term setback in AI sales targets, Microsoft’s long-term AI and cloud trajectory remains robust, with Azure and Copilot AI driving significant revenue and user growth.

Analyst Sentiment: Wall Street maintains a "Strong Buy" consensus, with average price targets suggesting ~29% upside over the next year.

Strategic Partnerships: New deals (e.g., Nuvei, Lumen) and product launches continue to reinforce Microsoft’s leadership in cloud and AI.

Risks: Near-term volatility may persist as the market digests the implications of revised AI sales targets and ongoing macroeconomic uncertainties.

Actionable Scenarios for Week 50 (December 8–14, 2025)

Scenario | Trigger/Signal | Entry/Exit Levels | Risk Management |

|---|---|---|---|

Bullish 🟢 | Break above minor resistance (487.76) | Buy on breakout above 487.76 | Risk 0.5–1% of capital; use ATR for stop distance |

Bearish 🔴 | Break below major support (481.91) | Sell on breakdown below 481.91 | Risk 0.5–1% of capital; adjust stops if volatility increases |

Neutral/Range 🟠 | Price remains between 481.91 and 487.76 | Consider short-term range trades | Keep tight stops; monitor for breakout/breakdown |

Trade Ideas

Aggressive: Buy on breakout above 487.76, stop at 481.00, target 512.00.

Conservative: Wait for a pullback to 481.91, buy between 481.91–484.95, stop at 478.00, target 487.76.

Invalidation: Weekly close below 463.00 would indicate a shift to a bearish scenario.

Risk Management & Timeframe Alignment

Risk 0.5–1% of capital per trade.

Use ATR (Average True Range) for dynamic stop placement.

Daily chart confirms sideways action; intraday bias depends on consolidation break.

Conclusion

Microsoft (MSFT) enters Week 50 of 2025 in a consolidation phase, with technicals and fundamentals suggesting a neutral-to-bullish bias if resistance is broken. Near-term volatility is possible as the market digests AI sales revisions, but long-term prospects remain strong given Microsoft’s cloud and AI leadership. Traders should watch for a breakout from the current range and manage risk carefully.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Please conduct your own research or consult a professional before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles