Meta Platforms (META) Weekly Analysis & Outlook – Week 1, December 2025 (Week 1)

Ideas

Jan 3, 2026

3 Min Read

In-depth weekly analysis of Meta Platforms (NASDAQ:META) for Week 1, December 2025: chart review, support/resistance, technical and fundamental outlook, actionable trading scenarios, and risk management insights.

Meta Platforms (NASDAQ:META) – Weekly Analysis & Outlook for Week 1, December 2025 (Week 1)

Welcome to our comprehensive weekly analysis of Meta Platforms (META) for the first week of December 2025. This blog post provides a technical and fundamental review, actionable scenarios, and risk management insights to help traders and investors navigate the current market environment. 📊

📰 Latest News & Market Context

No major news or earnings releases for META in the past 7 days. The most recent significant events include Q4 2024 results published in January 2025 and a quarterly cash dividend announcement on December 3, 2025. [Press Release]

Q4 2025 guidance: Revenue expected at $56-59B, with analyst consensus EPS for Q4 2025 rising to $8.29. [Nasdaq Earnings]

Next earnings date: Unconfirmed, expected January 28, 2026. [Wall Street Horizon]

📈 Technical Analysis

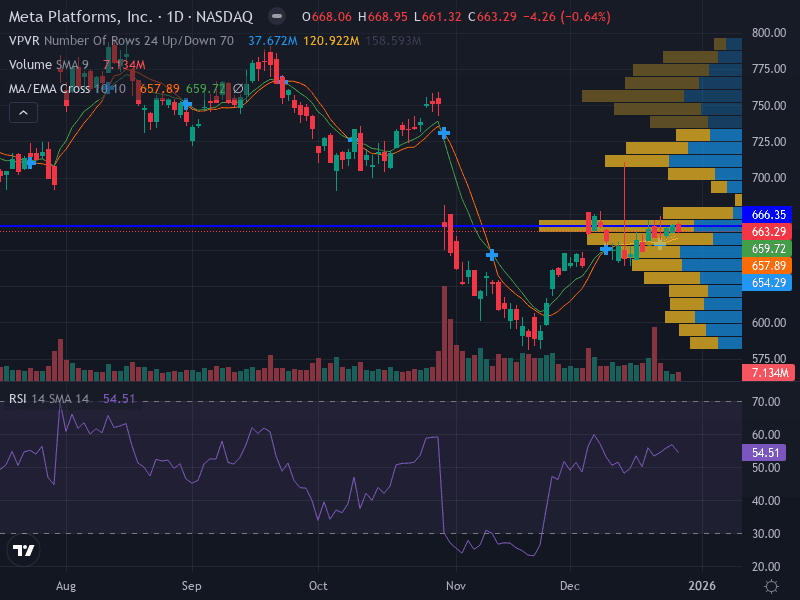

Aspect | Details |

|---|---|

Trend | Sideways/Neutral; price consolidating around 20-day and 50-day EMAs |

Support Levels | Major: 657.89 |

Resistance Levels | Major: 666.35 |

Chart Pattern | Horizontal consolidation range |

Momentum | RSI 54.51 (neutral) |

MACD | Not provided, but overall momentum is neutral |

Volume | Moderate, indicating neither strong accumulation nor distribution |

🔎 Interpretation

Price Action: META is consolidating in a horizontal range, with no clear breakout direction. The price is fluctuating around key moving averages, suggesting indecision.

Support/Resistance: The 657.89 level is a significant support, while 666.35 is a notable resistance. Watch for price action near these levels for potential breakouts or breakdowns.

Momentum & Volume: RSI at 54.51 confirms the neutral stance; moderate volume supports the idea of ongoing consolidation rather than a strong trend.

💡 Fundamental & News Impact

Steady Fundamentals: Despite the lack of fresh news, Meta remains fundamentally strong, with robust revenue guidance and rising analyst EPS estimates for Q4 2025.

Dividend Announcement: The recent quarterly dividend signals confidence in cash flow and shareholder returns.

Macro Environment: No major macro or regulatory catalysts reported this week, keeping the focus on technical levels and upcoming earnings.

🚦 Possible Scenarios for the Upcoming Week

Scenario | Trigger | Key Levels | Actionable Idea |

|---|---|---|---|

Bullish 🟢 | Break and close above 666.35 | Entry: 668.00 | Consider long positions on breakout, with tight risk management |

Bearish 🔴 | Break and close below 654.29 | Entry: 653.00 | Consider short positions if support fails, with stop above 658.00 |

Neutral/Range 🟡 | Price remains between 654.29 and 666.35 | Range: 654.29–666.35 | Range trading strategies (buy near support, sell near resistance) |

📋 Trade Management & Risk

Risk 1% of capital per trade.

Use ATR-based stop losses for dynamic position sizing.

Monitor for increased volatility around breakout attempts.

📅 Weekly Outlook Summary

Meta Platforms (META) enters Week 1 of December 2025 in a consolidation phase, with price action centered around key moving averages and well-defined support/resistance levels. With no major news or earnings in the past week, technicals are likely to drive short-term moves. Traders should watch for a breakout above 666.35 for bullish momentum or a breakdown below 654.29 for bearish scenarios. Until then, range-bound strategies may be most effective.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Please conduct your own research or consult a financial advisor before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles