JPMorgan Chase (JPM) Weekly Analysis & Outlook – Week 52, December 2025

Ideas

Dec 22, 2025

3 Min Read

In-depth weekly analysis of JPMorgan Chase (JPM) for Week 52, December 2025: chart, technical levels, news, and actionable trading scenarios. Stay informed for the week ahead.

Welcome to our comprehensive weekly analysis of JPMorgan Chase & Co. (NYSE: JPM) for Week 52, December 2025. As the year draws to a close and markets anticipate the upcoming Q4 and full-year earnings release, we break down the technical, fundamental, and news-driven context for JPM, providing actionable insights for traders and investors. 📈

Latest News & Market Context (Past 7 Days)

Q4 & Full-Year 2025 Earnings Scheduled: JPMorgan Chase will release its Q4 and full-year 2025 results on January 13, 2026, with a conference call at 8:30 a.m. ET. [JPMorgan IR]

Market Anticipation: Recent headlines and investor commentary focus on expectations for JPM’s earnings, with attention on global economic shifts and the bank’s $4.6 trillion in assets. [YouTube Analysis]

Third-Quarter Recap: The latest available financials (Q3 2025) show robust equity and asset positions, setting a backdrop of stability ahead of earnings. [JPMorgan Quarterly Earnings]

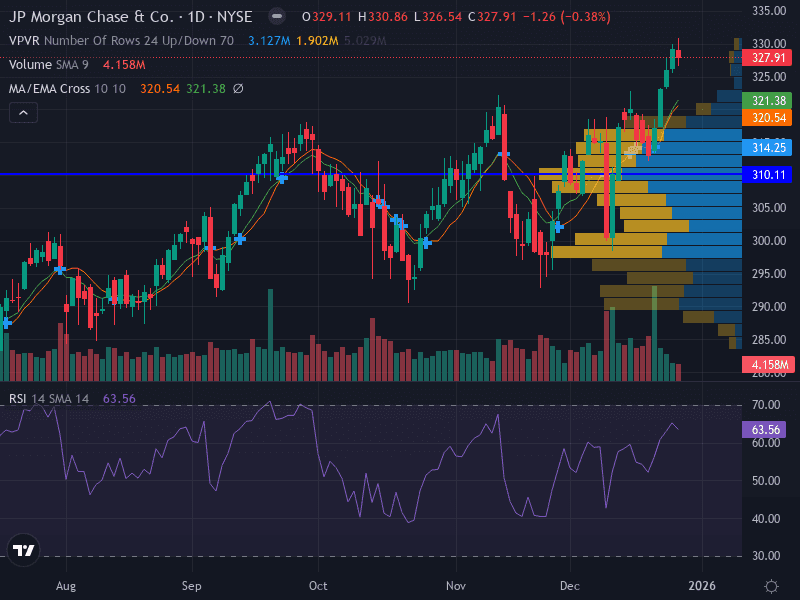

Technical Analysis

Aspect | Details |

|---|---|

Trend | Uptrend – price above 10- and 20-day moving averages, higher highs and higher lows |

Support Levels | 314.25 (major), 310.42 (minor) |

Resistance Levels | 317.21 (major), 320.00 (minor) |

Pattern | Bullish consolidation, recent break above consolidation |

Momentum | RSI 56.02 (positive, room to grow) |

Volume | Consistent, slightly increasing on upward moves |

MACD: While the MACD is not explicitly visible, the price action and trend context suggest continued bullish momentum.

Volume: The uptick in volume on upward moves supports the bullish case, indicating institutional participation.

Chart Structure & Price Action

The chart for JPM this week shows a bullish consolidation phase with a recent breakout above resistance. The price is holding above key moving averages, and the formation of higher lows indicates underlying strength. The RSI at 56.02 is healthy, suggesting there is still room for further upside before entering overbought territory. 🔍

Fundamental & News Impact

Earnings Anticipation: With Q4 and full-year 2025 results due in early January, the market is likely to remain in a holding pattern, with potential for increased volatility as the date approaches.

Macro Environment: JPM’s scale ($4.6 trillion in assets) positions it as a bellwether for the financial sector. Investors are watching for commentary on loan growth, credit quality, and global economic headwinds.

Analyst Sentiment: No major analyst rating changes or previews were reported in the past week, but the consensus remains focused on JPM’s ability to navigate macroeconomic uncertainty.

Actionable Scenarios for the Upcoming Week

Scenario | Key Levels | Strategy | Probability |

|---|---|---|---|

Bullish | Above 317.21 (major resistance), target 320.00 | Buy on breakout above 317.21 or on pullback to 314.00–315.00; SL 310.50 | Moderate-High |

Bearish | Below 310.42 (minor support) | Sell/short if price closes below 310.42; SL 314.25 | Low-Moderate |

Neutral | Between 314.25 and 317.21 | Wait for breakout or breakdown; avoid new positions | Moderate |

Aggressive Bullish Entry: Buy at 315.00 (continuation), stop-loss 310.50, target 320.00.

Conservative Bullish Entry: Wait for a pullback to 314.00, buy 314.00–315.00, stop-loss 308.50, target 317.21.

Bearish Scenario: If the weekly close is below 310.42, bias shifts to neutral/bearish, with potential for a deeper pullback.

Risk Management

Risk no more than 1% of capital per trade.

Consider ATR-based stops for tighter risk control.

Align entries with intraday confirmation for best risk/reward.

Summary Table: Key Takeaways

Factor | Current Status |

|---|---|

Trend | Uptrend |

Support | 314.25 (major), 310.42 (minor) |

Resistance | 317.21 (major), 320.00 (minor) |

Momentum | Positive (RSI 56.02) |

Upcoming Catalyst | Q4 & Full-Year 2025 Earnings (Jan 13, 2026) |

Conclusion & Outlook

JPMorgan Chase enters the final week of December 2025 in a position of technical strength, with bullish momentum and a supportive macro backdrop. The upcoming earnings release is likely to be the next major catalyst. Traders should watch for a breakout above 317.21 for further upside, while a close below 310.42 would warrant caution. Maintain disciplined risk management, and stay alert for news flow as earnings approach. 🛡️

This analysis is for informational purposes only and does not constitute investment advice. Trading involves risk; please do your own research.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles