Ethereum (ETH/USD) Weekly Analysis & Outlook – Week 52, December 2025

Ideas

Dec 22, 2025

3 Min Read

In-depth Ethereum (ETH/USD) analysis for Week 52, December 2025: price chart, technical levels, news impact, and actionable trading scenarios. Discover support/resistance, MACD, volume, and key catalysts for ETH/USD.

Ethereum (ETH/USD) Weekly Analysis & Outlook – Week 52, December 2025

Welcome to this week’s comprehensive analysis of Ethereum (ETH/USD) for Week 52, December 2025. In this post, we’ll break down the latest price action, technical patterns, news catalysts, and actionable scenarios for traders and investors. Let’s dive in! 🚀

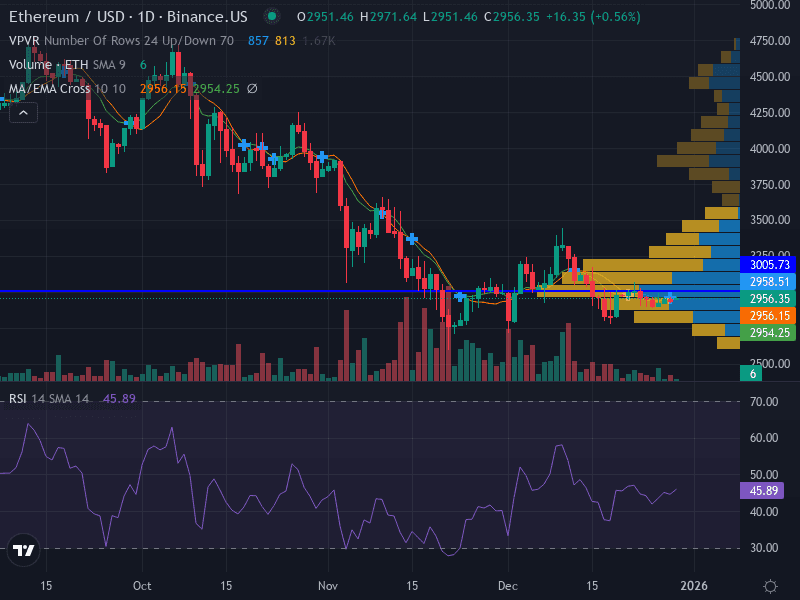

📈 Price Chart Overview

Trend: Bearish – ETH is trading below key moving averages, with a declining trend line from October.

Momentum: RSI near 48.4 (neutral-bearish), reflecting weak momentum and indecision.

MACD: Bearish crossover persists, with no clear sign of reversal.

Volume: Decreasing on rallies, suggesting weak buying interest.

Pattern: Descending channel, with lower highs and lower lows.

📰 Latest News & Catalysts (Past 7 Days)

Bearish short-term trend: ETH trades below $3,000, with sellers in control and market sentiment in “Extreme Fear” (Fear & Greed Index at 20).

[forex24.pro]Bulls defend $3,000: Inverse head-and-shoulders pattern tests market conviction, but upside is capped unless $3,025 is reclaimed.

[Brave New Coin]Upcoming technical upgrade: Ethereum’s gas limit is set to increase from 60M to 80M units after the January 7 hard fork, potentially impacting transaction throughput and fees.

[Brave New Coin]

🔎 Technical Analysis

Key Level | Support | Resistance |

|---|---|---|

Immediate | $2,976.44 (major), $2,981.97 (minor) | $3,029.03 (minor), $3,053.12 (major) |

Weekly | $2,405 – $2,500 | $3,500 – $4,045 |

2025 Pivots | $2,500 | $4,000 – $10,000 |

Support: $2,976.44 (major), $2,981.97 (minor). A break below $2,976 could open the way to $2,900 and $2,500.

Resistance: $3,029.03 (minor), $3,053.12 (major). Bulls need a close above $3,053 to shift momentum.

Pattern: Descending channel. Lower highs and lower lows signal continuation of the downtrend.

MACD: Bearish crossover persists, with histogram below zero. No bullish divergence detected.

Volume: Declining on rallies, indicating weak conviction among buyers. Watch for a volume spike to signal a potential reversal.

RSI: 48.4 – Neutral to bearish. Not oversold, so further downside is possible before a technical bounce.

📊 Fundamental & News Impact

Macro sentiment: Extreme fear dominates the crypto market, with ETH closely tracking Bitcoin’s consolidation.

Technical upgrade: The upcoming gas limit increase (January 7) could improve network throughput, but its short-term price impact is uncertain.

ETF & DeFi tailwinds: Institutional interest and DeFi growth remain long-term bullish factors, but have yet to offset near-term selling pressure.

No major regulatory news: The past week was quiet on the regulatory front for Ethereum.

🧭 Actionable Scenarios for the Week

Scenario | Trigger/Signal | Potential Move | Risk Management |

|---|---|---|---|

Bullish 🟢 | Close above $3,053.12 (major resistance) | Upside toward $3,110, then $3,500 | Use stop-loss below $3,000; risk 0.5–1% capital |

Bearish 🔴 | Break below $2,976.44 (major support) | Downside to $2,900, then $2,500 | Use stop-loss above $3,030; risk 0.5–1% capital |

Neutral/Range 🟡 | Consolidation between $2,976 and $3,053 | Range trading ($2,976–$3,053); fade extremes | Smaller position sizes, quick profit-taking |

Aggressive trade idea: Sell near $3,029 (test of resistance), stop-loss at $3,055, target $2,975.

Conservative trade idea: Wait for a break below $2,976, sell at $2,975, stop-loss at $3,000, target $2,900.

Invalidation: Weekly close above $3,053.12 would shift bias to neutral/bullish.

📅 Weekly Outlook Summary

ETH/USD remains in a short-term downtrend, with risk skewed to the downside unless $3,053 is reclaimed.

Watch for a decisive move outside the $2,976–$3,053 range for directional clarity.

Upcoming network upgrade (January 7) could be a catalyst, but technicals dominate for now.

Risk management is crucial: limit exposure and use stops, as volatility may increase.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Please conduct your own research and consult a financial advisor before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles