Ethereum (ETH/USD) Weekly Analysis & Outlook – Week 51 December 2025

Ideas

Dec 22, 2025

3 Min Read

In-depth weekly analysis of Ethereum (ETH/USD) for December 15-21, 2025: price chart, technical and fundamental insights, key support/resistance, and actionable scenarios for traders. Neutral trend with range-bound structure and upcoming catalysts.

Ethereum (ETH/USD) Weekly Analysis & Outlook 📈

For the week of December 15–21, 2025 (Week 51)

Summary & Context

Ethereum (ETH/USD) enters Week 51 of 2025 in a neutral, range-bound phase, trading between $3,070 and $3,155. The price action is characterized by sideways movement, with conflicting signals from technical indicators and a lack of strong conviction from market participants. This week’s outlook is shaped by recent macroeconomic events, subdued trading volumes, and a cautious sentiment across the crypto market.

Latest News & Short-Term Catalysts 📰

Price Recovery Amid Volatility: ETH rebounded from weekend lows around $2,800–$2,941 to trade near $3,100–$3,124 after a sharp market-wide drop and subsequent stabilization. [U.Today]

Market Sentiment & Technicals: Despite a 2.3% gain on December 8, technicals show low volume and consolidation in the $3,050–$3,150 range. The Fear & Greed Index hit 21 (Extreme Fear), suggesting caution among traders. [Crypto.News]

Macro Events: The U.S. Federal Reserve’s decision on December 11 led to de-risking, but easing ETF selling and lower CME futures could support a rebound. Analysts view the recent correction as a healthy positioning reset. [MEXC]

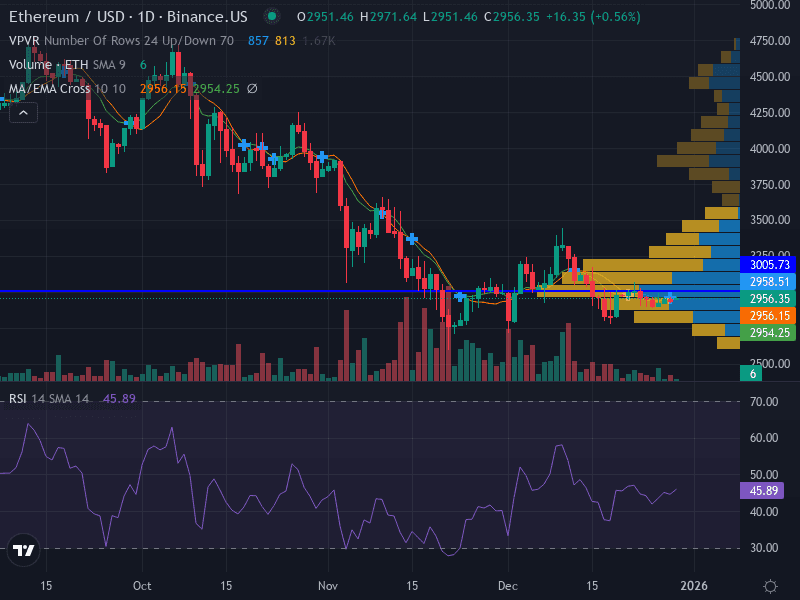

Technical Analysis 📊

Indicator | Current Value | Interpretation |

|---|---|---|

Support | $3,070 (major), $3,040 (minor) | Key levels for potential bounce; watch for breakdown risk below $3,040 |

Resistance | $3,155 (major), $3,145 (minor) | Breakout above $3,155 could trigger bullish momentum |

Trend | Sideways | Price between 20- and 50-day SMAs; no clear direction |

RSI | 47 | Neutral; neither overbought nor oversold |

MACD | Flat/Neutral | Confirms lack of strong momentum |

Volume | Decreasing | Suggests low conviction and possible range continuation |

Chart Structure & Patterns

Pattern: Range-bound; no clear breakout or breakdown.

Volume: Decreasing, indicating traders are waiting for a catalyst.

MACD: Neutral, supporting the sideways bias.

Fundamental & News Impact 💡

There have been no major protocol upgrades or Ethereum Foundation announcements this week. The focus remains on price recovery and macroeconomic influences. The U.S. Federal Reserve’s recent policy meeting contributed to short-term volatility, but the broader crypto market’s stabilization, easing ETF outflows, and institutional interest provide a cautiously optimistic backdrop. Prediction markets and analyst forecasts suggest a potential for recovery if key resistance levels are breached, but sentiment remains fragile.

Scenario Analysis & Outlook for the Upcoming Week 🔮

Scenario | Trigger | Actionable Levels | Probability |

|---|---|---|---|

Bullish 🐂 | Break above $3,155 with volume | Entry: $3,160–$3,170 | Moderate (30–40%) |

Bearish 🐻 | Close below $3,040 | Entry: $3,030–$3,020 | Low to Moderate (20–30%) |

Neutral/Range 🤝 | Price remains between $3,070–$3,155 | Range trade: Buy near $3,070, Sell near $3,155 | High (40–50%) |

Trade Ideas & Risk Management

Aggressive: Buy on breakout above $3,155, stop-loss at $3,100, target $3,250.

Conservative: Wait for a pullback to $3,070, buy $3,070–$3,080, stop-loss $3,050, target $3,155.

Invalidation: Close below $3,040 shifts bias to bearish, targeting lower supports.

Risk: Limit risk to 1% of capital per trade; use ATR(14) for dynamic stops.

Weekly Price Projection Table

Date | Projected Change | High Target |

|---|---|---|

Dec 15 | -0.43% | - |

Dec 16 | +0.67% | - |

Dec 17 | +2.78% | - |

Dec 18 | +6.91% | $3,392 |

Dec 19 | +9.65% | - |

Conclusion

Ethereum enters this week with a neutral, range-bound outlook. The absence of strong momentum, declining volume, and mixed sentiment suggest traders should focus on key support and resistance levels for actionable entries. Macro factors and market-wide sentiment will likely dictate direction. Stay nimble and manage risk carefully as the market awaits a decisive move.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Please conduct your own research and consult a professional before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles