Ethereum (ETHUSD) Weekly Analysis & Outlook – Week 45, November 2025

Ideas

Nov 3, 2025

3 Min Read

In-depth weekly analysis of Ethereum (ETHUSD) for Week 45, November 2025: chart review, latest news, technical and fundamental insights, and actionable trading scenarios.

Welcome to the comprehensive weekly analysis for Ethereum (ETHUSD) covering Week 45, November 2025. This post provides a detailed review of the latest price action, technical structure, fundamental news, and actionable scenarios for traders and investors. (Today’s date: November 3, 2025 – Week 45)

📊 Ethereum (ETHUSD) Price Chart Overview

The chart for ETHUSD this week reveals a bearish bias as the price remains below both the 10-day and 50-day exponential moving averages (EMAs), forming a descending pattern. The MACD indicator confirms negative momentum, while volume analysis shows declining interest on rallies, supporting the downtrend thesis.

Support Levels: $3,853.62 (major), $3,750.00 (minor)

Resistance Levels: $3,941.61 (major), $4,099.03 (minor)

Pattern: Potential descending triangle with lower highs and stable lows

Momentum: RSI at 43.48 (bearish)

Volume: Decreasing on rallies

📰 Latest News & Short-Term Catalysts

Date | Headline | Summary | Source |

|---|---|---|---|

2025-11-01 | $1B Ethereum Sell-Off Sparks Market Speculation | Ethereum experienced a $1B+ sell-off, increasing volatility and speculation about further downside. ETH is trading below the 50-day EMA, and a break above could shift sentiment. | |

2025-11-02 | Bearish Correction Expected | Analysts predict a bearish correction with ETHUSD possibly testing support near $3,475. If support holds, a rebound is possible; a break below $2,825 would invalidate bullish scenarios. | |

2025-11-03 | November Price Predictions | Experts forecast ETHUSD to stay above $3,866.75 in November, with a possible peak at $4,664.15. Average value expected around $4,265.45. |

🔎 Technical Analysis

Trend: Clear downtrend, with ETHUSD below both 10- and 50-day EMAs. The sequence of lower highs and lows, alongside a descending triangle, signals persistent bearish pressure.

Support/Resistance: Key support at $3,853.62 (major) and $3,750.00 (minor). Resistance is at $3,941.61 (major) and $4,099.03 (minor). A break below support could accelerate selling, while a move above resistance may trigger short covering.

MACD: The MACD remains in negative territory, confirming bearish momentum. No bullish crossover is present this week.

Volume: Volume is decreasing on rallies, suggesting limited buying interest and reinforcing the downtrend.

RSI: At 43.48, the RSI is below the neutral 50 mark, indicating negative momentum but not yet oversold.

Pattern: The descending triangle pattern, with stable lows and lower highs, often precedes a bearish continuation if support breaks.

📈 Fundamental & News Impact Analysis

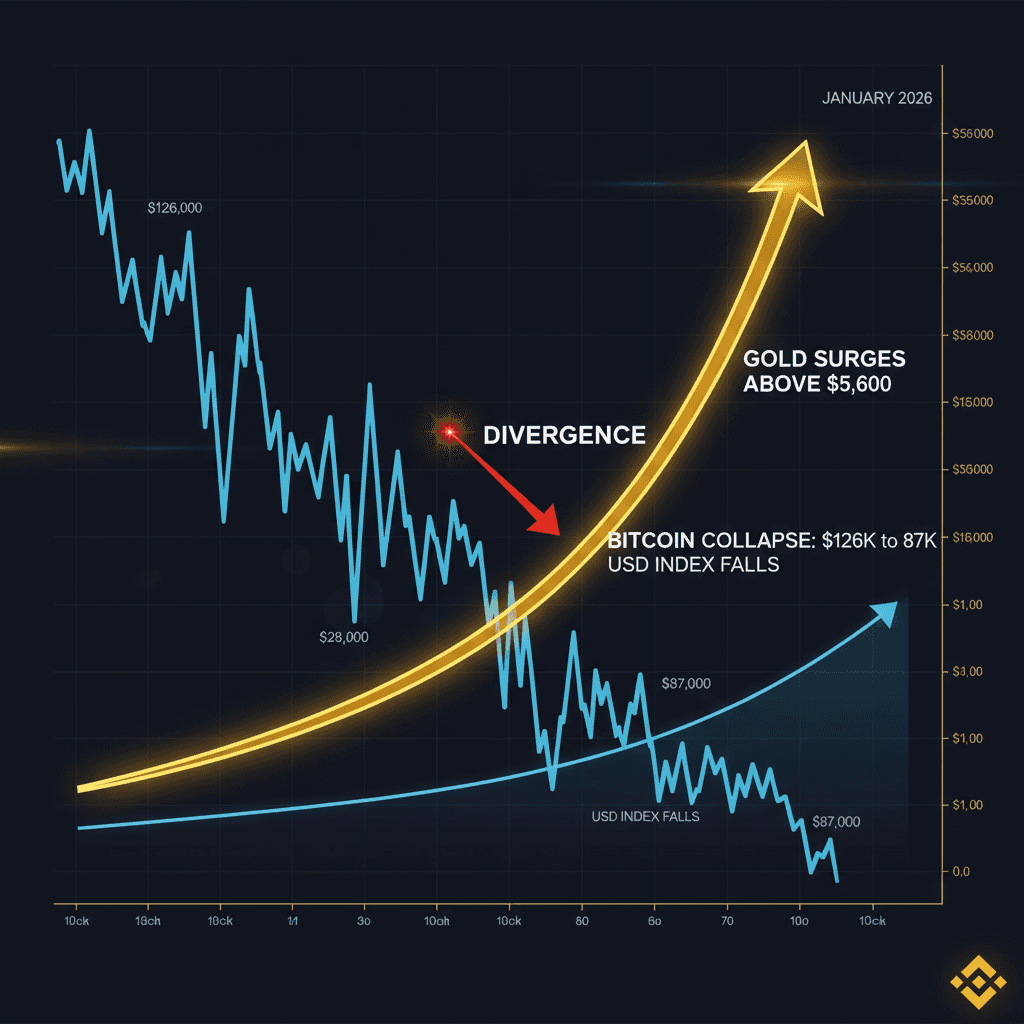

Market Sentiment: The $1B+ sell-off has increased short-term bearish sentiment, with traders watching for further downside or a technical rebound.

Macro & Regulatory: Ongoing regulatory support and the potential for Ethereum ETFs remain positive catalysts, but have yet to offset the current bearish technicals.

Analyst Forecasts: Most analysts expect ETHUSD to remain above $3,866.75 for November, with a possible peak at $4,664.15 if sentiment improves.

Volatility Drivers: Leveraged liquidations and macroeconomic news (such as US inflation data or crypto regulatory updates) could trigger sharp moves in either direction.

🚦 Actionable Scenarios for the Upcoming Week

Scenario | Trigger/Confirmation | Key Levels | Potential Targets | Risk Management |

|---|---|---|---|---|

Bullish | Break and close above $4,099.03 (minor resistance) | Resistance: $4,099.03, $4,664.15 | $4,265.45 (average), $4,664.15 (peak) | Use tight stops below $3,941.61; risk 1% of capital per trade |

Bearish | Break below $3,853.62 (major support) | Support: $3,853.62, $3,750.00 | $3,750.00 (minor), $3,475.00 (next major) | Stop loss above $3,941.61; risk 1% of capital per trade |

Neutral | Consolidation between $3,853.62 and $3,941.61 | Range: $3,853.62 - $3,941.61 | Range-bound trading; wait for breakout | Reduce position size; avoid overtrading |

Summary Table: ETHUSD Week 45, November 2025

Indicator | Current Reading | Interpretation |

|---|---|---|

Trend | Downtrend | Bearish bias, price below EMAs |

MACD | Negative | Bearish momentum |

RSI | 43.48 | Negative momentum, not oversold |

Support | $3,853.62 / $3,750.00 | Key levels to watch for breakdown |

Resistance | $3,941.61 / $4,099.03 | Key levels for reversal |

Pattern | Descending Triangle | Bearish continuation risk |

Volume | Decreasing on rallies | Weak buying interest |

🔔 Key Takeaways & Trading Tips

ETHUSD is in a bearish technical structure, with lower highs and persistent negative momentum.

Watch for a break below $3,853.62 for further downside, or a close above $4,099.03 for a potential bullish reversal.

Macro news, regulatory updates, and ETF headlines could trigger volatility.

Risk management is crucial: consider risking no more than 1% of capital per trade and using ATR-based stops.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Trading cryptocurrencies involves significant risk.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles