Ethereum (ETHUSD) Weekly Analysis & Outlook – Week 1 December 2025

Ideas

Dec 4, 2025

3 Min Read

In-depth weekly analysis of Ethereum (ETHUSD) for Week 1 December 2025: price chart, technical and fundamental insights, key levels, and actionable scenarios for traders.

Welcome to our comprehensive Ethereum (ETHUSD) analysis for Week 1 of December 2025 (Week 49). In this detailed outlook, we examine the latest price action, technical structure, and fundamental drivers shaping Ethereum’s prospects for the week ahead. Whether you’re a trader or investor, this blog provides actionable insights, scenario planning, and risk management tips to help you navigate the current market landscape. Let’s dive in! 🚀

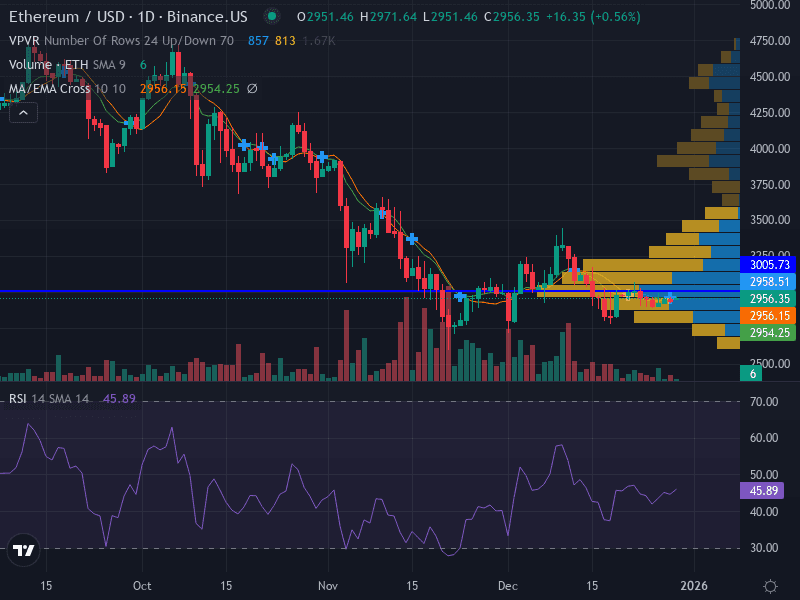

📊 Ethereum (ETHUSD) Price Chart Overview

Trend: Bearish — ETH is trading below both the 10- and 50-week EMAs, confirming ongoing downside pressure.

Pattern: Descending channel, with lower highs and lower lows, reinforcing the bearish structure.

Momentum: RSI at 35.01 (near oversold), suggesting possible exhaustion but no clear reversal yet.

Volume: Increasing on declines, indicating strong selling pressure and conviction among bears.

Key Technical Levels | Price (USD) |

|---|---|

Major Support | 2,856.58 |

Minor Support | 2,750.00 |

Major Resistance | 2,941.87 |

Minor Resistance | 3,040.44 |

📰 Latest News & Short-Term Catalysts

Ethereum stabilizes above $3,000 after November volatility: ETH recovered from a 21% monthly decline, now trading near $3,030 as traders look for a rebound. [Trading News]

Whale accumulation and institutional interest: Over $700 million in long positions defend the $2,960 support, with ETF inflows and whale buying supporting price stabilization. [99Bitcoins]

Fusaka upgrade scheduled for early December: This major network upgrade aims to improve scalability, driving renewed accumulation and optimism among investors. [Forex24]

🔎 Technical Analysis

Support & Resistance: ETH faces major support at $2,856.58 and resistance at $2,941.87. A break below support could open the door to $2,750.00, while a move above resistance may target $3,040.44 and higher.

Pattern Recognition: The descending channel pattern highlights persistent bearish sentiment. Lower highs and lower lows dominate, with sellers in control.

MACD & Volume: MACD remains negative, confirming downside momentum. Volume spikes on declines reinforce the strength of the bearish move.

Momentum: RSI at 35.01 is approaching oversold territory, which could signal exhaustion and a possible short-term bounce if buyers step in.

Indicator | Current Reading | Interpretation |

|---|---|---|

10-week EMA | Below Price | Bearish |

50-week EMA | Above Price | Bearish |

RSI | 35.01 | Near Oversold |

MACD | Negative | Bearish Momentum |

Volume | Rising on Declines | Bearish Conviction |

📈 Fundamental & News Impact

Macro Headwinds: Global risk sentiment remains fragile due to U.S.-China trade tensions and a hawkish Fed, keeping crypto markets in "Extreme Fear" territory.

Institutional Flows: Whale accumulation and ETF inflows are supporting ETH’s stabilization, even as derivatives data points to short-term caution.

Fusaka Upgrade: The upcoming network upgrade is a key bullish catalyst, with potential to improve scalability and attract further institutional interest.

🧭 Scenario Planning: ETHUSD Outlook for Week 1 December 2025

Scenario | Key Levels | Actionable Plan |

|---|---|---|

Bullish 🟢 | Break above $2,941.87; next targets $3,040.44, $3,150.00 | Watch for bullish reversal signals (e.g., MACD crossover, RSI recovery). Consider long entries above $2,950 with stops below $2,850. Target $3,040–$3,150. |

Bearish 🔴 | Break below $2,856.58; next support $2,750.00 | Consider short entries on a confirmed break below $2,856.58. Use stops above $2,940. Target $2,750 or lower if selling accelerates. |

Neutral 🟡 | Range $2,856.58–$2,941.87 | Wait for a clear breakout from the range. Avoid aggressive trades until direction is confirmed. Monitor volume and news flow for clues. |

Risk Management Tips

Risk no more than 1% of capital per trade.

Consider ATR-based stops to account for volatility.

Stay updated on macro news and the Fusaka upgrade schedule.

📅 Weekly Summary & Takeaways

ETHUSD remains in a bearish trend, but oversold momentum and upcoming network upgrades could spark a short-term bounce.

Key levels to watch: $2,856.58 (support) and $2,941.87 (resistance).

Major catalysts: Fusaka upgrade, institutional flows, macroeconomic news.

Traders should stay nimble and manage risk carefully as volatility persists.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Please conduct your own research and consult with a professional before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles