Cardano (ADAUSD) Weekly Analysis & Outlook – Week 1, January 2025

Ideas

Jan 3, 2026

3 Min Read

In-depth technical and fundamental analysis of Cardano (ADAUSD) for the first week of January 2025. Includes price chart, key support/resistance, volume, MACD, news impact, and actionable trading scenarios.

Welcome to the comprehensive weekly analysis for Cardano (ADAUSD) as we enter Week 1 of January 2025! This post delivers a thorough breakdown of ADA’s current technical setup, recent news, and actionable scenarios for traders and investors. Let’s dive in! 🚀

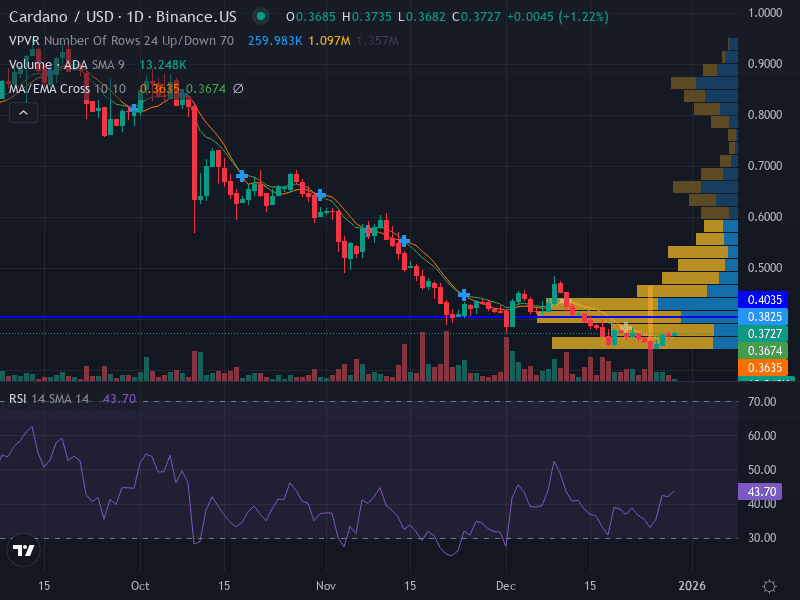

📈 Cardano (ADAUSD) Price Chart Overview

(See full-width chart above for technical details, including volume and MACD)

Trend: Sideways/consolidation; price is hovering around the 9-day EMA.

Momentum: RSI is at 43.7 (neutral), suggesting indecision and a lack of strong directional momentum.

Pattern: Price action is consolidating near recent lows, with a potential double-bottom formation emerging.

Volume: Slight increase on recent upticks, hinting at possible accumulation.

📰 Latest News & Market Context (Past 7 Days)

Date | Headline | Summary | Source |

|---|---|---|---|

2025-12-28 | Cardano (ADA) Price Prediction | Forecasts suggest ADA could target $0.70–$1.00 by year-end, but short-term technicals remain mixed with resistance at $0.36–$0.37. | |

2025-12-28 | Technical Analysis & Local Resistance | Analysts note local resistance at $0.359–$0.36 and emphasize the importance of daily/weekly closes above support for bullish continuation. | |

2025-12-28 | Market Rebound & Sentiment | ADA rebounded ~7% after a three-day decline, but remains near the lower end of its 2025 range. Market sentiment is cautious, awaiting a breakout. |

No major regulatory or company-specific headlines for Cardano in the last week.

Market action is mainly driven by technical setups and broader crypto momentum.

🔍 Technical Analysis

Indicator | Current Reading | Interpretation |

|---|---|---|

Support Levels | $0.3635 (major), $0.3674 (minor) | Key zones to watch for potential bounces; breakdown below $0.3635 could trigger further downside. |

Resistance Levels | $0.3825 (major), $0.4035 (minor) | Upside capped unless price breaks above these levels with volume. |

MACD | Flat/neutral | No strong bullish or bearish momentum; watch for crossovers. |

Volume | Increasing on upticks | Suggests possible accumulation, but confirmation needed. |

Pattern | Double-bottom forming | Potential reversal if neckline breaks; otherwise, risk of further consolidation. |

Key Takeaways:

ADA is consolidating, with neither bulls nor bears in clear control.

Volume upticks may signal accumulation, but confirmation is lacking.

Breakout above $0.3825 or breakdown below $0.3635 will likely set the next directional move.

📊 Fundamental & News Impact

Recent news is dominated by price forecasts and technical commentary, not major project or regulatory updates.

Analyst sentiment is cautiously optimistic for 2025, but short-term technicals suggest a wait-and-see approach.

Broader crypto market momentum, especially Bitcoin’s direction, is likely to influence ADA’s near-term path.

🛠️ Actionable Scenarios for the Upcoming Week

Scenario | Trigger/Signal | Action | Targets & Stops |

|---|---|---|---|

Bullish | Breakout above $0.3825 with strong volume and MACD crossover | Enter long positions | Target: $0.3880–$0.4035 |

Bearish | Daily close below $0.3635, especially with rising sell volume | Enter short positions or reduce exposure | Target: $0.3500–$0.3400 |

Neutral/Range | Price remains between $0.3635–$0.3825, MACD/RSI flat | Wait for clearer signals; consider range trading | Buy near $0.3674, sell near $0.3825 |

Risk Management: Limit risk to 1% of capital per trade. Consider ATR-based stops to adjust for volatility.

📝 Summary & Outlook

Cardano (ADAUSD) enters the first week of January 2025 in a state of consolidation, with technicals and sentiment suggesting a neutral bias. While medium-term forecasts remain optimistic, the immediate outlook depends on whether ADA can break out of its current range. Traders should watch the $0.3635–$0.3825 band closely for actionable signals, with volume and MACD crossovers providing confirmation. As always, maintain disciplined risk management and stay alert to broader crypto market moves.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Please conduct your own research and consult a professional before making investment decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles