Cardano (ADAUSD) Weekly Analysis & Outlook – Week 50, December 2025

Ideas

Dec 9, 2025

3 Min Read

In-depth weekly analysis of Cardano (ADAUSD) for Week 50, December 2025. Includes technical chart review, latest news (Midnight sidechain, treasury funding), support/resistance, and actionable trade scenarios.

Welcome to the comprehensive weekly analysis for Cardano (ADAUSD) covering Week 50, December 2025 (starting December 8, 2025). This report delivers a data-driven review of price action, technicals, and the latest news shaping ADA’s near-term outlook. Whether you’re a trader, investor, or crypto enthusiast, this blog provides actionable insights, scenario planning, and risk management tips for navigating the current market landscape. 🔍📊

Latest News & Catalysts (Dec 1–8, 2025)

Midnight Sidechain Launch (Dec 8): Cardano’s highly anticipated Midnight sidechain launches this week, aiming to boost network utility and liquidity. This event is expected to drive short-term volatility and attract significant trading activity. [Read more]

70 Million ADA Treasury Funding: The Cardano community approved a major treasury withdrawal to fund infrastructure projects, signaling ongoing development and future network enhancements. [Source]

Price Forecasts & Sentiment: Analysts project ADA’s December range between $0.41 and $0.54, with some bullish long-term targets but a cautious short-term outlook due to prevailing bearish momentum. [Forecasts]

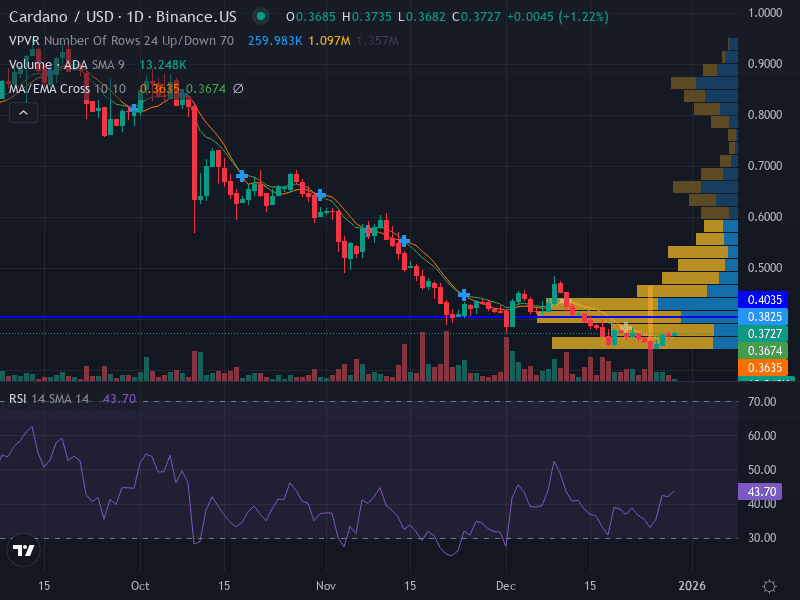

Technical Analysis: Chart Structure & Key Levels

Aspect | Details |

|---|---|

Trend | Bearish – Price below declining 9 & 21 EMA, confirming a downtrend. |

Pattern | Descending channel with lower highs and lower lows. |

Support | $0.4103 (major), $0.4206 (minor) |

Resistance | $0.4230 (major), $0.4474 (minor) |

Momentum | RSI at 40.27 (bearish, nearing oversold territory) |

Volume | Increasing on declines, indicating strong selling pressure |

MACD | Likely negative, reinforcing bearish bias |

Chart Insights

Price action remains below both short-term (9 EMA) and medium-term (21 EMA) moving averages, confirming the prevailing downtrend.

The descending channel structure highlights persistent lower highs and lower lows, a classic bearish continuation pattern.

Volume spikes on down days suggest sellers remain in control, with little evidence of accumulation by buyers.

RSI at 40.27 signals bearish momentum, but not yet deeply oversold—room for further downside exists.

Fundamental & News Impact

Despite the technical weakness, Cardano’s fundamentals are in focus this week due to:

Midnight Sidechain: Launching December 8, this upgrade is expected to improve Cardano’s scalability and privacy, potentially attracting new users and developers. However, immediate price impact may be muted by prevailing bearish sentiment.

Treasury Funding: The approval of 70 million ADA for infrastructure signals long-term commitment to ecosystem growth, but short-term price action remains dominated by technicals and broader crypto market risk appetite.

Overall, while these developments are positive for Cardano’s long-term outlook, traders should be mindful that technical factors and market sentiment are likely to dictate near-term price action.

Actionable Scenarios for the Upcoming Week

Scenario | Trigger | Potential Move | Key Levels |

|---|---|---|---|

Bullish 🟢 | Break and close above $0.4230 (major resistance) | Potential rally toward $0.4474; further upside possible if $0.4474 is cleared | $0.4230, $0.4474 |

Bearish 🔴 | Failure to reclaim $0.4230 and/or close below $0.4103 | Downside extension toward $0.4000 or lower | $0.4103, $0.4000 |

Neutral ⚪ | Consolidation between $0.4103 and $0.4230 | Range-bound trading; wait for breakout confirmation | $0.4103–$0.4230 |

Trade Ideas & Risk Management

Aggressive Bearish: Consider shorting near $0.4206 with stop-loss at $0.4270, targeting $0.4103. Rationale: trend continuation.

Conservative Bearish: Wait for a confirmed close below $0.4103, then short with stop-loss at $0.4150, targeting $0.4000.

Bullish Invalidator: A close above $0.4474 would invalidate the bearish thesis and could signal a trend reversal.

Risk: Limit exposure to 0.5–1% of capital per trade; use ATR or volatility-based stops.

Summary Table: Key Data & Outlook

Item | Value |

|---|---|

Current Price Range | $0.41–$0.44 |

Major Support | $0.4103 |

Major Resistance | $0.4230 |

Bearish Target | $0.4000 |

Bullish Target | $0.4474 |

Momentum Indicator | RSI 40.27 (bearish) |

Volume Trend | Rising on declines |

Key News | Midnight sidechain launch, 70M ADA treasury funding |

Conclusion

This week, Cardano (ADAUSD) faces a critical juncture: while major network upgrades and funding initiatives support its long-term prospects, the technical setup remains bearish. Traders should watch for a breakout above $0.4230 for bullish confirmation, or a breakdown below $0.4103 for further downside. Stay nimble, manage risk, and monitor both price action and news flow as the week unfolds. 📅💡

This analysis is for informational purposes only and does not constitute financial advice. Please conduct your own research and consult a professional before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles