Cardano (ADA) Weekly Analysis & Outlook – Week 51, December 2025

Ideas

Dec 22, 2025

3 Min Read

In-depth Cardano (ADA) analysis for Week 51, December 2025: chart, technical levels, major news (Midnight sidechain, FOMC), and actionable trading scenarios. Read the full outlook for ADA/USD.

Welcome to the Cardano (ADA) Weekly Analysis for Week 51, December 2025! This comprehensive review covers the latest price action, technical levels, major news, and actionable scenarios for ADA/USD. Whether you’re a trader or investor, this analysis will help you navigate the current landscape with clarity and confidence. 🚀📊

Latest News & Catalysts (Dec 8–14, 2025)

Midnight Sidechain Launch: Cardano’s Midnight sidechain went live on December 8, introducing the NIGHT token as a native asset. This event spurred new exchange listings, liquidity shifts, and increased trading activity. [InvestingHaven]

70 Million ADA Treasury Funding: The Cardano network approved a major 70M ADA withdrawal to fund infrastructure projects—stablecoins, oracles, bridges, custody, DeFi, RWA tokenization, and DePIN. Updates from these projects are expected soon. [Bankless Times]

FOMC Decision & Macro Impact: ADA rebounded 13% on the 4-hour chart after the Fed’s 25bps rate cut and Treasury purchases. The next FOMC meeting (Dec 15) is a key watch for further volatility. [KuCoin]

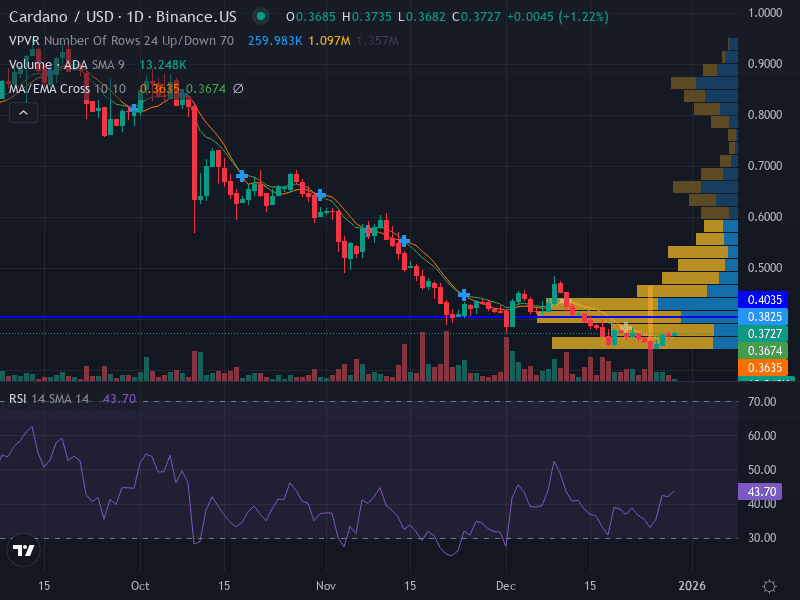

Technical Analysis (as of Week 51, December 2025)

Indicator | Current Value | Interpretation |

|---|---|---|

Support | $0.3960 (major), $0.3860 (minor) | Key levels to watch for breakdowns |

Resistance | $0.4220 (major), $0.4350 (minor) | Potential reversal or breakout zones |

Trend | Downtrend (below 50-day EMA) | Lower highs since October |

RSI | 38.58 | Weak momentum, near oversold |

Pattern | Descending channel, consolidation | Range-bound between $0.3960–$0.4220 |

Volume | Higher on declines, lower on rallies | Weak buying interest |

MACD | Bearish, slight improvement post-FOMC | Potential for reversal if momentum builds |

Chart Structure & Insights

ADA remains in a descending channel, consolidating near $0.40–$0.42.

Volume spikes on declines suggest sellers dominate, while rallies are met with low conviction.

RSI below 40 signals weak momentum but hints at possible oversold conditions—watch for reversal signals.

MACD shows bearish bias but is improving after the FOMC-driven bounce.

Fundamental & News Impact

Cardano’s price action this week is shaped by both network and macro events:

Midnight Sidechain: The launch introduces new DeFi and privacy features, potentially attracting fresh capital and developer activity. Early liquidity and trading volume are key to watch for sustained impact.

Treasury Funding: The 70M ADA allocation for infrastructure could drive medium-term adoption and utility, though immediate price impact depends on project milestones and market sentiment.

FOMC Rate Cut: The Fed’s dovish stance has boosted risk assets, including ADA. The upcoming December 15 decision could trigger further volatility—either a continuation of the rebound or renewed pressure if the macro tone shifts.

Overall, ADA’s fundamentals are improving, but technical and macro headwinds remain.

Actionable Scenarios for the Upcoming Week

Scenario | Trigger | Action | Target | Stop Loss |

|---|---|---|---|---|

Bullish | Break & close above $0.4350 | Long entry | $0.50–$0.55 | $0.4220 |

Bearish | Break below $0.3960 | Short entry | $0.3700–$0.3500 | $0.4100 |

Neutral/Range | Stuck between $0.3960–$0.4350 | Wait for breakout or fade extremes | Scalp $0.40–$0.42 | $0.3860/$0.4350 |

Aggressive traders: Consider shorting near $0.4200 with a stop at $0.4350, targeting $0.3860, if resistance holds.

Conservative traders: Wait for a confirmed break below $0.3960 before entering shorts, or above $0.4350 for longs.

Invalidation: A weekly close above $0.4350 would negate the bearish bias and suggest a possible trend reversal.

Summary Table: Key Levels & Events

Support | Resistance | Major Events |

|---|---|---|

$0.3960 / $0.3860 | $0.4220 / $0.4350 | Midnight launch, FOMC Dec 15, Treasury updates |

Conclusion

Cardano (ADA) enters Week 51 of December 2025 at a technical crossroads. While the Midnight sidechain launch and treasury funding are positive for long-term fundamentals, the short-term trend remains bearish unless ADA can break above $0.4350. The upcoming FOMC decision is a major catalyst that could set the tone for the rest of the month. Traders should watch key levels closely and manage risk accordingly. ⚖️

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Please conduct your own research and consult a professional before making investment decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles