Cardano (ADA) Weekly Analysis & Outlook – Week 1 December 2025

Ideas

Dec 4, 2025

3 Min Read

In-depth weekly analysis of Cardano (ADA) for Week 1 December 2025: chart, technicals, news impact, and actionable trading scenarios. Stay updated on ADA price trends, support/resistance, and catalysts like the Midnight launch.

Welcome to our comprehensive weekly analysis of Cardano (ADA) for Week 1 of December 2025! This blog post provides a deep dive into ADA’s price action, technical setup, and the latest news shaping its outlook. Whether you’re a trader or investor, you’ll find actionable scenarios, key levels, and a balanced perspective on what to expect for ADA in the coming week. 🚀📉

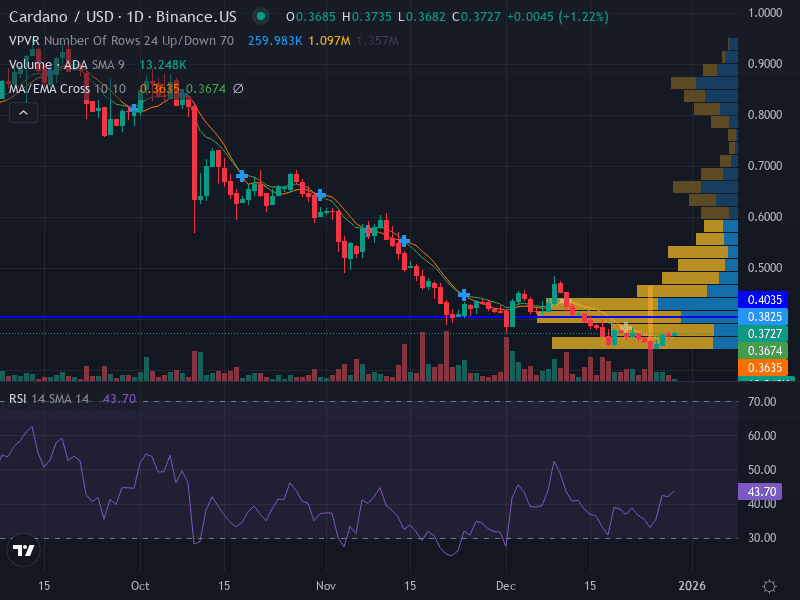

Price Chart Overview

The chart below (not shown here) displays ADA/USD on BinanceUS, featuring price action, volume, and MACD for the current week.

Trend: Bearish – price remains below key moving averages (10- and 20-week EMAs).

Momentum: RSI at 28.33 (oversold), MACD confirms bearish momentum.

Pattern: Descending triangle, suggesting risk of further decline.

Volume: Decreasing, indicating waning buying interest at lower levels.

Latest News & Catalysts (Past 7 Days)

Date | Headline | Summary |

|---|---|---|

2025-11-30 | Cardano price fell 31% in November, with bearish technicals raising concerns of a deeper breakdown as December begins. | |

2025-11-30 | ADA shows bullish reversal signals as the Midnight sidechain launch (Dec 8) approaches, with analysts targeting a move toward $0.65–$0.75 if $0.48 resistance breaks. | |

2025-11-29 | Anticipation for the Midnight sidechain launch is driving speculation about a price explosion and renewed ecosystem growth for Cardano. |

Technical Analysis

Support Levels:

$0.39 – Major support, recent consolidation zone

$0.31 – Minor support, next key level if $0.39 breaks

Resistance Levels:

$0.42 – Minor resistance, recent high

$0.45 – Major resistance, previous support now turned resistance

Trend: Downtrend confirmed by price action below 10- and 20-week EMAs.

Momentum: RSI at 28.33 signals oversold conditions, but MACD remains bearish.

Pattern: Descending triangle, typically a bearish continuation pattern.

Volume: Decreasing, suggesting lack of strong buying interest at current levels.

Chart Interpretation

The current technical setup for ADA is dominated by a clear downtrend, with price action forming a descending triangle. The RSI indicates oversold conditions, which could lead to a short-term rebound, but the overall momentum remains bearish. Decreasing volume further supports the view that buyers are hesitant to step in at these levels.

Fundamental & News Impact

Midnight Sidechain Launch: The upcoming launch on December 8 is the most significant near-term catalyst, expected to enhance Cardano’s privacy and scalability. This event has generated excitement and could trigger a bullish reversal if market sentiment improves. (source)

Smart Contract Growth: Nearly 10,000 new contracts added in the past year highlight Cardano’s ongoing ecosystem expansion.

Market Sentiment: Despite a steep drop in November, ADA is showing early signs of recovery as traders position ahead of the Midnight launch and new wallet releases.

Scenario Outlook for the Upcoming Week

Scenario | Trigger/Confirmation | Key Levels | Potential Action |

|---|---|---|---|

Bullish 🟢 | Break and close above $0.42, especially with strong volume and positive news from the Midnight launch. | Resistance: $0.42, $0.45; Next target: $0.48, then $0.65–$0.75 if momentum builds. | Consider long entries above $0.42 with stop-loss below $0.39. Watch for confirmation post-launch. |

Bearish 🔴 | Failure to hold $0.39 support, or a breakdown below the descending triangle base. | Support: $0.39, $0.31; Downside target: $0.31, possibly lower if selling accelerates. | Short entries below $0.39 with stop-loss above $0.42. Target $0.31 for partial profit-taking. |

Neutral ⚪ | Sideways price action between $0.39 and $0.42, with no decisive breakout or breakdown. | Range: $0.39–$0.42 | Wait for a clear move outside the range before committing to new positions. |

Risk Management & Trade Ideas

Risk 0.5–1% of capital per trade.

Use ATR-based stops to account for volatility.

Aggressive traders: Sell below $0.39 with stop-loss at $0.42, target $0.31.

Conservative traders: Wait for a confirmed break and retest of $0.39–$0.40 before entering short.

Invalidation: Weekly close above $0.45 could shift bias to neutral or bullish.

Summary Table

Key Level | Type | Significance |

|---|---|---|

$0.39 | Support | Major, recent consolidation zone |

$0.31 | Support | Minor, next downside target |

$0.42 | Resistance | Minor, recent high |

$0.45 | Resistance | Major, previous support now resistance |

Conclusion

Cardano (ADA) enters December 2025 at a critical juncture, with technicals pointing to a bearish bias but a significant fundamental catalyst (Midnight sidechain launch) on the horizon. Traders should monitor key levels ($0.39, $0.42, $0.45) and watch for confirmation from both price action and news flow. As always, use prudent risk management and stay alert to changing market dynamics. 📊🛡️

This analysis is for informational purposes only and does not constitute financial advice. Please conduct your own research and consult a professional before making investment decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles