Bitcoin (BTCUSD) Weekly Outlook & Analysis – Week 51 December 2025

Ideas

Dec 22, 2025

3 Min Read

Comprehensive weekly analysis of Bitcoin (BTCUSD) for Week 51, December 2025. Explore technical levels, news impact, and actionable scenarios after the Fed rate cut. Neutral trend with support/resistance, MACD, and volume insights.

Welcome to the in-depth weekly analysis of Bitcoin (BTCUSD) for Week 51, December 2025! This post covers everything traders and investors need to know about BTC’s recent price action, technical structure, fundamental drivers, and actionable scenarios for the coming week. Let’s dive in! 🚀

🔍 Executive Summary

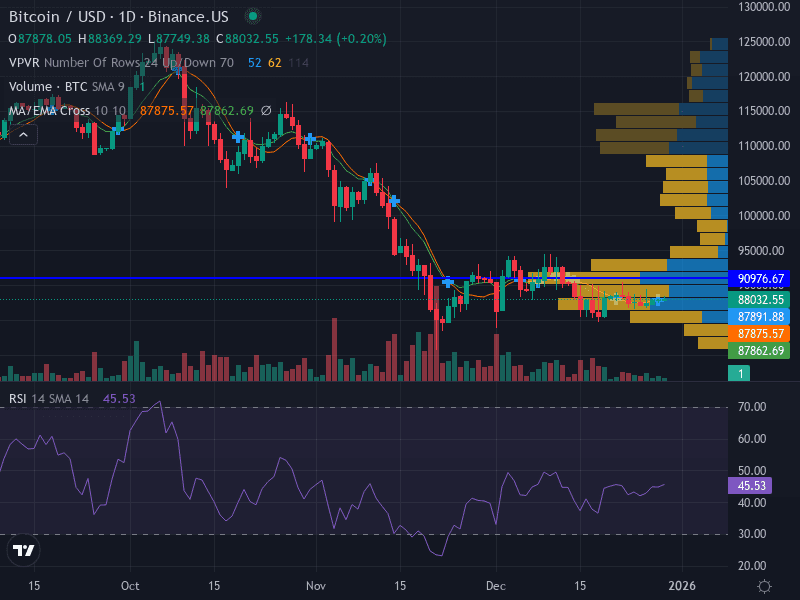

Bitcoin (BTC) is consolidating in a neutral range, oscillating between major support at $88,620 and resistance at $90,976. The market is digesting the recent Federal Reserve rate cut, with price action reflecting indecision and a lack of strong directional momentum. Volume is subdued, and the MACD is not providing a clear signal, suggesting traders are waiting for a catalyst.

📰 Latest News & Short-Term Catalysts

Fed Rate Cut: The Federal Reserve delivered a 25 bps rate cut (now 3.50%–3.75%), its third in 2025. BTC spiked above $94,000 post-announcement but quickly settled back, indicating the move was already priced in. (Binance)

BTC Volatility & Withdrawals: Bitcoin traded between $87,992 and $93,555 this week, with a sharp drop below $88,000 on Dec 14. A $93M leveraged long position and record options open interest signaled significant activity near range highs. (Coinpaper)

Market Sentiment & Macro: Despite the Fed’s move, crypto markets remain cautious. Spot Bitcoin ETFs saw ~$4B outflows in November, and macro uncertainty persists. (Binance Research)

📈 Technical Analysis

Key Level | Price | Significance |

|---|---|---|

Major Support | $88,620 | Lower boundary of consolidation |

Minor Support | $85,000 | Potential downside extension |

Major Resistance | $90,976 | Upper boundary of consolidation |

Minor Resistance | $91,069 | Breakout trigger |

Trend: Sideways. BTC is trading between its 10-day and 50-day moving averages, showing no clear trend direction.

Momentum: RSI at 41.39 is slightly bearish but near neutral. MACD is inconclusive, reinforcing the range-bound view.

Pattern: Horizontal range. Price is contained within a tight band, with neither bulls nor bears in control.

Volume: Decreasing during consolidation, indicating a lack of strong conviction from either side.

🔎 Chart Structure & Interpretation

BTCUSD’s current technical setup is characterized by a horizontal range, with repeated tests of support and resistance. The lack of a breakout suggests traders are waiting for a decisive macro or crypto-specific catalyst. Volume analysis confirms the absence of strong conviction, while the MACD’s neutrality aligns with the sideways movement.

💡 Fundamental & News Impact

Macro: The Fed’s rate cut was widely anticipated and failed to spark a sustained BTC rally. The market’s reaction was muted, with profit-taking and thin holiday liquidity dominating flows.

Institutional Activity: Large leveraged positions and record options open interest point to hedging and speculative activity, but not a clear directional bet.

Market Sentiment: Outflows from spot Bitcoin ETFs and cautious investor sentiment highlight macro uncertainty and a wait-and-see approach.

Regulatory Developments: Ongoing global regulatory innovation and U.S. policy debates may shape medium-term direction but are not immediate catalysts.

📊 Scenario Analysis for the Upcoming Week

Scenario | Probability | Key Levels | Actionable Idea |

|---|---|---|---|

Bullish 🟢 | 30% | Above $91,069 | Look for breakout and sustained close above $91,069; target $92,000+, stop-loss below $90,000. |

Bearish 🔴 | 30% | Below $88,620 | Short on breakdown below $88,620; target $85,000, stop-loss above $89,000. |

Neutral/Range 🟡 | 40% | $88,620 – $90,976 | Consider range trading: sell near resistance, buy near support, tight stops. |

Risk Management Tips

Limit risk to 1–2% of capital per trade.

Use tight stops given the narrow range.

Be patient for a confirmed breakout before increasing position size.

📝 Summary & Outlook

Bitcoin enters Week 51 of December 2025 in a state of indecision. The Fed’s rate cut, while significant, was anticipated and failed to provide a lasting directional impulse. Technicals point to a range-bound market, with major support at $88,620 and resistance at $90,976. Volume and momentum indicators reinforce the neutral stance, while macro and regulatory factors remain in the background.

For traders, the most prudent approach is to respect the current range and wait for a breakout. Aggressive strategies can target reversals at range boundaries, but risk management is paramount. Keep an eye on macro headlines, options activity, and any sudden shifts in volume or sentiment for early signs of a directional move.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Trading cryptocurrencies involves significant risk.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles