Berkshire Hathaway (BRK.A) Weekly Analysis & Outlook – Week 1, December 2025

Ideas

Jan 3, 2026

3 Min Read

In-depth weekly analysis of Berkshire Hathaway (NYSE:BRK.A) for Week 1, December 2025: technical chart review, latest news, support/resistance, and actionable scenarios for traders and investors.

Welcome to our comprehensive weekly analysis of Berkshire Hathaway (NYSE:BRK.A) for Week 1, December 2025! This report provides a professional, actionable review of BRK.A’s technical landscape, recent news, and key scenarios to watch as we enter the new year. 📊

Summary of the Latest News & Context 📰

No major news or earnings releases in the past week (Dec 22–28, 2025): The most recent company-specific update was leadership appointments on December 8, with Johnson named President as Berkshire prepares for Warren Buffett’s retirement. [Source]

Q3 2025 Earnings Context: Berkshire reported $30.8B in Q3 earnings (up 17% YoY), driven by insurance and operating businesses. No Q4 update yet. [Source]

Recent Stock Performance: BRK.A traded in a consolidation range, closing at 746,196 on Dec 26, down 0.67% for the week. [Source]

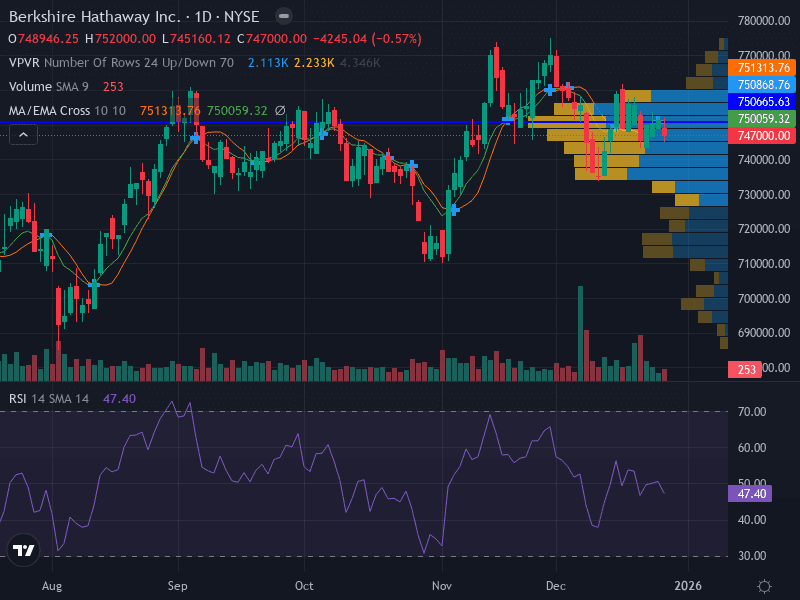

Technical Analysis 📈

Indicator | Current Reading | Interpretation |

|---|---|---|

Trend | Sideways | Price fluctuating around 10- and 20-day SMAs; no clear direction |

Momentum (RSI) | 47.40 (neutral) | Indecision; neither overbought nor oversold |

Support Levels | 745,160 (major), 740,000 (minor) | Potential bounce zones if price declines |

Resistance Levels | 751,314 (major), 750,666 (minor) | Potential rejection zones if price rallies |

Volume | Decreasing | Reduced trading interest; possible holiday effect |

Pattern | Range-bound | No clear breakout or breakdown; consolidation phase |

MACD | Flat/Neutral | No strong momentum signal; aligns with sideways trend |

Chart Structure & Key Observations

Price is near the 20-day SMA, reflecting indecision and lack of trend.

Major support at 745,160 and resistance at 751,314 define the current range.

Volume has tapered off, likely due to year-end holidays and lack of fresh catalysts.

MACD and RSI both neutral, suggesting traders are waiting for direction.

Fundamental & News Impact 💼

Leadership Transition: The market is closely watching the transition as Warren Buffett prepares to retire. The separation of Chairman/CEO roles and appointment of Johnson as President are significant, but no new developments have emerged in the past week.

Strong Q3 Earnings: The robust Q3 results provide a cushion for the stock, but with no Q4 data or major deals announced recently, investors are in a wait-and-see mode.

Strategic Moves: Earlier in December, Berkshire made headlines with a $9.7B OxyChem acquisition and a $1.4B Buffett share donation, but these are now digested into the price.

Macro Context: No major macroeconomic events (Fed, GDP, etc.) have directly impacted BRK.A this week. The stock’s consolidation mirrors broader market indecision at year-end.

Actionable Scenarios for the Upcoming Week 🔮

Scenario | Trigger/Signal | Action | Key Price Levels |

|---|---|---|---|

Bullish 🟢 | Break and close above 751,314 | Consider buying, targeting 760,000; stop-loss at 748,000 | 751,314 (breakout), 760,000 (target), 748,000 (stop) |

Bearish 🔴 | Rejection at 750,666 or break below 745,160 | Consider shorting, targeting 740,000; stop-loss at 753,000 | 750,666 (resistance), 745,160 (breakdown), 740,000 (target), 753,000 (stop) |

Neutral ⚪ | Continued range-bound trade between 745,160 and 751,314 | Wait for clear breakout or breakdown; avoid overtrading | 745,160 (support), 751,314 (resistance) |

Risk Management Tips

Risk only 0.5–1% of capital per trade; use ATR-based stops for volatility.

Be cautious of false breakouts, especially with low year-end volume.

Monitor for any surprise news or macro events that could shift sentiment.

Weekly Outlook & Confidence Level 🧐

The technical and fundamental backdrop for BRK.A this week is neutral. With price consolidating near key moving averages and no strong news catalysts, the probability of a range-bound week is high unless a breakout above 751,314 or a breakdown below 745,160 occurs. Confidence in directional trades is low until a new trend emerges.

Key Takeaways ✅

BRK.A is consolidating in a tight range with neutral momentum and volume.

Watch for a decisive move above 751,314 (bullish) or below 745,160 (bearish) for next week’s direction.

Leadership transition and Q4 earnings remain the main potential catalysts ahead.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Please conduct your own research and consult a financial advisor before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles