Apple (AAPL) Weekly Analysis & Outlook – Week 52, December 2025

Ideas

Dec 22, 2025

3 Min Read

Comprehensive weekly analysis of Apple Inc. (AAPL) for Week 52, December 2025: technical chart review, latest news, support/resistance, MACD, volume, and actionable trading scenarios for the upcoming week.

Apple Inc. (AAPL) Weekly Stock Analysis – Week 52, December 2025

Welcome to this week’s in-depth analysis of Apple Inc. (NASDAQ: AAPL), covering the period of December 22–28, 2025 (Week 52). This blog post delivers a comprehensive technical and fundamental review, the latest news, and actionable trading scenarios for the upcoming week. 📈🍏

Summary of Latest News & Fundamental Context

Layoffs in Sales Divisions: Apple eliminated dozens of positions in its enterprise, education, and government sales teams. The move, described as affecting a "small number of roles," is aimed at improving customer connections amid government spending pressures. (Source)

Stock Performance: AAPL closed at $274.11, down 1.5% for the week, underperforming major indices. (Source)

Upcoming Earnings: The December quarter (Q1 FY2026) is projected to be a record, with consensus EPS at $2.65 (+10.4% YoY) and revenue at $137.46B (+10.6% YoY). (Source)

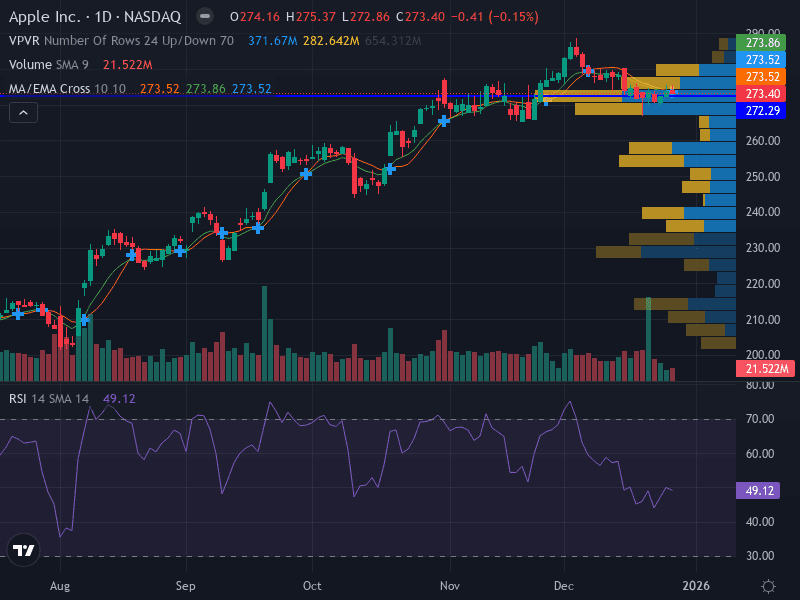

Technical Analysis: Chart Structure & Key Levels

Aspect | Details |

|---|---|

Trend | Sideways/Neutral – Price fluctuating around 9-day EMA, no clear direction |

Support Levels | Major: $272.29 (recent low, point of control); Minor: $265.00 |

Resistance Levels | Major: $275.66 (recent highs); Minor: $279.37 |

Pattern | Consolidating range between $272.29 and $275.66 |

Momentum | RSI: 48.95 (neutral); MACD: Stable/Neutral |

Volume | Decreasing on upward moves, indicating weak buying pressure |

Chart Insights

Price Action: AAPL is consolidating in a narrow range, with neither bulls nor bears in clear control.

MACD & RSI: Both indicators signal neutrality; momentum is lacking, and the market awaits a catalyst.

Volume: Lower volume on upswings suggests buyers are cautious, possibly awaiting earnings or further news.

Fundamental & News Impact

Despite the layoffs in sales divisions, Apple’s fundamentals remain robust, with record-setting revenue and EPS projected for the December quarter. The layoffs are seen as a strategic move to streamline operations rather than a sign of financial distress. However, the stock’s underperformance relative to the broader market and the premium valuation (forward P/E of 34.26) suggest that investors are cautious ahead of earnings. Government spending pressures and macroeconomic uncertainties may also be weighing on sentiment.

Possible Scenarios for the Upcoming Week

Scenario | Trigger | Actionable Levels | Probability |

|---|---|---|---|

Bullish 🟢 | Break above $275.66 with volume | Entry: $276.00+ | Moderate (requires catalyst) |

Bearish 🔴 | Break below $272.29 with volume | Entry: $272.00- | Low-Moderate (if sentiment worsens) |

Neutral/Range ⚪ | Price remains between $272.29–$275.66 | Buy near $272.50 | High (current structure) |

Aggressive traders may look to buy a breakout above $275.66, targeting $279.00, with a stop-loss at $272.00.

Conservative traders may wait for a pullback to $272.29 support, entering around $272.50 with a stop at $270.00 and a target of $275.50.

Invalidation: A sustained move below $272.29 with strong volume could trigger a bearish shift toward $265.00.

Risk Management

Risk no more than 1% of capital per trade.

Use the 14-day ATR to set stop-loss distances.

Monitor volume and price action for confirmation before entering trades.

Conclusion & Outlook

Apple (AAPL) is in a holding pattern as the market awaits its December quarter earnings. The technical setup is neutral, with clear support and resistance levels defining the range. While recent layoffs have made headlines, they are not expected to materially impact Apple’s near-term financials. Traders should watch for a breakout or breakdown from the current range, with risk management paramount given the potential for volatility around earnings.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Trading stocks involves risk, and you should consult your financial advisor before making investment decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles