Apple (AAPL) Weekly Analysis & Outlook – Week 49, December 2025

Ideas

Dec 4, 2025

3 Min Read

Comprehensive weekly analysis of Apple (NASDAQ:AAPL) for Week 49, December 2025. Includes technical chart review, latest news, support/resistance, and actionable trading scenarios for the week.

Welcome to our in-depth analysis of Apple Inc. (NASDAQ:AAPL) for Week 49, December 2025! This week’s review covers the latest technical chart insights, recent news and catalysts, and actionable scenarios for traders and investors. Let’s dive in! 🍏📈

📰 Latest News & Market Context (Past 7 Days)

Operational Streamlining: Apple announced dozens of layoffs in its sales organization to boost efficiency, while achieving all-time high stock prices. This signals a focus on profitability, not distress.

Record Earnings: Apple’s Q4 2025 earnings (reported Oct 30) beat estimates with EPS of $1.85 (vs. $1.74 expected) and revenue of $102.47B (8.7% YoY growth). Analysts remain bullish, with several price target upgrades (JPMorgan: $305, TD Cowen: $325, BofA: $320).

Strong Outlook: For the December quarter, Apple expects 10-12% net sales growth, driven by iPhone 17 demand and robust Services revenue (now 1B+ subscribers).

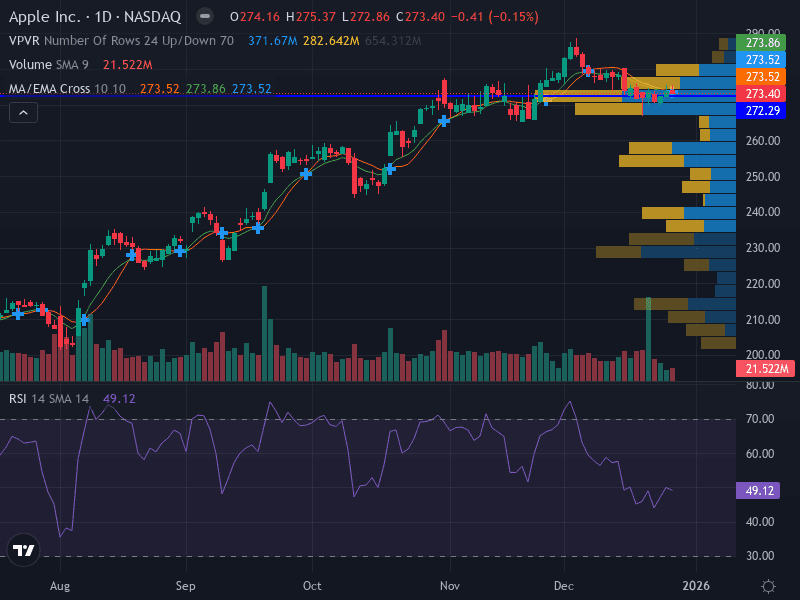

📊 Technical Analysis: Chart Structure & Key Levels

Aspect | Details |

|---|---|

Trend | Uptrend – Price above 9- and 10-day EMAs, confirming bullish bias |

Momentum | RSI at 68.3 (bullish, nearing overbought) |

Pattern | Possible ascending channel formation |

Volume | Decreasing slightly on recent moves, indicating consolidation phase |

Support Levels | 273.92 (major, EMA support), 271.29 (minor) |

Resistance Levels | 278.85 (major, recent swing high), 280.00 (psychological) |

Price Action: Apple is consolidating above its 9-day EMA, making higher highs. This is a classic signal of continued bullish momentum.

MACD: The MACD remains above its signal line, supporting the bullish case. However, watch for any divergence as RSI approaches overbought territory.

Volume: Slightly declining volume on recent up moves suggests consolidation, not exhaustion. A breakout with strong volume would confirm further upside.

📈 Fundamental & News Impact

Apple’s fundamentals remain robust:

Revenue & Earnings: Q4 revenue up 8.7% YoY, net margin 24.3%. EPS and revenue both beat expectations.

Growth Drivers: iPhone 17 and Services (over 1B paid subscribers) are fueling growth. Wearables (Watch, AirPods) also gaining traction.

Valuation: Forward P/E below 34x, attractive for a tech/AI leader.

Institutional Activity: Minor stake reductions by some funds, but overall sentiment remains positive with multiple analyst upgrades.

Operational Moves: Layoffs are seen as efficiency measures, not a sign of weakness.

🔮 Scenarios & Actionable Outlook for Week 49 (Dec 1–7, 2025)

Scenario | Trigger/Action | Key Levels | Probability |

|---|---|---|---|

Bullish 🟢 | Breakout above 279.00 with volume | Entry: 279.00+ | Likely (momentum strong, news supportive) |

Neutral 🟡 | Consolidation between 273.92–278.85 | Buy on pullback to 273.92 | Possible (if volume remains low, no catalyst) |

Bearish 🔴 | Close below 271.29 (trend change) | Short below 271.29 | Low (unless negative catalyst emerges) |

Risk Management Tips

Risk no more than 1% of capital per trade.

Adjust position size based on ATR/volatility.

Monitor for news surprises or macro shocks.

📅 Weekly Recap Table

Date | Close | Volume |

|---|---|---|

Nov 28, 2025 | $278.85 | 20,135,620 |

Nov 26, 2025 | $277.55 | 33,431,420 |

Nov 25, 2025 | $276.97 | 46,914,220 |

Nov 24, 2025 | $275.92 | 65,585,800 |

📝 Summary & Takeaways

Apple is in a strong uptrend, consolidating near all-time highs with bullish technicals and supportive fundamentals.

Key levels to watch: 273.92 (support), 278.85–280.00 (resistance).

Actionable setups: Buy breakout above 279.00 or on pullback to 273.92, with stops as outlined above.

Monitor for news on iPhone/Services growth, macro events, and any unusual volume spikes.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Please conduct your own research and consult a financial advisor before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles