Amazon (AMZN) Weekly Analysis & Outlook – Week 49, December 2025

Ideas

Dec 4, 2025

3 Min Read

Comprehensive weekly analysis of Amazon (NASDAQ:AMZN) for Week 49, December 2025. Includes technical chart review, key news, support/resistance, and actionable trading scenarios.

Amazon (NASDAQ:AMZN) enters Week 49 of 2025 with a neutral technical setup, consolidating between key support and resistance levels amid mixed market sentiment and evolving macroeconomic factors. This in-depth analysis covers the latest chart signals, news, and actionable scenarios for traders and investors. 📈

📰 Latest News & Catalysts (Past 7 Days)

Stock Recovery & Analyst Sentiment: Amazon shares climbed 7% last week but remain below their November highs. Analyst consensus remains bullish, with a Strong Buy rating and an average price target near $280 (+20% upside). However, some caution persists regarding AI profitability and AWS growth. (TipRanks)

Q3 2025 Earnings: Amazon beat estimates with EPS of $1.95 (vs. $1.57 expected) and revenue up 13% YoY to $180.2B. Despite strong results, stock gains faded due to concerns over AI-related profitability and broader tech sector pressure. (Amazon IR)

Macro & Retail Trends: Black Friday online sales hit $11.8B (+9.1% YoY), with Amazon typically seeing a 3% sales boost post-event, signaling robust consumer demand. Broader market sentiment is affected by Fed policy uncertainty and sector rotation. (TradingView)

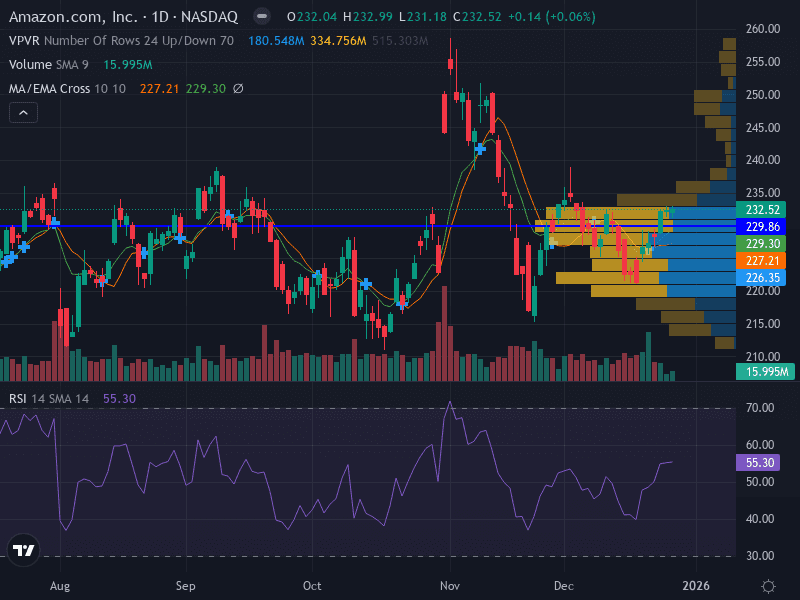

📊 Technical Analysis

Aspect | Details |

|---|---|

Trend | Sideways/Neutral – Price oscillating between 9-day and 20-day EMA, lacking clear direction. |

Support Levels | Major: 226.90 (high volume node); Minor: 223.34 |

Resistance Levels | Major: 233.22 (recent swing high); Minor: 229.58 |

Pattern | Consolidation between 226.90 and 233.22 – potential for range breakout. |

Momentum | RSI at 52.32 (neutral); MACD not provided in chart, but price action shows indecision. |

Volume | Decreasing on recent upswing, suggesting weakening buying pressure. |

🔍 Chart Structure & Interpretation

Range-Bound Action: AMZN is consolidating between $226.90 and $233.22, with no decisive breakout yet. This range reflects indecision as traders await new catalysts.

Volume Analysis: Lower volume on recent rallies hints at buyer fatigue. Watch for a volume spike to confirm any breakout attempt.

Momentum: RSI near 52 signals a lack of strong directional bias. A move above 60 or below 40 would indicate a shift in momentum.

💡 Fundamental & News Impact

AI & Cloud Growth: AWS remains a key driver, with analysts projecting acceleration in 2026 due to AI demand. However, some warn of potential dilution of returns from heavy AI capital spending.

Retail Strength: Strong Black Friday sales and robust Q3 earnings support Amazon’s retail segment, but margin pressures and macro uncertainty linger.

Analyst Consensus: Despite mixed short-term sentiment, the majority of analysts maintain a bullish long-term outlook with price targets well above current levels.

📈 Actionable Scenarios for the Week

Scenario | Trigger/Signal | Action | Price Levels | Risk Management |

|---|---|---|---|---|

Bullish | Breakout above $233.22 on strong volume | Buy on breakout confirmation | Entry: $233.50+ | Risk 1% of capital; use ATR(14) for stop sizing |

Bearish | Breakdown below $223.34 | Sell/Short on breakdown | Entry: $223.00 | Risk 1% of capital; adjust stops for volatility |

Neutral/Range | Continued consolidation between $226.90–$233.22 | Range trade: Buy near support, sell near resistance | Buy: $227.00 | Reduce size; quick profit-taking |

🛡️ Risk Management & Strategy Notes

Limit risk to 1% of capital per trade.

Use ATR(14) to dynamically size stops based on volatility.

Monitor volume and price action for breakout/breakdown confirmation.

Stay alert to macro news (Fed, sector rotation) and upcoming Amazon events.

🔚 Summary & Outlook

Amazon (AMZN) is in a holding pattern as it digests recent earnings, analyst revisions, and macro shifts. The technical picture suggests a likely continuation of range-bound trade unless a decisive breakout occurs. Traders should watch for volume-confirmed moves above $233.22 or below $223.34 for directional cues. Long-term fundamentals remain robust, but near-term caution is warranted given sector volatility and evolving AI/cloud narratives.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Please consult a licensed financial advisor before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles