Alphabet (GOOGL) Weekly Analysis & Outlook – Week 52, December 2025

Ideas

Dec 22, 2025

3 Min Read

In-depth weekly analysis of Alphabet (GOOGL) for Week 52, December 2025: Chart insights, technical levels, news impact, and actionable trading scenarios. Read the latest on support, resistance, and market outlook.

Welcome to our comprehensive weekly analysis of Alphabet Inc. (NASDAQ:GOOGL) for Week 52, December 2025! This blog post delivers a detailed, actionable breakdown of GOOGL’s technical setup, recent news, and what traders and investors should watch for in the coming week.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Please conduct your own research before making investment decisions.

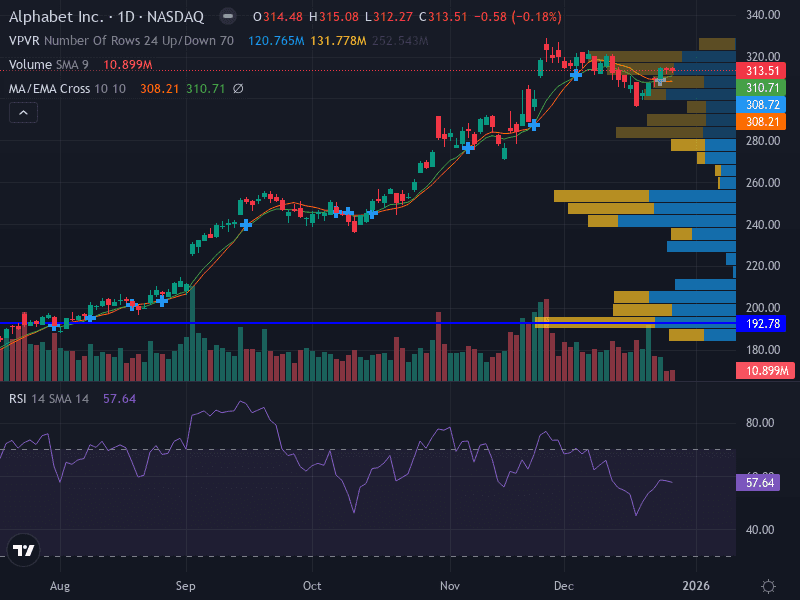

📊 Chart Overview & Technical Structure

Current Trend: Neutral – GOOGL is consolidating near its moving averages, reflecting indecision after a strong multi-month rally.

Key Support Levels: 301.00 (major), 251.15 (minor)

Key Resistance Levels: 311.44 (major), 307.68 (minor)

Pattern: Price is forming a horizontal range between 301.00 and 311.44, with no clear breakout yet.

Volume: Steady, with no significant spikes, indicating a lack of aggressive accumulation or distribution.

Momentum: RSI at 53.42 (neutral), MACD signals mixed momentum.

🗺️ Technical Analysis Table

Indicator | Value | Interpretation |

|---|---|---|

Support (Major) | 301.00 | Strong buying interest; potential bounce zone |

Resistance (Major) | 311.44 | Key breakout level; watch for volume surge |

RSI | 53.42 | Neutral – neither overbought nor oversold |

MACD | Mixed | Momentum unclear; wait for confirmation |

Volume | Consistent | No major accumulation/distribution |

📰 Latest News & Fundamental Context

Analyst Upgrades: Pivotal Research raised its price target to a Street-high $400, citing strong cloud growth and resilient Search revenues. [Read more]

Stock Performance: GOOGL is trading near its 52-week high ($328.83), up 10% in the past month and 73% over the past year, far outpacing the S&P 500. [Details]

Other Headlines: Minor legal news: Walt Disney sent a cease-and-desist letter to Google, but no material impact reported. [Source]

🔍 Fundamental & News Impact

Alphabet continues to benefit from robust cloud growth, AI-driven efficiencies, and resilient Search revenues. Analyst sentiment remains bullish, with a consensus "Strong Buy" and a mean target of $326.42, suggesting modest upside from current levels. No major macroeconomic headwinds or company-specific risks have emerged in the past week. The legal dispute with Disney appears immaterial for now.

📈 Actionable Scenarios for Week 52, December 2025

Scenario | Trigger | Action | Target | Stop Loss |

|---|---|---|---|---|

Bullish 🟢 | Breakout above 311.50 on strong volume | Long entry | 320.00 | 306.50 |

Bearish 🔴 | Breakdown below 301.00 with high volume | Short entry | 291.00 | 306.00 |

Neutral/Range 🟡 | Price remains between 301.00 and 311.44 | Range trading (buy near support, sell near resistance) | 311.00 | 296.00 |

🛡️ Risk Management Tips

Risk 0.5–1% of capital per trade.

Use ATR (Average True Range) for dynamic stop placement.

Monitor volume for confirmation of breakouts/breakdowns.

🔮 Weekly Outlook & Summary

GOOGL is consolidating after a stellar run, with technicals suggesting a wait-and-see approach as the market digests recent gains. The setup favors range trading unless a decisive breakout or breakdown occurs. Fundamentals remain strong, and news flow is supportive, but the stock may need a catalyst to move out of its current range. Short-term traders should watch the 301.00–311.44 zone closely for actionable signals.

For more weekly trading ideas and in-depth analysis, check back every Monday!

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles