Alphabet (GOOGL) Weekly Analysis & Outlook – Week 49, December 2025 (Week 1 December 2025)

Ideas

Dec 4, 2025

3 Min Read

In-depth weekly analysis of Alphabet (GOOGL) for Week 49, December 2025: price chart, news, technicals, fundamentals, and actionable trading scenarios. Stay ahead with our expert insights.

Alphabet (GOOGL) continues to demonstrate remarkable strength as we enter Week 49 of 2025, with the stock riding a robust uptrend and fresh record earnings fueling bullish sentiment. This comprehensive weekly analysis covers the latest price action, technical and fundamental drivers, and offers actionable scenarios for traders and investors. 📈

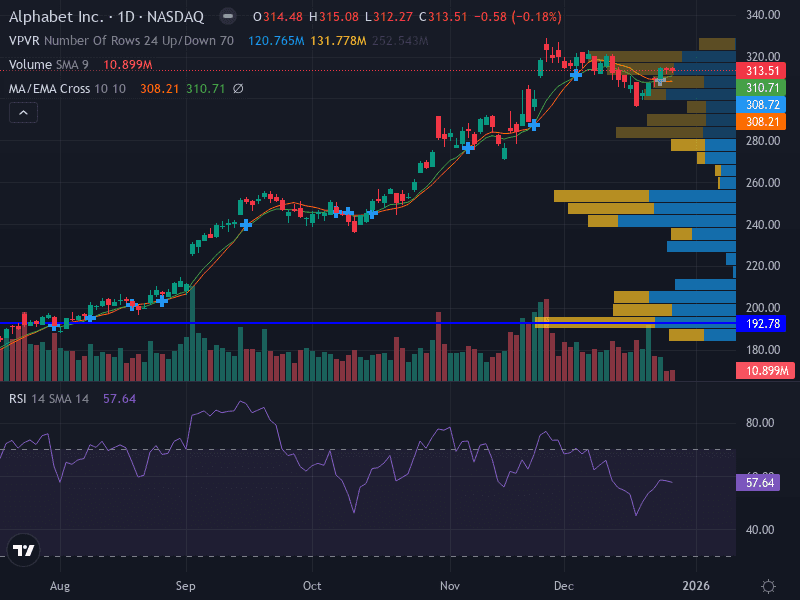

📊 Price Chart Overview

The current price chart for GOOGL (see above) reveals a strong uptrend, with the stock trading above key moving averages and consistently printing higher highs. Volume has increased on rallies, and the MACD remains positive, reinforcing the bullish momentum.

Key Technical Levels | Price |

|---|---|

Major Resistance | 326.85 |

Minor Resistance | 340.00 |

Major Support | 305.78 |

Minor Support | 287.43 |

📰 Latest News & Catalysts

Record Q3 2025 Earnings: Alphabet posted its first-ever $100 billion quarter, with consolidated revenues reaching $102.3 billion (16% YoY growth). This milestone highlights Alphabet’s accelerating business momentum. [Google Blog]

AI & Gemini Expansion: The Gemini AI platform now processes 7 billion tokens per minute, with over 650 million monthly active users. Token processing across Google’s ecosystem has grown 20x YoY, underscoring Alphabet’s leadership in AI. [Google Blog]

Cloud & Subscription Growth: Google Cloud’s backlog surged 46% QoQ to $155 billion, and paid subscriptions (Google One, YouTube Premium) surpassed 300 million. Operating margins expanded by 160 basis points. [Morningstar]

🔎 Technical Analysis

Trend: GOOGL is in a confirmed uptrend, trading above both the 10- and 20-week EMAs. The chart structure shows higher highs and higher lows, a classic bullish pattern.

Momentum: The RSI stands at 73.51, indicating strong bullish momentum but also approaching overbought territory. The MACD remains positive, supporting the ongoing uptrend.

Volume: Volume has increased on upward moves, confirming the conviction behind the rally. This is a healthy sign for trend continuation.

Support & Resistance: Immediate support is seen at 305.78 (major) and 287.43 (minor). Resistance is at 326.85 (major recent high) and a potential target at 340.00.

Pattern: The price action suggests a continuation of the bullish trend, with no immediate signs of reversal. However, the elevated RSI warrants caution for potential short-term pullbacks.

💡 Fundamental & News Impact

Alphabet’s fundamentals remain robust, driven by:

AI Leadership: Gemini and other AI initiatives are translating into tangible business growth, with rapid adoption and usage across Google’s platforms.

Cloud Momentum: Google Cloud’s accelerating backlog and AI-driven revenue growth are key positives, with more large enterprise deals signed than ever before.

Subscription Expansion: The milestone of 300 million paid subscriptions reflects strong consumer demand for premium Google services.

Profitability: Operating margins are expanding, and consensus EPS forecasts for Q4 2025 have been revised higher.

Overall, the combination of record earnings, AI-driven growth, and expanding cloud and subscription businesses positions Alphabet as a market leader heading into the final month of 2025.

📅 Scenarios & Trading Outlook for Week 49 (December 1–7, 2025)

Scenario | Key Levels | Actionable Plan |

|---|---|---|

Bullish 🟢 | Above 326.85 | Look for breakouts above 326.85. Aggressive traders may buy on minor pullbacks to 320.00 (SL 305.00, Target 340.00). Trend-followers can add on strength above 326.85. |

Bearish 🔴 | Below 305.78 | If price closes below 305.78, consider short-term bearish setups targeting 287.43. Use tight stops and monitor for reversal signals. |

Neutral 🟡 | 305.78–326.85 | Sideways action likely. Wait for a decisive break above resistance or below support before initiating new positions. |

Risk Management Tips

Risk only 0.5–1.5% of capital per trade.

Use ATR-based dynamic stops to adjust for volatility.

Monitor RSI for signs of overbought conditions and potential pullbacks.

🌐 Weekly Recap & Outlook

Alphabet (GOOGL) enters December 2025 with strong momentum, supported by record earnings, AI-driven growth, and robust technicals. While the uptrend is likely to continue, traders should remain vigilant for overbought signals and adjust risk accordingly. The key to this week is to watch for a breakout above 326.85 for further upside, or a breakdown below 305.78 for a potential reversal.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Please conduct your own research or consult a financial advisor before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles