Alphabet (GOOGL) Weekly Analysis & Outlook – Week 2 December 2025 (Week 50)

Ideas

Dec 9, 2025

3 Min Read

In-depth weekly analysis of Alphabet Inc. (GOOGL) for Week 2 December 2025: chart, technicals, news, support/resistance, and actionable trading scenarios.

Welcome to our comprehensive weekly analysis of Alphabet Inc. (NASDAQ:GOOGL) for the week of December 8, 2025 (Week 50). This post delivers a full technical, fundamental, and actionable trading outlook for GOOGL, leveraging the latest price action, news, and chart analytics. 📈

Summary of Latest News & Catalysts 📰

Q3 2025 Earnings Beat: Alphabet reported Q3 2025 EPS of $2.87, beating analyst estimates by $0.58, with revenue up 13.8% YoY to $96.43B. [MarketBeat]

Analyst Projections: Q4 2025 consensus EPS stands at $2.49, with full-year 2025 EPS expected between $9.01–$9.56, reflecting ~15% YoY growth. [Nasdaq]

Macro & Operational Factors: Alphabet continues to show high-margin growth in advertising and cloud, with no major adverse macro factors reported. [Alphabet Investor Relations]

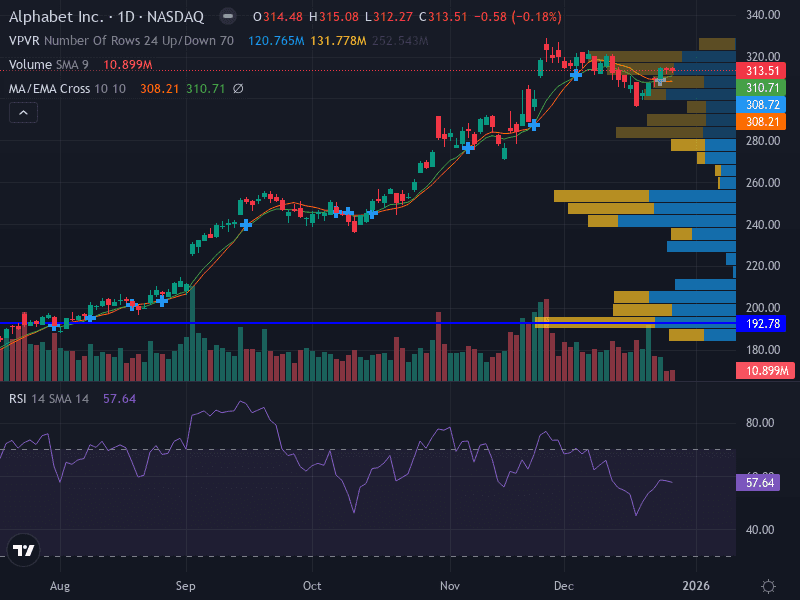

Technical Analysis 🛠️

Aspect | Details |

|---|---|

Trend | Uptrend – Price above 10- & 20-day MAs |

Momentum | RSI 70.08 (overbought, strong bullish momentum) |

MACD | Bullish momentum suggested by price action |

Pattern | Ascending continuation, recent breakout |

Volume | Strong on upward moves, indicating accumulation |

Support Levels | 313.79 (major), 311.44 (minor) |

Resistance Levels | 323.16 (minor) |

Interpretation

Uptrend: GOOGL is trading above its key moving averages, confirming a bullish structure.

Momentum: The RSI at 70.08 signals strong buying but also cautions for potential short-term pullbacks due to overbought conditions.

Volume: High volume on upswings supports the bullish case, indicating institutional accumulation.

Pattern: The breakout from previous highs suggests continuation potential, but traders should watch for false breakouts if momentum wanes.

Fundamental & News Impact 🏦

Strong Earnings Momentum: Alphabet’s Q3 2025 results exceeded expectations, with robust revenue and profit growth across its core businesses.

Positive Analyst Sentiment: Upward revisions in EPS forecasts and revenue estimates reflect confidence in continued growth.

Macro Stability: No significant negative macroeconomic or regulatory news has emerged in the past week, supporting a stable outlook.

Actionable Scenarios for the Upcoming Week (December 8–12, 2025) 📊

Scenario | Entry | Stop Loss | Target | Probability | Notes |

|---|---|---|---|---|---|

Bullish | Buy at 321.27 (current level) | 313.79 | 330.00 | High | Continuation of uptrend; strong momentum and volume |

Conservative Bullish | Buy on pullback to 313.79–314.00 | 311.00 | 323.00 | Moderate | Wait for potential dip due to overbought RSI |

Bearish | Sell if weekly close below 311.44 | 315.00 | 305.00 | Low | Would signal a shift to neutral or negative bias |

Neutral | Wait & watch between 313.79–323.16 | N/A | N/A | Moderate | Sideways consolidation possible after strong run |

Key Takeaways & Outlook

GOOGL remains in a strong uptrend, supported by both technical and fundamental factors.

Short-term caution is warranted due to overbought RSI, but volume and price action favor bulls.

Watch for a pullback to support for potential entries, or a breakout above 323.16 for momentum trades.

Bearish scenarios have low probability unless price closes below 311.44 on a weekly basis.

Conclusion

Alphabet (GOOGL) enters Week 50 of 2025 with strong bullish momentum, robust earnings, and positive analyst sentiment. Traders should monitor key support and resistance levels for actionable opportunities, while remaining vigilant for any signs of reversal or consolidation. As always, risk management is crucial in all trading scenarios. 🚦

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Please conduct your own research or consult a financial advisor before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles