Alphabet (GOOGL) Weekly Analysis & Outlook – Week 41, October 2025

Ideas

Oct 6, 2025

3 Min Read

In-depth weekly analysis of NASDAQ:GOOGL for Week 41, October 2025. Explore technical trends, news impact, support/resistance, and actionable trading scenarios driven by AI and earnings momentum.

Welcome to our comprehensive weekly analysis of Alphabet Inc. (NASDAQ:GOOGL) for Week 41, October 2025! This post delivers a world-class, actionable breakdown of GOOGL’s technical and fundamental landscape, leveraging the latest news, chart insights, and scenario planning to help you navigate the week ahead. 📈🚀

📰 Latest News & Short-Term Catalysts

AI Leadership & Quantum Leap: Alphabet’s breakthrough with its new quantum chip, Willow, is making headlines, reinforcing its leadership in generative AI and advanced computing. [Finviz]

Strong Earnings & Cloud Growth: Alphabet’s Q2 2025 report beat expectations, with a 14% revenue increase and a 32% jump in Google Cloud revenue. This surge is fueling bullish sentiment. [Nasdaq]

Analyst Upgrades: Morgan Stanley raised its price target to $270 (from $210), citing AI-driven earnings potential and robust cloud growth. Consensus among 47 analysts stands at $240.76, with a high of $295. [MarketBeat]

📊 Technical Analysis: Chart Structure, Support & Resistance

Key Level | Type | Significance |

|---|---|---|

246.86 | Resistance (Major) | Recent high; potential breakout trigger |

250.00 | Resistance (Psychological) | Round number, minor resistance |

239.47 | Support (Major) | 20-day EMA; trend-defining level |

230.00 | Support (Minor) | Previous consolidation area |

Trend: GOOGL is in a well-established uptrend, trading above both the 20- and 50-day EMAs. The price action is supported by a rising trendline, and bullish momentum is confirmed by an RSI of 64.04.

Pattern: The stock is moving within an ascending channel, with recent pullbacks finding support above the 20-day EMA.

Volume: Volume increases on upswings and tapers off during pullbacks, indicating healthy accumulation.

MACD: While the MACD line is not directly available, the prevailing trend and momentum suggest a bullish MACD crossover is likely in play.

🔎 Fundamental & News Impact

Alphabet’s fundamentals are robust, underpinned by:

AI & Cloud Expansion: Continued investment in AI, quantum computing, and cloud infrastructure is driving revenue and margin growth.

Positive Analyst Sentiment: Upgrades and price target hikes reflect confidence in Alphabet’s ability to monetize AI and cloud innovations.

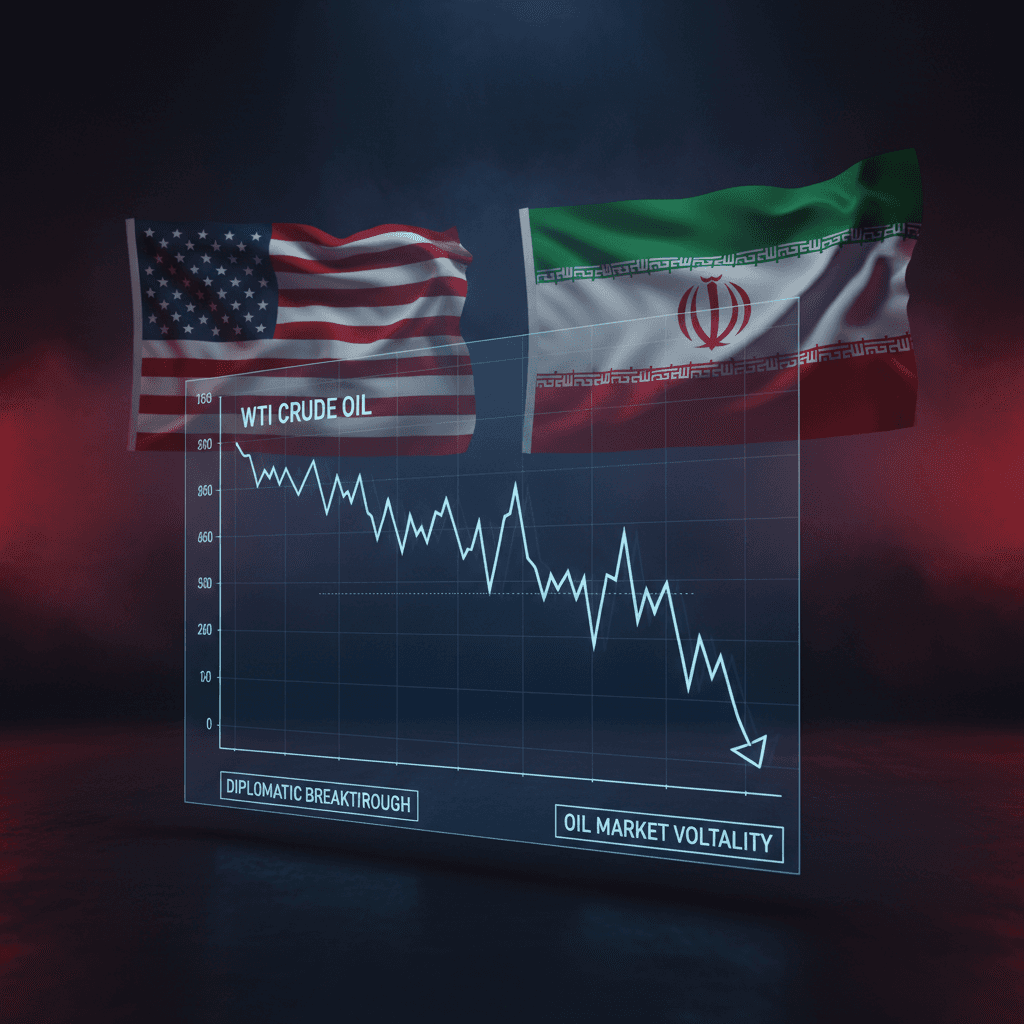

Macro Environment: Despite broader tech volatility, Alphabet’s diversified business model and leadership in AI provide resilience.

📈 Scenario Planning: What to Watch for This Week

Scenario | Key Price Levels | Potential Action | Probability |

|---|---|---|---|

Bullish | Above 246.86, target 250.00+ | Buy on breakout or pullback to 239.50 | High |

Bearish | Below 239.47 | Switch to neutral/short bias | Low |

Neutral | Between 239.47 and 246.86 | Wait for confirmation | Moderate |

Aggressive Bulls: Consider buying at current levels (~245.50), with a stop-loss at 239.00 and a target of 250.00, betting on trend continuation.

Conservative Bulls: Wait for a retracement to the 239.50 support zone before entering, with a stop at 235.00 and a target of 246.50.

Invalidation: A close below 239.47 would invalidate the bullish thesis and suggest a period of consolidation or reversal.

🛡️ Risk Management & Trade Ideas

Risk no more than 1% of capital per trade.

Use ATR-based stops to adjust for volatility.

Monitor volume and price action near key levels for early signals.

🧠 Summary & Outlook

Alphabet (GOOGL) enters Week 41 with strong bullish momentum, driven by AI innovation, cloud growth, and positive analyst sentiment. Technicals favor further upside as long as the price holds above the 20-day EMA (239.47). Traders should watch for a breakout above 246.86 to target the psychological 250.00 level, while a close below support would warrant caution.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Please conduct your own research or consult a financial advisor before making trading decisions.

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

More Articles