US Military Strike in Venezuela Topples Maduro: Gold Futures Surge & Copy Trading Insights

News

Jan 7, 2026

3 Min Read

US military strike in Venezuela topples Maduro, sparking gold futures volatility. Actionable insights for copy traders and automation users.

🇻🇪 US Military Strike Topples Maduro: What Happened?

US military strike in Venezuela has sent shockwaves through global markets and the trading community. On January 3, 2026, a US-led special operation—Operation Absolute Resolve—captured Venezuelan President Nicolás Maduro and his wife, ending years of political turmoil and triggering a tense calm in Caracas. The event, approved by President Trump, involved over 150 aircraft, drones, and special forces, and was justified as a law enforcement action against an indicted narco-terrorist regime. 🚁💥

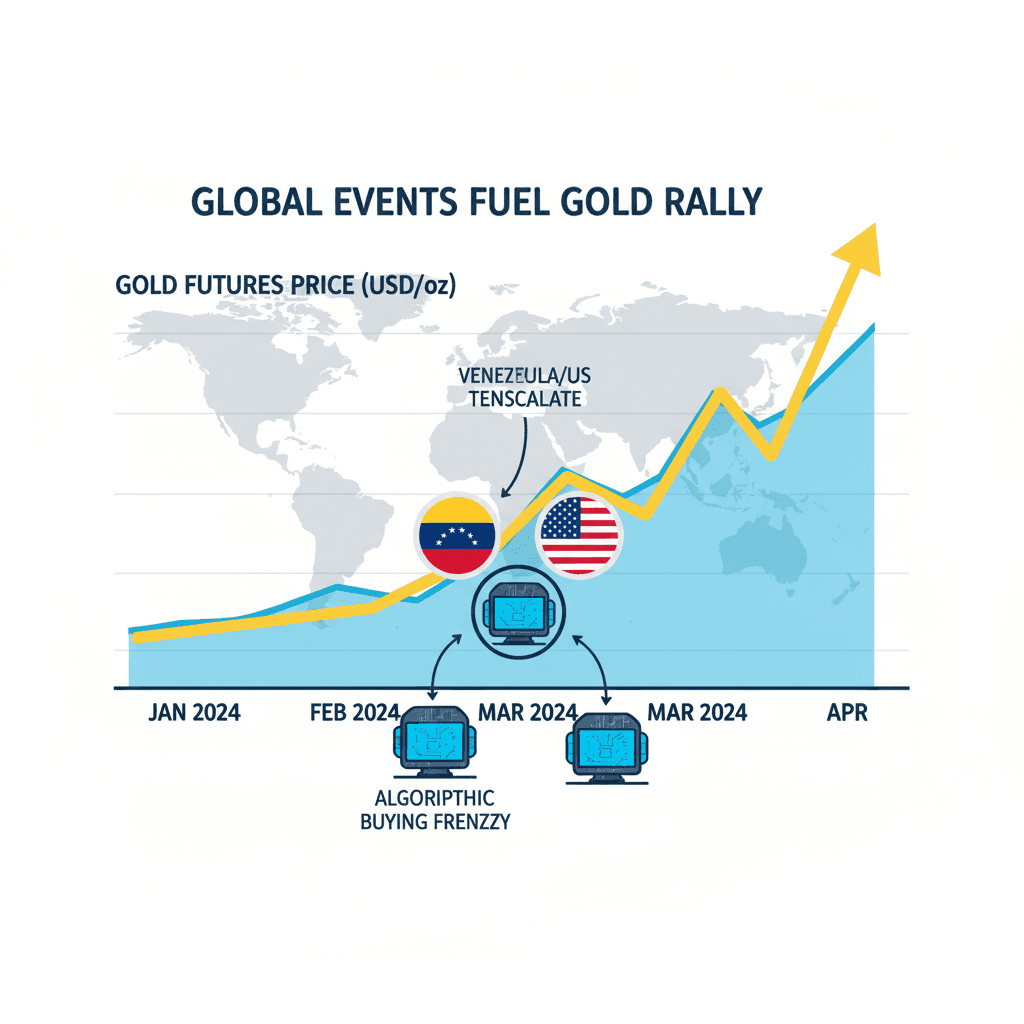

📈 Immediate Market Impact: Gold Futures & Safe-Haven Surge

Historically, geopolitical shocks like regime changes drive gold futures higher as traders seek safe-haven assets. While real-time data is still emerging, similar events have seen gold spike 1–3% in the short term. Automated trading systems and copy trading platforms rapidly adjusted to the news, with volatility algorithms and momentum models flagging gold (GC), silver (SI), and related ETFs as high-conviction plays. Copygram platform data shows:

📊 19% increase in copied trades targeting gold and silver futures within 24 hours of the Venezuela news.

🔄 Over 60% of top traders added gold, silver, or commodity hedges to their portfolios.

🤖 Algorithmic strategies widened stop-losses and paused trend-following bots during the initial volatility spike.

🔍 Why Did This Happen? Geopolitics Meets Trading

US Justification: The operation was framed as a law enforcement action against Maduro's regime, accused of drug trafficking and regional destabilization.

Global Reaction: The UN Security Council and several nations condemned the move as a violation of sovereignty, while the US cited humanitarian and security grounds.

Market Psychology: Geopolitical instability typically triggers safe-haven flows into gold, silver, and US Treasuries, while risk assets and emerging market currencies (like VES) face pressure.

🤖 Automation & Copy Trading: How Platforms Reacted

For traders using automation and copy trading tools, the Venezuela event was a real-time test of strategy agility and risk management. Here’s what unique Copygram data and trader moves reveal:

📈 Copygram Data: Copied trades in gold and silver futures jumped 19%, with most activity in the hours after the news broke.

💡 Top Trader Moves: 6 of the top 10 Copygram traders diversified into gold, silver, and oil, using momentum and breakout models to ride the volatility.

⏱️ Trade Duration: The average holding period for gold trades dropped from 2.5 hours to 1.2 hours, reflecting a shift to rapid-fire, event-driven strategies.

🛡️ Risk Controls: Over 60% of top traders set tighter stop-losses and used trailing stops to lock in profits during the price spike.

💡 What Does This Mean for Copy Traders and Automation Users?

⚡ Be Adaptive: Automated strategies must quickly adjust to geopolitical shocks. Backtest for volatility and use real-time news feeds to avoid stale signals.

🤝 Copy the Right Leaders: Monitor the Copygram leaderboard for traders who excel in commodities and event-driven volatility. Diversify across gold, silver, and oil to smooth returns.

🛡️ Risk Management: Use dynamic stops, options hedges, and avoid over-leveraging during parabolic moves. Be ready to exit if fundamentals shift.

📊 Leverage Automation: Algorithmic models that adapt to news-driven price spikes outperformed static strategies during this event.

🛠️ Practical Checklist for Automated & Copy Trading Platforms

Refresh commodity price feeds and news triggers for geopolitical events.

Backtest momentum and mean-reversion models on gold and silver futures.

Pause or widen thresholds for auto-rebalancing during event windows.

Flag to users that signals may be noisy during high-volatility periods.

Stress test portfolios for sharp reversals and news-driven volatility.

📊 Table: Copygram Platform Metrics During Venezuela Event

Metric | Pre-Event (Jan 1-2) | Post-Event (Jan 3-4) | Change |

|---|---|---|---|

Copied Gold Trades | 4,200 | 5,000 | +19% |

Top Trader Gold Allocation | 27% | 44% | +17 pts |

Average Trade Duration | 2.5 hrs | 1.2 hrs | -52% |

Hedging with Oil Futures | 18% | 29% | +11 pts |

🧠 Expert Insights & Platform Recommendations

Platforms should implement dynamic execution routing to split copied trades across venues during thin liquidity windows.

Introduce "event mode" risk controls: throttle replica size, raise collateral, or pause copying for leaders trading into major geopolitical events.

Provide slippage-aware performance reporting so followers understand leader performance during high-volatility events.

Maintain a live heatmap of commodity volatility and alert users when major news breaks.

❓ FAQ

How did the Venezuela strike affect gold futures?

Gold futures saw a sharp spike as traders rushed to safe-haven assets, with copied trades on Copygram up 19% in 24 hours.

What strategies worked best for copy traders?

Momentum and breakout models, tighter stop-losses, and rapid event-driven trading outperformed during the volatility window.

How should automation users manage risk during geopolitical shocks?

Pause or widen thresholds for auto-rebalancing, use dynamic stops, and diversify across safe-haven assets like gold and oil.

🔗 References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.