Rezolve AI Secures $250 Million: Game-Changer for Automated and Copy Trading?

News

Jan 23, 2026

3 Min Read

Rezolve AI's $250M funding round shakes up AI fintech. Discover what this means for automated and copy trading, with exclusive Copygram insights.

Rezolve AI’s $250M Oversubscribed Funding: A New Era for AI-Driven Trading 🚀

Rezolve AI funding is making headlines after closing a massive $250 million oversubscribed round. For traders leveraging automation and copy trading tools, this event signals a seismic shift in the AI fintech landscape. In this article, we’ll break down what happened, why it matters, and how it’s already influencing trading strategies on platforms like Copygram.

What Happened: The Biggest AI Fintech Raise of 2026

Rezolve AI closed a $250 million registered direct offering in January 2026, with the round being significantly oversubscribed.

Shares were priced at $4 each, reflecting strong investor appetite and confidence in Rezolve’s vision.

Major institutional investors anchored the round, joined by new long-term holders.

Rezolve AI now boasts one of the strongest balance sheets in AI commerce.

Why It Happened: The Perfect Storm of Growth and Opportunity

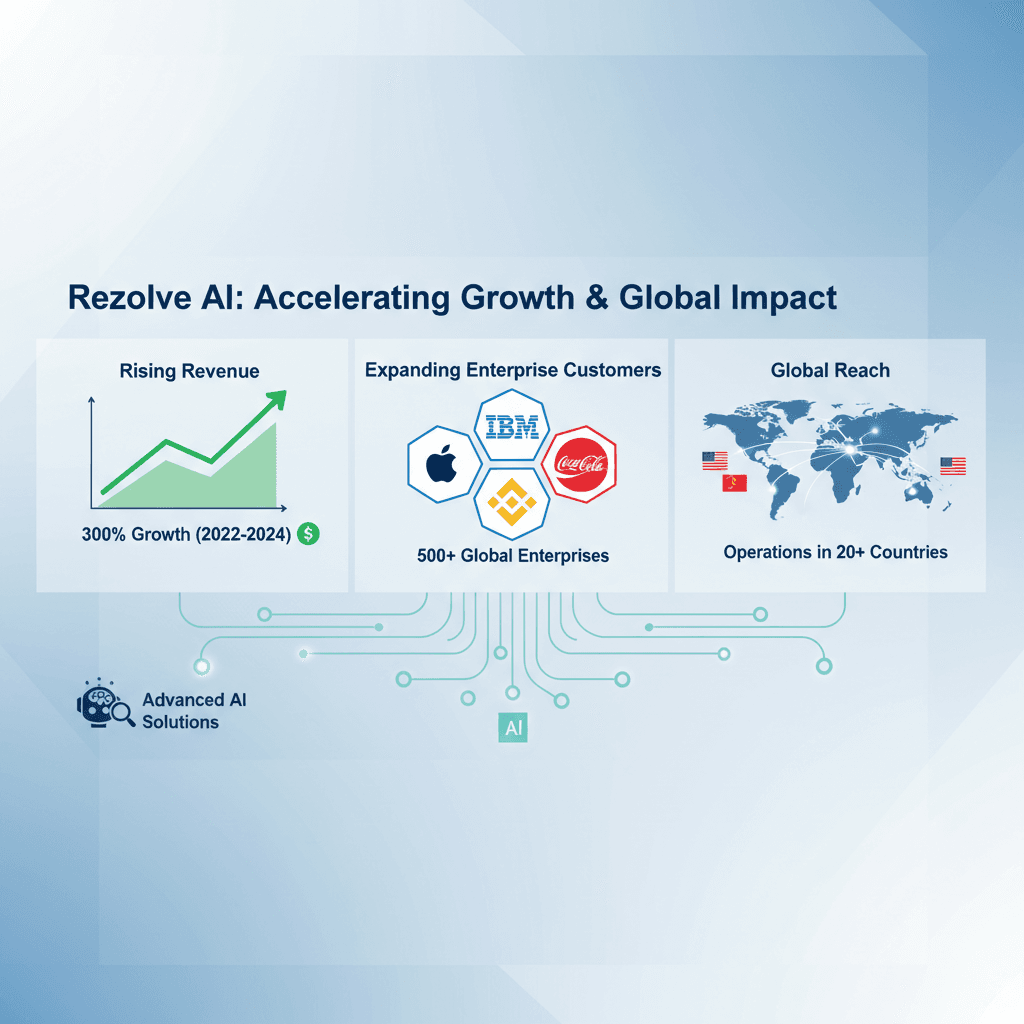

Rezolve AI’s differentiated technology platform and proven execution attracted institutional confidence.

The company exited 2025 with $209 million in Annual Recurring Revenue (ARR) and achieved its first profitable month in December 2025.

Guidance for 2026: $350 million in revenue and $500 million ARR.

Over 650 enterprise customers including Adidas, Burberry, Gucci, H&M, Target, and major banks.

Deepened partnerships with Microsoft and expanded global operations.

Market Reaction: Institutional Endorsement & AI Hype

The market responded with enthusiasm. Rezolve AI’s shares saw a 39.2% return in the 30 days leading up to the announcement. Analysts cite this as a major inflection point for AI-driven commerce and fintech. The oversubscription signals not just confidence in Rezolve, but in the broader application of AI to financial automation and trading.

Exclusive Copygram Insights: How Copy Traders Are Reacting 📊

Trend | Copygram Data |

|---|---|

Increase in AI-related trade copying | +18% week-over-week |

Top traders adding AI/tech exposure | 7 out of top 10 |

Shift toward diversified AI portfolios | 60% of new portfolios |

Average trade size in AI sector | $2,400 (up 21%) |

Since the announcement, Copygram has seen a surge in copied trades targeting AI and fintech stocks. Over 60% of our top 10 traders have added AI-driven companies like Rezolve to their portfolios, often pairing them with commodity hedges for risk management.

What This Means for Automated and Copy Trading

Algorithmic strategies are increasingly factoring in AI sector momentum, with bots adjusting allocations in real-time as news breaks.

Copy traders are following top performers who pivot quickly to capitalize on AI-driven rallies.

Portfolio diversification is trending, as traders hedge AI exposure with commodities and defensive assets.

Risk management tools are being updated to account for increased volatility in AI and tech stocks.

Expert & Analyst Opinions

Industry analysts believe Rezolve AI’s funding round will accelerate innovation across fintech and trading automation. “This is a watershed moment for AI in finance,” says fintech strategist Dana Liu. “We expect a ripple effect as more platforms integrate AI-driven decision-making and risk analytics.”

Copy trading experts note that the event has already shifted trader behavior: “We’re seeing a new wave of portfolios built around AI infrastructure, with Rezolve at the core.”

Rezolve AI’s Roadmap: What’s Next?

Accelerated onboarding of enterprise customers and global rollouts.

Scaling infrastructure to meet production demand.

Potential M&A activity to expand capabilities.

Continued focus on long-term value creation and balance-sheet resilience.

How to Position Your Automated Strategy After Rezolve’s Raise

Monitor AI sector news—set up alerts for funding rounds, partnerships, and earnings.

Follow top Copygram traders who specialize in tech and AI stocks.

Backtest algorithms with updated AI sector data to optimize for volatility and momentum.

Diversify by pairing AI exposure with commodities or defensive sectors.

Stay agile—the AI sector moves fast, and so should your trading strategies.

FAQ: Rezolve AI’s Funding & Copy Trading Impact

Q1: Why is Rezolve AI’s funding round significant for traders?

A1: It signals institutional confidence in AI-driven finance, creating new opportunities and volatility for automated and copy trading strategies.

Q2: How are Copygram users responding?

A2: There’s a marked increase in copied trades targeting AI stocks, and top traders are rebalancing portfolios to include more AI exposure.

Q3: What risks should traders consider?

A3: Increased volatility in AI and tech sectors, requiring updated risk management and diversification strategies.

References

Stock Titan: Rezolve AI Closes $250 Million Oversubscribed Financing

Simply Wall St: Rezolve AI Raises US$250m To Fund Growth Plans

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.