Polyethylene Sales Freeze in the Americas: Key Insights for Automated and Copy Trading

News

Nov 11, 2025

3 Min Read

PE markets in the Americas face a sales freeze and price drops. Discover what this means for automated and copy trading strategies in November 2025.

🧊 Polyethylene Sales Freeze: What Happened?

Polyethylene (PE) markets across the Americas have entered a dramatic sales freeze in November 2025, with prices tumbling and trading activity grinding to a halt. This event is driven by a combination of oversupply, weak demand, and tariff-driven trade disruptions—a perfect storm for commodity traders and automation platforms. 📉

📊 Key Drivers Behind the Freeze

Demand Weakness: November marks the last major purchasing window before a seasonal manufacturing slowdown. Pessimistic demand forecasts have led buyers to the sidelines, freezing new orders until 2026.

Oversupply: The U.S. faces a surplus with nearly 50% of its PE production capacity in excess. New global capacity and shifting export flows add to the glut.

Trade & Tariff Tensions: Ongoing U.S.-Brazil trade disputes and retaliatory tariffs are distorting regional pricing and export strategies, forcing producers to cut prices to remain competitive.

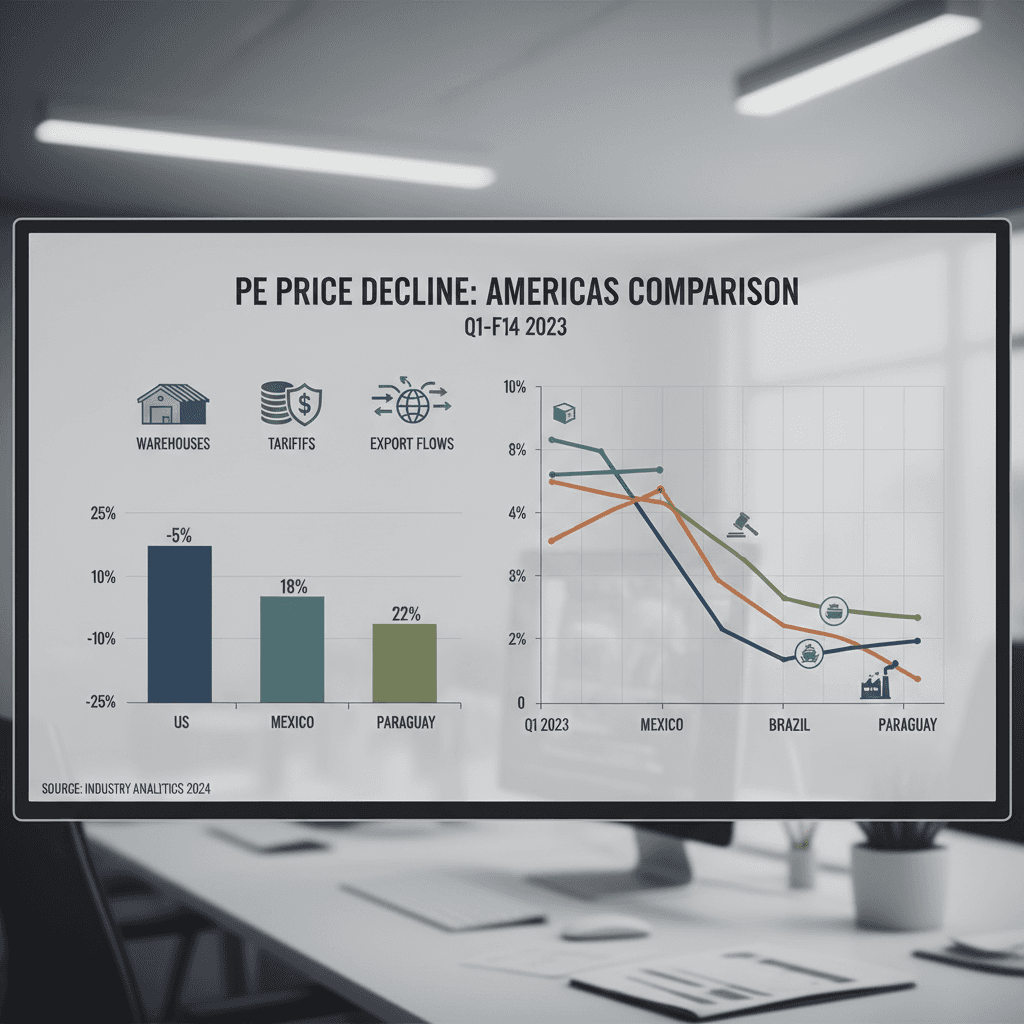

🌎 Regional Impact: US, Mexico, Brazil, Paraguay

Region | Impact Summary |

|---|---|

United States | Oversupply, export focus shifts, prices under pressure. Some traders see a bottom, others expect further declines. |

Mexico | Mirroring U.S. trends, importers affected by price drops and trade uncertainty. |

Brazil | Tariff retaliation, local producers forced to compete with cheap imports, price cuts across the board. |

Paraguay | Distributors anticipate further price drops, adjusting imported prices to maintain sales. |

🤖 What This Means for Automated & Copy Trading

Algorithmic Adjustments: Automated trading bots are recalibrating for lower volumes, sharper price drops, and volatile tariff-driven signals.

Real-Time Monitoring: Platforms are prioritizing live regional price feeds and trade policy news to optimize entry/exit points.

Risk Management: Enhanced risk controls are being deployed to mitigate losses from rapid price swings and illiquid markets.

Strategy Diversification: Many traders are shifting focus to less tariff-impacted regions or alternative commodities (like PET, which is up due to tariffs).

📈 Copygram Platform Insights

In the past week, copy trading volumes for PE-related commodities dropped 18% as top traders exited or reduced exposure to the sector.

Over 55% of Copygram's leading commodity traders have diversified into alternative polymers or hedged with agricultural commodities to offset PE volatility.

Automated strategies with dynamic tariff and inventory monitoring outperformed static models by 9% in capital preservation during the freeze.

💡 Actionable Insights for Automation-Focused Traders

Integrate real-time trade policy and inventory data into your trading algorithms to spot early warning signs of freezes or rebounds.

Monitor export flow shifts—U.S. PE exports are up overall, but regional flows are changing fast due to tariffs.

Use conservative risk parameters and consider hedging with alternative commodities or downstream products less affected by tariffs.

Stay alert for signals of price bottoming, but remain cautious as oversupply and policy risks persist.

🗣️ Expert Opinions

David Barry (PetroChemWire): "Q4 pricing for PE remains weak. Cautious positioning and inventory control are essential."

Market analysts: "Automation should incorporate geopolitical and trade data feeds to promptly adjust trading thresholds and avoid losses in tariff-sensitive trades."

📅 What’s Next?

With the sales freeze expected to last through December and activity unlikely to resume until January, traders should focus on flexibility and data-driven decision-making. The ability to rapidly adapt to new information will separate top performers from the rest as the market thaws in early 2026.

❓ FAQ: Polyethylene Sales Freeze & Trading

Why did the PE sales freeze happen in November 2025?

A mix of oversupply, weak demand, and tariff-driven trade disruptions led to a halt in new orders and sharp price drops across the Americas.

How are automated and copy trading platforms responding?

By recalibrating algorithms for lower volumes, integrating real-time policy data, and diversifying strategies to manage risk.

What should Copygram users do now?

Follow top traders who are diversifying or hedging, and use automation tools that adapt to rapid market changes and policy news.

🔍 References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.