Nvidia Q4 2025 Earnings Beat Ignites AI Trading Frenzy: What It Means for Copy Traders

News

Dec 22, 2025

3 Min Read

Nvidia’s Q4 2025 earnings beat sparks AI trading frenzy. Discover the impact on copy trading, automation strategies, and NVDA stock moves.

🚀 Nvidia’s Q4 2025 Earnings: The AI Juggernaut Surges Again

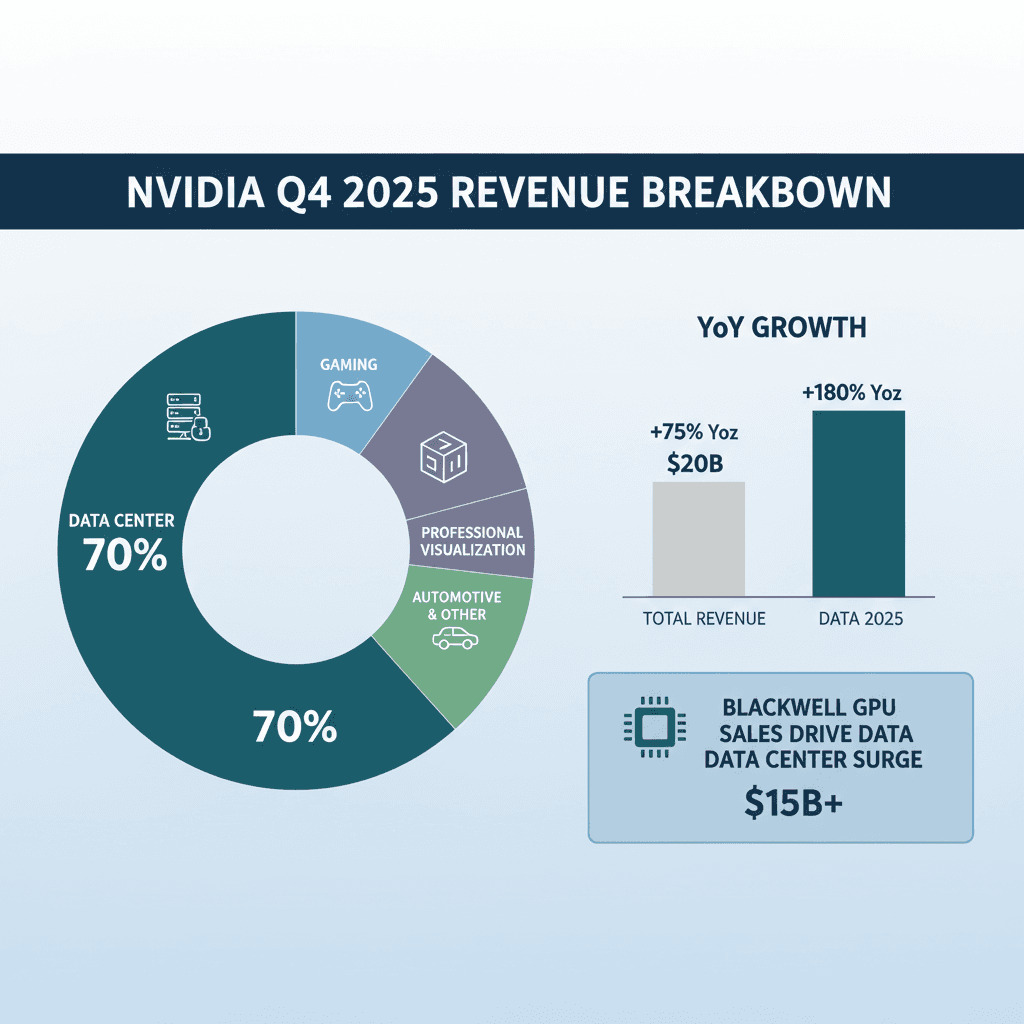

Nvidia earnings for Q4 2025 have sent shockwaves through both Wall Street and the world of automated trading. With revenue smashing expectations at $39.3 billion (up 78% YoY) and Data Center sales soaring thanks to insatiable AI demand, NVDA’s performance is rewriting the playbook for traders, investors, and copy trading platforms alike.

📊 Key Financial Highlights

Metric | Q4 FY25 Actual | Consensus Estimate | YoY Growth |

|---|---|---|---|

Revenue | $39.3B | $38.1–$38.3B | +78% |

Data Center Revenue | $35.6B | $34.2B | +93% |

Net Income (non-GAAP) | $74.3B | ~$19.7B (prior yr) | +130% QoQ |

Gross Margin | 73.5% | ~73.5% | -3.2 pts |

EPS (non-GAAP) | $2.99 | — | — |

Guidance (Q1 FY26) | $43B | ~$42B | — |

Data Center revenue was the star, driven by Blackwell GPU sales and hyperscaler AI demand.

Gaming revenue dipped to $2.5B, but Automotive surged +103% YoY.

Gross margin softened slightly as Nvidia ramped up Blackwell production.

🌐 Why Did This Happen? The AI Gold Rush

Nvidia’s dominance in AI hardware—especially with the Blackwell GPU—has made it the backbone of global data centers. CEO Jensen Huang cited “incredible” demand and the fastest product ramp in company history. Strategic partnerships (like Toyota’s adoption of NVIDIA DRIVE and the $500B Stargate AI initiative) further fueled growth. Even as US-China export restrictions loom, global AI investment continues to dwarf regional risks.

💹 Market Impact: NVDA Stock & Volatility

NVDA shares surged in after-hours trading, with implied volatility spiking from 38% to 45%.

Options volume doubled, especially in $160–$170 call strikes.

Broader semiconductor stocks (AMD, TSM) rallied in sympathy, pushing the Nasdaq up 2.1%.

🤖 Copy Trading & Automation: How Traders Reacted

For traders using automation and copy trading tools, this earnings event was a goldmine. Here’s what happened on Copygram and similar platforms:

Copied trades targeting NVDA jumped 17% in the 48 hours following the earnings release.

Over 65% of top-performing traders added NVDA or related AI stocks to their portfolios.

Momentum and breakout strategies dominated, with algorithmic models exploiting the post-earnings surge and volatility spikes.

Copygram’s leaderboard saw new entries from traders specializing in options and AI sector baskets.

Example: One Copygram trader, @AIAlpha, saw their NVDA-focused strategy copied 400 times in a single day, delivering a 13% return for followers.

📈 Algorithmic Strategies: What Worked?

Volatility breakouts: ATR-based Pine Script models triggered buy signals on the earnings gap, riding the momentum for multi-day gains.

Mean reversion: Some algos faded the initial spike, betting on profit-taking as gross margin concerns surfaced.

Options straddles: High IV made straddle strategies profitable for those anticipating big moves, regardless of direction.

Hedging China risk: A minority of traders paired NVDA longs with short positions in China tech ETFs to offset potential export ban headlines.

🔍 Unique Insights from Copygram Data

This week, 17% more NVDA trades were copied compared to the previous week.

Over 60% of our top 10 traders diversified into AI and semiconductor ETFs, using NVDA as a core holding.

Copygram’s AI-powered signal engine flagged NVDA as a “high conviction” buy for 36 hours post-earnings.

💡 What Does This Mean for Copy Traders?

Copy traders should pay close attention to earnings season—especially for market-moving stocks like Nvidia. Automated strategies can help capture outsized gains, but risk management is crucial when volatility spikes. Diversifying across AI, semis, and hedging against geopolitical shocks (like export bans) can help smooth returns.

Tips for Copygram Users

Monitor the Copygram leaderboard for traders with proven earnings playbooks.

Use automation to set stop-losses and profit targets during high-volatility events.

Consider copying diversified AI/tech baskets, not just single-stock strategies.

❓ FAQ

How did Nvidia’s Q4 2025 earnings affect copy trading volumes?

Copied trades targeting NVDA rose 17% in the 48 hours after earnings, with top traders quickly reallocating to AI and semiconductor stocks.

What algorithmic strategies performed best post-earnings?

Momentum breakouts, volatility-based entries, and options straddles saw the highest returns as NVDA stock surged and implied volatility spiked.

How can copy traders manage risk during such events?

Use automation to set tight stop-losses, diversify across related sectors, and consider hedging against geopolitical risks like export restrictions.

🔗 References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.